**This article is not a substitute for the advice of an attorney.**

Last Friday, the San Antonio Court of Appeals issued a decision in Springer Ranch, LTD . v. Jones, which involved the payment of royalties from a horizontal well. Although the case is fact-specific based upon a specific contractual agreement between the royalty holders, it provides interesting insight into issues that arise due to the use of horizontal drilling.

Background

In 1956, a landowner held 8,545 acres in Webb and La Salle counties. The landowner entered into a mineral lease with an oil company for the entire tract. Subsequently, the landowner passed away and the property was divided into three parcels, each given to a different person: Springer Ranch, Sullivan, and Matthews. Thus, the oil company then owed royalties to three separate persons, rather than to the original landowner. Each parcel had 2 vertical wells located on the land, but the proration units for each well sometimes reached into another of the tracts. Realizing this was a potential problem, in 1993, the three landowners entered into a contractual agreement amongst themselves regarding royalty payments.

The 1993 agreement between the parties stated that “the parties contract and agree with each of the other parties, that all royalties payable under the above described Oil and Gas Lease from any well or wells on said 8,545.02 acre tract, shall be paid to the owner of the surface estate on which such well or wells are situated, without reference to any production unit on which such well or wells are located…”

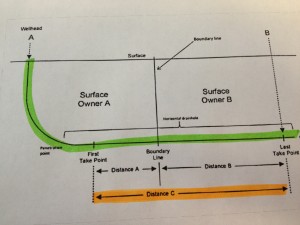

In recent years, the first horizontal well was drilled on the property. The wellhead is located on the Springer Ranch property and the borehole was drilled vertically, curves, and then horizontally extends crossing the boundary line between the Springer property and the Sullivan property, and ends underneath the Sullivan property.

The Lawsuit

A dispute arose between Springer Ranch and Sullivan about who should receive the royalties from the horizontal well. Springer Ranch argued that it was entitle dot all royalties because the physical, above ground portion of the well was located on its surface. Sullivan argued that because the productive portion of the well extended over onto its property, it was entitled to a percentage of the royalties. The trial court sided with Sullivan, ordering that royalties from the horizontal well should be divided between Sullivan and Springer Ranch based on the productive portions of the well on each of their properties. Springer Ranch appealed this ruling.

The Court of Appeals Opinion

The Court of Appeals affirmed the trial court and entered judgment in favor of Sullivan. The court found that because the “well” included more than just the wellhead, it was located on the surface estates owned by both Springer Ranch and Sullivan. By defining well to include the “entire shaft or hole bored or sunk in the earth through which the presence of minerals may be detected and their production obtained” the “well” was located on the surface estates of both Springer Ranch and Sullivan, meaning that they were required to share royalties pursuant to the 1993 contract. The “well” as defined by the Court is highlighted in green on the image above.

Next, the court determined how the royalties would be divided. Springer Ranch argued that the royalties should be divided based upon the percentage of the length of the well lying under each property. Sullivan argued that royalties should be divided not based on the entire length of the well, but instead should be divided based on the percentage of the “productive portions” of the well that lie under each property. The “productive portion” of the well is highlighted in orange above. The Court of Appeals sided with Sullivan. “Production from a well, whether horizontal or vertical, is not obtained from the entire length of the well, but from the part of the well that pierces and drains the reservoir in which the hydrocarbons reside….Royalty, as a fraction of production, is only obtainable from the part of the well actually within the [productive area].” Thus, the court held that royalties should be divided by looking at the percentage of the productive portion of the well held by Sullivan and Springer Ranch, which equates to about 1/3 for Springer Ranch and 2/3 for Sullivan. [Read full opinion here.]

Why Does This Matter?

Although most mineral owners do not have contracts similar to the one at issue in this case, the facts of the case illustrate interesting and complex issues that arise due to the use of horizontal drilling. It is important for landowners to understand these issues when negotiating and entering into a mineral lease.