The big news this week is that states are easing COVID restrictions, which is both good for the economy, at least in the short term, and risky. Several states, including Texas, have begun the process of reopening the state’s economy. In Texas, that will be a slow process, with nonessential retail outlets initially being open for curbside pick-up only. No wandering around boutiques or dining in restaurants just yet. Other states, including Georgia, are taking a more aggressive approach. There is still widespread debate about whether we are seeing a slowdown in new COVID cases, and several news outlets are reporting on the possibility of a second wave of COVID-19 cases. Johns Hopkins data do not yet demonstrate a leveling off of COVID-19 cases. In good news, the University of Texas predicts the peak will have hit by May 10 in both Texas and the U.S., which could support continued implementation of economic restrictions.

In theory, some of the looser restrictions in Texas should be helpful. In reality, policies are not the only restrictions in play. Many of the elective surgeries that will be permitted under new guidelines require the same equipment (e.g., masks and medications) needed by hospitals to see COVID patients and place them on ventilators. With limited supplies on hand and weak supply chains, healthcare professionals are hesitant to use these resources. Opening medical centers to more services also presents additional health concerns, of course. It is hard to believe that healthcare workers are among those with reduced hours or placed on furlough.

I still can’t wander through my favorite shops on a Saturday afternoon. And maybe I don’t have any business doing that. I’m not a doctor. I am a shopper, and I know that it is not the same to see an item online as it is to walk through a store. Many stores have already been selling items on websites and through social media. New guidelines probably won’t do much to boost many of these small retail businesses. On the other hand, curbside pickup from department and other large chain stores may support local employment (as opposed to just warehouse employment). These purchases may also boost local sales taxes if people order more goods for pickup, although sales taxes are already being remitted on purchases from these large retailers.

The March unemployment rate was 4.4 percent nationwide. In Texas, the seasonally adjusted rate was slightly higher at 4.7 percent, up from 3.5 percent in February. These figures are widely regarded as out-of-date and irrelevant to the current, fluid situation. Multiple sources are reporting economic analysts estimate unemployment is closer to 10 percent, and the U.S. Labor Department estimated an advance seasonally adjusted insured unemployment rate of 11.0 percent for the week ending April 11. Another 4.4 million people filed for unemployment benefits the week ending April 18, fewer than in the previous three weeks. However, the total number of insured unemployed rose to almost 16.0 million.

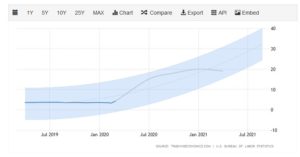

Unemployment is expected to continue climbing. The Trading Economics forecast (which has nice, free graphs) expects 15 percent unemployment in the U.S. by the end of June with employment hitting 20 percent by January and lingering in double digits into 2022. This peak unemployment is at Great Depression levels but is lower than some sources have predicted. Easing of COVID-19 restrictions may help reduce unemployment, both as people go back to work and as companies form expectations about future conditions.

The shape of the unemployment curve is related to our ability to get back to work. Opening the economy to more activities will have positive effects as long as people perceive activities are safe and we do not see sharp increases in COVID activity. Outbreaks are likely to tighten economic restrictions and reverse gains in jobs, GDP, and tax collections. Just as we don’t like the uncertainty of wondering if our jobs are secure or our vacations are cancelled, the economy does not react well to uncertainty. Officials are facing pressure from politicians and protestors to open the economy quickly, but we can make an economic as well as health argument for “slow and steady.”

On the policy front, congress is in the process of authorizing more funding for small businesses. St. Louis Federal Reserve research found that unemployment insurance supports household income, especially for individuals who are borrowers, while liquidity assistance for businesses helps stabilize employment.

Food and agriculture have been bigger news stories than usual, mostly due to COVID outbreaks among meat plant workers and out of concern for potential food shortages. While meat, milk, and eggs have been making the news as farmers have faced significant market challenges and customers have seen purchasing limits on some items, food supply chains and the FDA have been moving to adapt to new demand patterns. The FDA has provided flexibility in labeling and packaging requirements. Governments have also allowed institutional food buyers, such as restaurants, to repackage and resell foods they purchase in bulk.

Adapting to uncertainty and fluid situations may be the theme of the week. Consumers and retailers are adapting to new patterns and realities. Governments are adapting to both facilitate these transactions and reopen the economy while protecting human health. Manufacturers, whom we are not hearing much about, are adapting by producing essential goods like masks and ventilators. In other words…