This hasn’t been a good news week on most fronts. Keep reading for some bright spots at the end of this article. The U.S. Department of Labor released a glimmer of good news this morning, announcing Americans filed 5.2 million new unemployment claims the week ending April 11. That is down by 1.37 million from an adjusted 6.6 million the previous week. Still, more than 15 million Americans have filed for unemployment in the past few weeks. March unemployment should be released tomorrow, April 17.

The IMF announced we are probably in a global recession unmatched by anything but the Great Depression of the 1930s. Yes, the Texas Comptroller said it last week, but the IMF is global. Americans are not surprised. The USA Today reported 65 percent of Americans said the economy is getting worse—a 40 percent jump in a month, and 70 percent said they were at least somewhat worried about their finances. Of course, 26,700 deaths among more than 629,000 confirmed U.S. COVID-19 cases (and many more worldwide) weigh on people’s minds and hearts.

The Wall Street Journal reported that the IMF expects the US economy to shrink by 5.9 percent in 2020 and then rebound by 5.8 percent in 2021. This is twice the 2.5 percent decline in 2009. Declining demand is a key driver of this recession. Retail sales were down 8.7 percent in March. Grocery sales were up 26 percent as consumers stocked up. Fitch Ratings estimates discretionary consumer spending to drop by almost half in the first half of 2020. In line with those expectations, JPMorgan Chase economists expect the U.S. economy will shrink by 40% in the second quarter of this year.

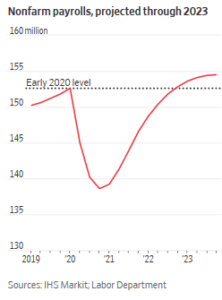

1Image from Wall Street Journal

Separately, the WSJ published nonfarm payroll projections that continue to decline through the third quarter of 2020 and do not return to early 2020 levels until late 2022. No one knows how employment and payroll will respond as the COVID-19 response continues, but multiple sources are expecting unemployment in at least the teens by summer. Uncertainty may be the watchword of this crisis, with uncertainty surrounding public health, social interaction, and economic outcomes. National, state, and local plans to roll back shelter in place restrictions will be closely watched to improve economic predictions. More information should be available today, but there will still be a fair bit of uncertainty going forward as governors and local officials react to the president’s guidelines.

2 Image from Wall Street Journal

2 Image from Wall Street Journal

Agriculture incomes are also predicted to drop. FAPRI estimated farm incomes to drop by 20 billion in 2020 with livestock bearing the brunt of declining demand and prices. Stories of dumped milk have flooded the news, highlighting supply chain constraints for perishable products. COVID-19 illnesses have shut down some large packinghouses, further spotlighting industry structure. Both declining U.S. incomes and reduced global trade are factors. Farmers are already coming through difficult

Texans tend to see the Lone Star State as a big and bright. The Austin American Statesman reported state’s unofficial unemployment rate is estimated to approach 8% in March as more than 740,000 Texans filed for unemployment over the past three weeks. Texas unemployment was just 3.5 percent in February but is expected to go higher in April. It took more than a year to reach the 8.3 percent peak Texas unemployment in the last recession. Meanwhile, twice as many people applied for SNAP benefits in March 2020 as compared to March 2019.

Low oil prices compound the state’s economic struggles. The state’s oil industry and regulators met earlier this week to discuss cutting back production. The Railroad Commission did not announce cuts, and the West Texas Intermediate price continued to struggle this week. Midland prices have trended lower than U.S. WTI prices over the past few weeks. FAPRI estimates oil prices will drop by 15 percent as a result of COVID-19 after accounting for production tensions between Russia and Saudi Arabia. These supply-side issues resulted in a dramatic drop from more than $60/barrel earlier in the year, and lower global demand will continue to dampen prices as consumers stay home and global trade and transport contract.

So where exactly are the bright spots? The U.S. Treasury said 80 million people were set to receive their stimulus check this week, which could help struggling families. We are seeing some pretty cool manifestations of community right now. Dumas, TX, projected a movie up on the elevator last week. Countless families enjoyed Easter on Zoom and FaceTime and other remote platforms. I’ve been surprised at how ready the local governments and NGOs I work with are to get back to work on planned projects. They know resources may be scarcer than they had anticipated, and plans are being modified but moving forward. Several small business I follow are really upping their marketing game with personalization and enhanced social media—it’s fun to watch.

As heartbreaking as the pandemic and recession are to individuals, families, and society, these same phenomenon are shining are highlighting the importance of small businesses, food systems, child and family nutrition, and a sense of community. The White House and governors are looking at the best ways to roll back COVID-19 shelter-in-place restrictions and re-open (most likely gradually) society and the economy. I think the question for us is how to we bring the best of our social interactions and ourselves to these issues as we come back together. How do we keep up our commitment to community?

Good reads for (un)certainty:

- If you want to be uplifted, check out the https://thisibelieve.org/. This about the things of which you are certain and learn more about what others believe.

- If you want to think about econ/epidemiology tradeoffs, check out this article: https://www.wsj.com/articles/economics-vs-epidemiology-quantifying-the-trade-off-11586982855?mod=lead_feature_below_a_pos1