I’ve written before about The Role of Rural in addressing the world’s wicked problems—challenges including providing food, water, and energy for 9 billion people by 2050: climate change; health; and poverty. These challenges are serious, but they provide opportunities for rural areas.

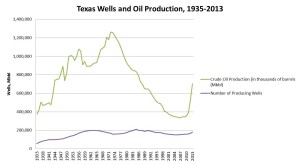

The Texas energy economy has grown substantially in recent years, and is a major part of the Texas economic narrative. Of course, oil has long been been a part of the Texas story and an important component of the economy. After 30 years of falling production, hydraulic fracturing renewed the industry in the late 2000s (Fig. 1).

Figure 1. Texas oil production and well count, based on data from Texas Railroad Commission.

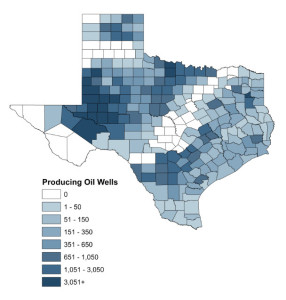

Rural areas contribute significantly to the energy economy. In general, wells tend to be clustered in multi-county regions, thus affecting not only the economy of a single community or county but of the entire region (Fig. 2).

Figure 2. Producing oil wells by county, based on data from Texas Railroad Commission.

Most oil and gas wells are in rural areas. According to Texas Railroad Commission (TX RRC) data, 84,477 producing oil wells are located in 131 rural counties; 38,901 are in 46 OMB-designated micropolitan counties; and 55,252 are in the state’s 77 metropolitan counties. Of course, 96.65% of Texas land is rural, and even metropolitan counties contain large swaths of rural land.

On average, rural counties have 645 producing oil wells, micropolitan counties 846, and urban counties 718. Recall, the OMB defines a Micropolitan Statistical Area as a county or multicounty commuting region with an urban core with a population of 10,000 to 50,000. A few Texas micropolitan areas and counties include Andrews (Andrews Co.), pop. 11,088; Beeville (Bee Co.), pop. 12,863; and Snyder (Scurry Co.), pop. 11,202. These areas tend to be trade and/or industry centers surrounded by much rural land. Counties often have additional producing gas wells, many of which are located in metropolitan areas. For example, the Barnett shale includes much of the Dallas-Fort Worth area.

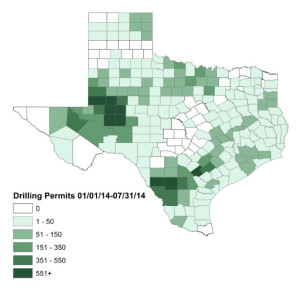

More recent energy development is trending toward rural counties. On average, 90 drilling applications were made for rural counties between January 1, 2014, and July 31, 2014, 65 for micropolitan counties, and 59 for urban counties, according to the TX RRC drilling querry (Fig. 3).

Figure 3. Drilling permits by county, January 1-July 31, 2014, based on data from Texas Railroad Commission.

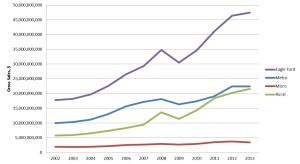

My analysis of recent economic data in the Eagle Ford has shown that the energy boom has enhanced local economies and rural energy counties have tended to outperform micropolitan and metropolitan ones (Fig. 4). However, the gains are not evenly distributed across communities. Existing trade centers continue to dominate the regional economy and attract growth, while growth is slower in smaller surrounding communities. More detailed information is available in the slides and report on the ruralcommunities.tamu.edu Energy Development page.

Figure 4. Sales growth for metro, micro, and rural areas within the Eagle Ford, data from Texas Comptroller.

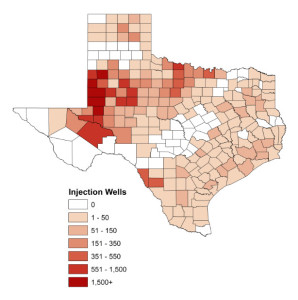

As discussed in the August 20 AgriLife NEXT talk, while there are substantial economic benefits to the energy boom, communities must also be prepared for additional challenges, including increased traffic, infrastructure burdens, income inequality, and potential environmental concerns. Many residents have concerns about injection wells, many (but not all) of which are used by the oil and gas industry, according to the EPA and the TX RRC. The TX RRC reports that there are 128 injection wells in the average rural county, 214 in micropolitan counties, and 81 in metro counties (Fig. 5).

Figure 5. Drilling permits by county, January 1-July 31, 2014, based on data from Texas Railroad Commission.

Additional resources are provided in the handout at the AgriLife NEXT link and the AgriLife Rural Communities website.