The 2023 crop and livestock budgets are now available on the AgriLife Extension Agricultural Economics website. In this post, we’ll look at the budgets for peanuts in Districts 1, 2, and 3. For the most part producers can expect higher revenues; however, expect this increase to be offset by higher input costs.

The 2023 crop and livestock budgets are now available on the AgriLife Extension Agricultural Economics website. In this post, we’ll look at the budgets for peanuts in Districts 1, 2, and 3. For the most part producers can expect higher revenues; however, expect this increase to be offset by higher input costs.

Board Update 2/13/2023

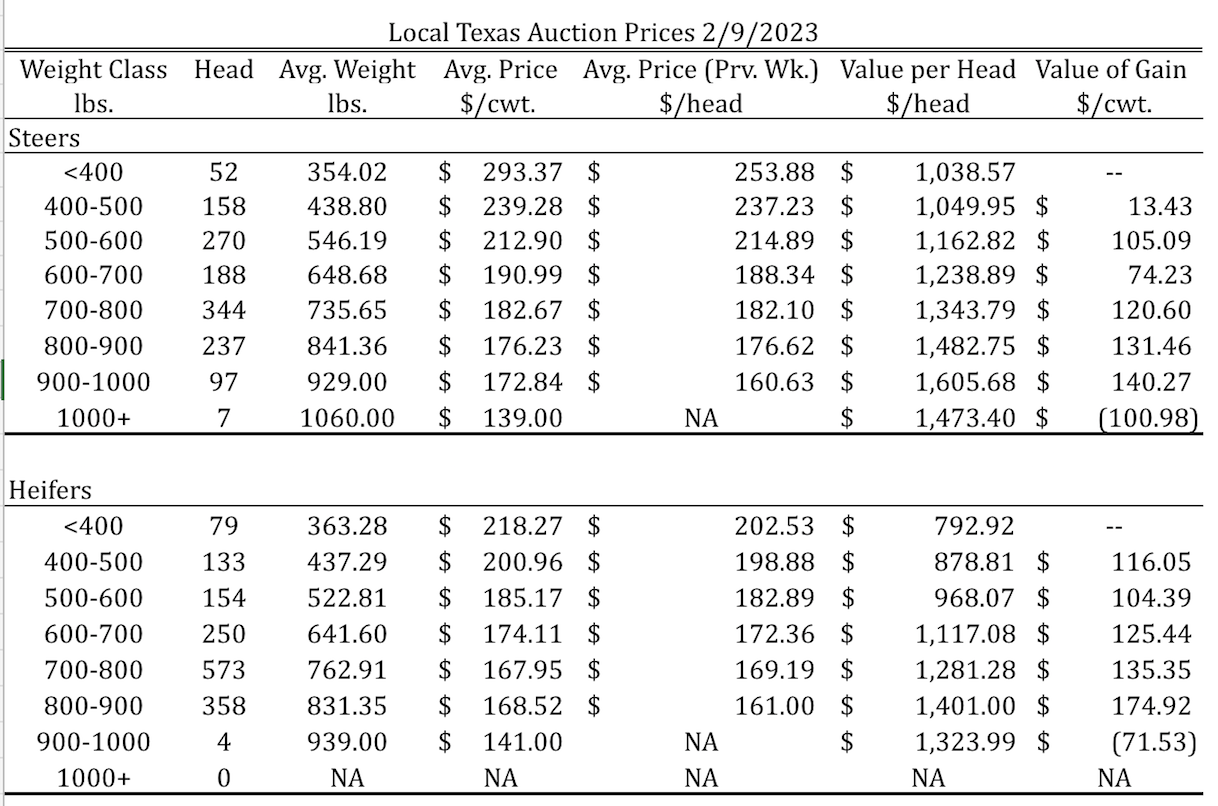

Tulia, Amarillo, Dalhart Average – Cattle Prices by Category 2/9/2023

Dates & Deadlines

2/17/2023 – 2023 Angora Goat Testing – Initial Weigh Day and Shearing

2/21/2023 – Soil Health Clinic – Olton

2/23/2023 – Vernon Master Marketer Program

2/28/2023 – Spring Mini Ag Conference – Groom/Claude

4/25-26/2023 – Hemphill County Beef Conference, Canadian

What We’re Reading

Cattle inventory confirms large-scale contraction – Morning Ag Clips

The Cattle Price Discovery and Transparency Act – Morning Ag Clips

Hay supply near 50-year low, prices near record highs – AgriLife Today

Cotton harvest aid: A bit of science, a bit of art – Southwest Farm Press

A Look at the 2023 Peanut Budgets

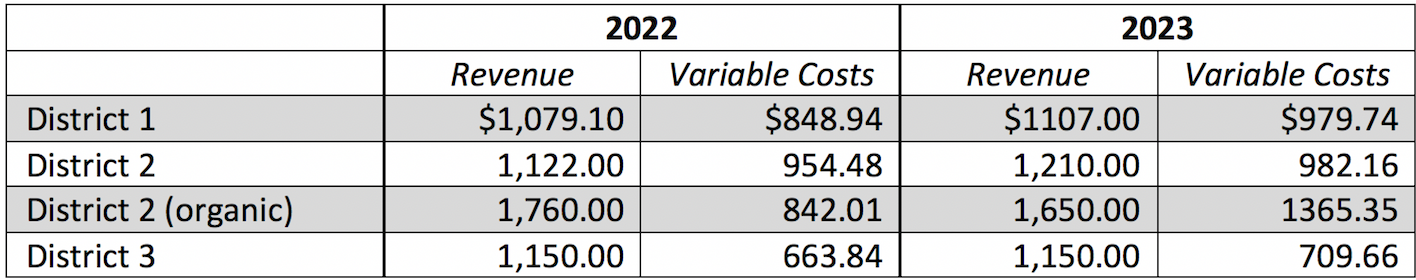

Table 1 compares the per-acre revenue and variable cost numbers in the 2022 budgets to the same values in the 2023 budgets for irrigated peanuts in Districts 1, 2, and 3, and for organic peanuts in District 2.

The budgets predict about a 2.6% increase in revenue for producers in District 1 and a 7.84% increase in revenue for District 2 in 2023, as a result of higher prices, while revenue for producers in District 3 is predicted to not change.

At the same time, budgets for all three districts predict an increase in variable costs. The reasons for this increase varies from district to district, but are primarily related to fertilizer, energy, and labor costs. Our January 18 post provides a detailed explanation for why input prices might increase in 2023.

It’s also important to note that the budgets for Districts 1 and 3 predict an increase in fixed costs related to peanut enterprises as a result of increases in interest rates. While this may not have a large impact on anyone already invested in peanut production, this can affect the decision to start a new peanut enterprise in 2023.

To see the impact that these changes will have on profitability, Table 2 compares the 2022 and 2023 values for both per-acre returns above variable costs and per-acre returns above total specified costs for Districts 1, 2, and 3.

With the exception of irrigated peanuts in District 2, profits from peanuts enterprises will be lower in 2023 than in 2022. The budges predict that returns from irrigated peanuts in District 2 will increase; however, the returns above total costs will still be negative. This means that despite larger returns, this is still probably not the year to invest and begin producing peanuts if you produce in District 2.

The other major change to highlight in this table is the returns above total cost for District 1, which the budgets predict will be negative in 2023. Again, this is due in large part to the expected increase in interest rates and their impact on investment costs related to purchasing the equipment used to produce peanuts.

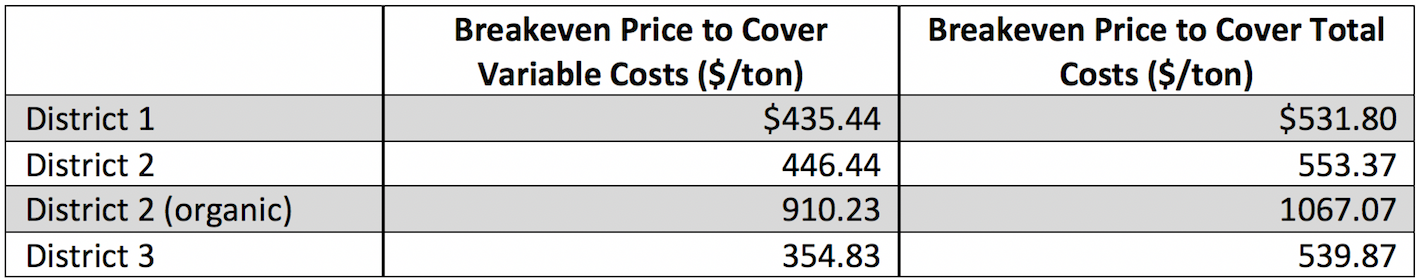

Breakeven Prices for 2023

One important value to be aware of in an enterprise budget is the commodity’s breakeven price. This is the price at which you can expect revenue to exactly equal costs, given the expected level of production in the budget. Table 3 lists the breakeven prices to cover both the variable costs and the total costs reported in the 2023 budgets.

Using irrigated peanuts in District 3 as an example, the expected yield per acre in the budget is 2.00 tons. If this yield is achieved, then an acre of peanuts will break even on its variable costs at a price of $354.83/ton and will break even on its total costs at a price of $539.87/ton. Using the expected prices in the budget, it appears that, peanut enterprises in all three districts will have no trouble breaking even on their variable costs in 2023; however, there is some risk to consider, especially in District 1. If yields in District 1 are reduced to 85% of their budgeted amount, a peanut enterprise no longer breaks even on its variable costs. This means that producing peanuts in would result in an economic loss to the producer.

Some Final Comments on the Budgets

There are a couple of things to keep in mind as you use this information and as you use the budgets for your district. First, the numbers in these budgets are general guidelines for cotton enterprises in their respective districts and will not represent every operation perfectly. To build a budget that better represents your operation, AgriLife offers tools to help you build your own budgets on our website.

Expectations for ARC/PLC Payments

The current USDA-FSA projected 2022-2023 MYA price for peanuts is currently sitting right at the reference price for PLC payments, and the budgets for Districts 2 and 3 project prices above the PLC reference price. For this reason, it is uncertain whether peanuts will be eligible for PLC or ARC-CO payments this year. If you are considering enrolling in either of these programs in 2023, the Agricultural and Food Policy Center at Texas A&M University has a decision tool you can use to help you understand the probability of receiving a payment. The deadline to enroll in these programs is March 25, 2023.