Can you borrow to finance new purchases when you need to? Or will borrowing more put your business at risk of bankruptcy? Your ability to answer these questions accurately is an important part of managing your business for long-term success. In today’s blog we’ll look at some information taken from a farm’s business records that can help you make financially responsible borrowing decisions.

Can you borrow to finance new purchases when you need to? Or will borrowing more put your business at risk of bankruptcy? Your ability to answer these questions accurately is an important part of managing your business for long-term success. In today’s blog we’ll look at some information taken from a farm’s business records that can help you make financially responsible borrowing decisions.

The Information You Will Need

Today we’re talking about solvency, which I’ll define shortly. All the information you need to evaluate solvency is taken from your business’s balance sheet.

Your balance sheet is a financial statement that provides you with the following information:

- The dollar value of your business’s assets, or what the business owns

- The dollar value of your business’s liabilities, or what the business owes

- The dollar value of your business’s equity, or what’s left over for you after all the business’s debts are paid

The balance sheet operates from the fact that Assets = Liabilities + Equity. As a business’s liabilities increase relative to its assets, business equity must decrease. As liabilities decrease relative to assets, equity increases.

Understanding Solvency

Solvency is your ability to pay all your debts if you sold your business today. In other words, on your balance sheet, what is the value of your assets relative to the value of your debts (liabilities)?

Why is solvency important to debt management? In general, a more solvent business faces a reduced risk of bankruptcy when it takes on extra debt. This means you face less financial risk when you borrow to fund new investments to maintain or grow your business. You also face less risk when you are forced to borrow to finance unplanned purchases.

Solvency Ratios

There are three ratios you can calculate to evaluate your business’s solvency, but we’ll only focus on two here. The first of these is the Debt-to-Asset ratio which compares the value of the liabilities listed on your balance sheet to the value of your assets:

Debt-to-Asset Ratio = Value of Total Liabilities ÷ Value of Total Assets

The second important ratio is the Debt-to-Equity ratio which compares the value of the liabilities listed on your balance sheet to the value of your business’ equity:

Debt-to-Equity Ratio = Value of Total Liabilities ÷ Value of Total Equity

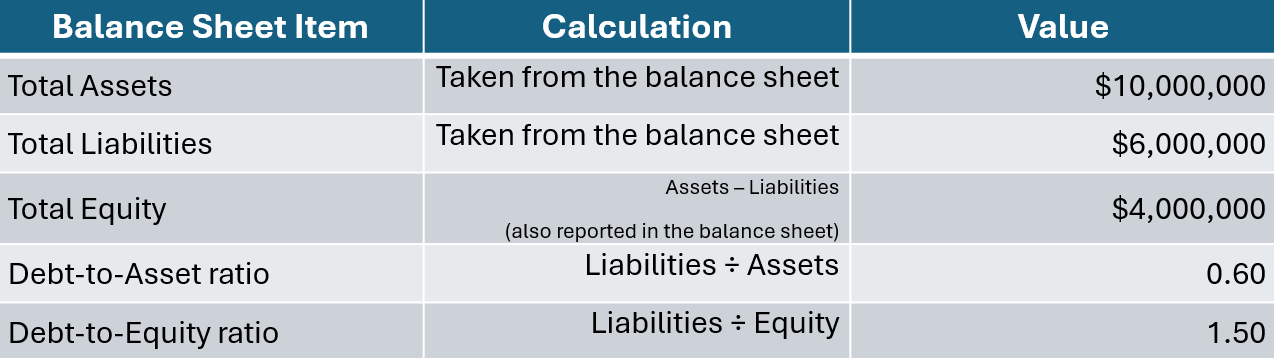

As an example, consider a business with $10 million in assets and that owes $6 million in debts. Table 1 illustrates the calculations and values for this business’ Debt-to-Asset and Debt-to-Equity ratios.

Table 1. Solvency Ratio Examples

Using the Ratios to Evaluate Your Business’ Solvency

In general, a smaller Debt-to-Asset ratio indicates a stronger solvency position. A larger Debt-to-Asset ratio indicates lesser ability to borrow new funds if they are needed. A Debt-to-Asset ratio greater than 1.00 means the business is bankrupt. Ideally, a farm business’ Debt-to-Asset ratio is less than or equal to 0.30. A value greater than 0.60 indicates weak solvency.

You also want to aim for a smaller Debt-to-Equity ratio. As this ratio decreases, you own more of your business’s assets outright and your debtors have a claim to less of those assets. The Debt-to-Equity ratio also give potential lenders a sense of how well you manage debt. A smaller ratio tends to indicate that you have consistently used borrowed funds to generate a good return on investment. That is, one large enough to pay back your lenders and still have funds left over to reinvest in the business. Try to aim for a Debt-to-equity value less than 0.43, and no higher than 1.50.

Using Solvency Ratios to Manage Debt

As you consider when and how much to borrow to finance your business, consider the impact that new borrowing will have on your solvency. For example, if taking out a real estate loan to purchase new land increases your Debt-to-Asset ratio from 0.5 to 0.75, that loan may be too risky. You may need to find a different way to finance that purchase.

It’s also a good idea to communicate with your banker so you know what value for these ratios they look for as they evaluate loans. Then, you can set financial goals related to solvency that will make you a more attractive borrower.

How To Improve Solvency

To improve solvency, a business should take steps to do three things:

- Reduce debts

- Increase profits

- Improve cash flow

Of course, finding ways to achieve any one of these three goals can be difficult. That is why Texas A&M AgriLife Extension offers the FARM Assistance program. This program provides producers with access to risk management specialists with the expertise necessary to evaluate a farm’s financial health. Based on their analysis, the specialist you work with will help you develop strategies to improve your business’s long-term financial position. For more information about the program and to sign up for assistance, visit the FARM Assistance website.