This week, we provide an update on the grain markets and look at the current supply and use projections for corn and sorghum in the August USDA World Agricultural Supply and Demand Estimate (WASDE) Report.

This week, we provide an update on the grain markets and look at the current supply and use projections for corn and sorghum in the August USDA World Agricultural Supply and Demand Estimate (WASDE) Report.

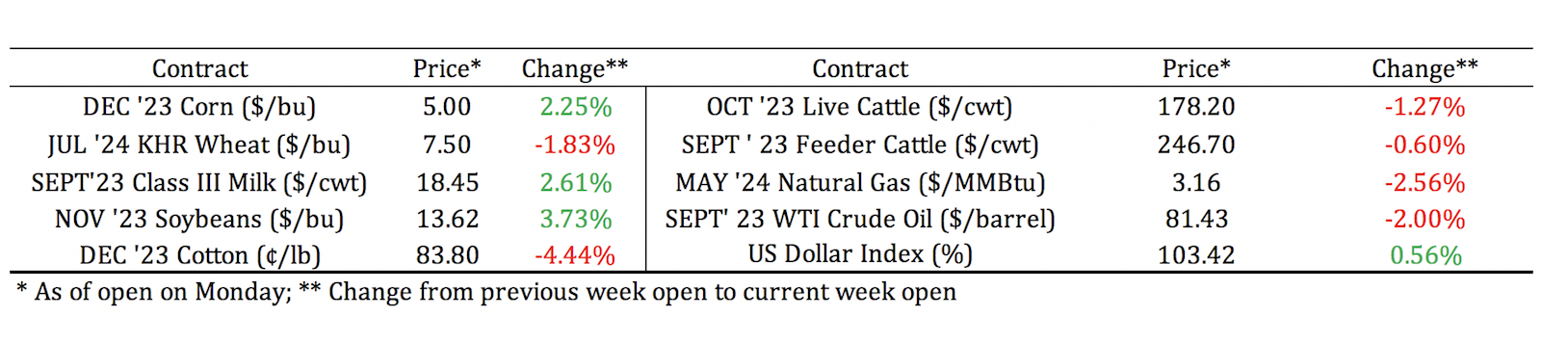

Board Update 8/21/2023

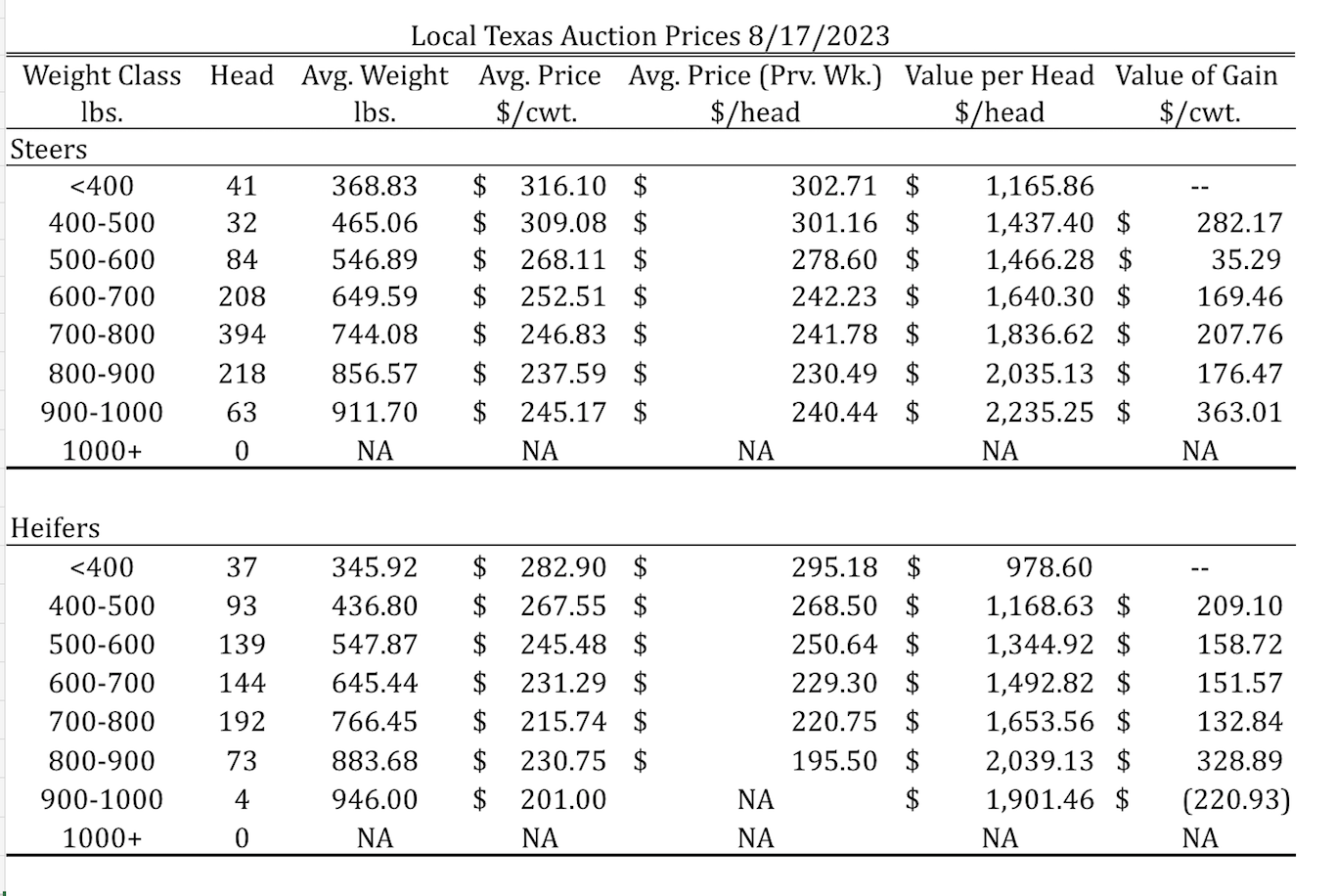

Tulia, Amarillo, Dalhart Average – Cattle Prices by Category 8/17/2023

Dates & Deadlines

9/7/2023 – Online – Return of the Natives Webinar

10/5/2023 – Online – White Tail Deer Management

10/23-27/2023 – College Station – Ranch Management University

11/2/2023 – Online – Wildfire and Prescribed Fire on Your Property

Grain Market Update

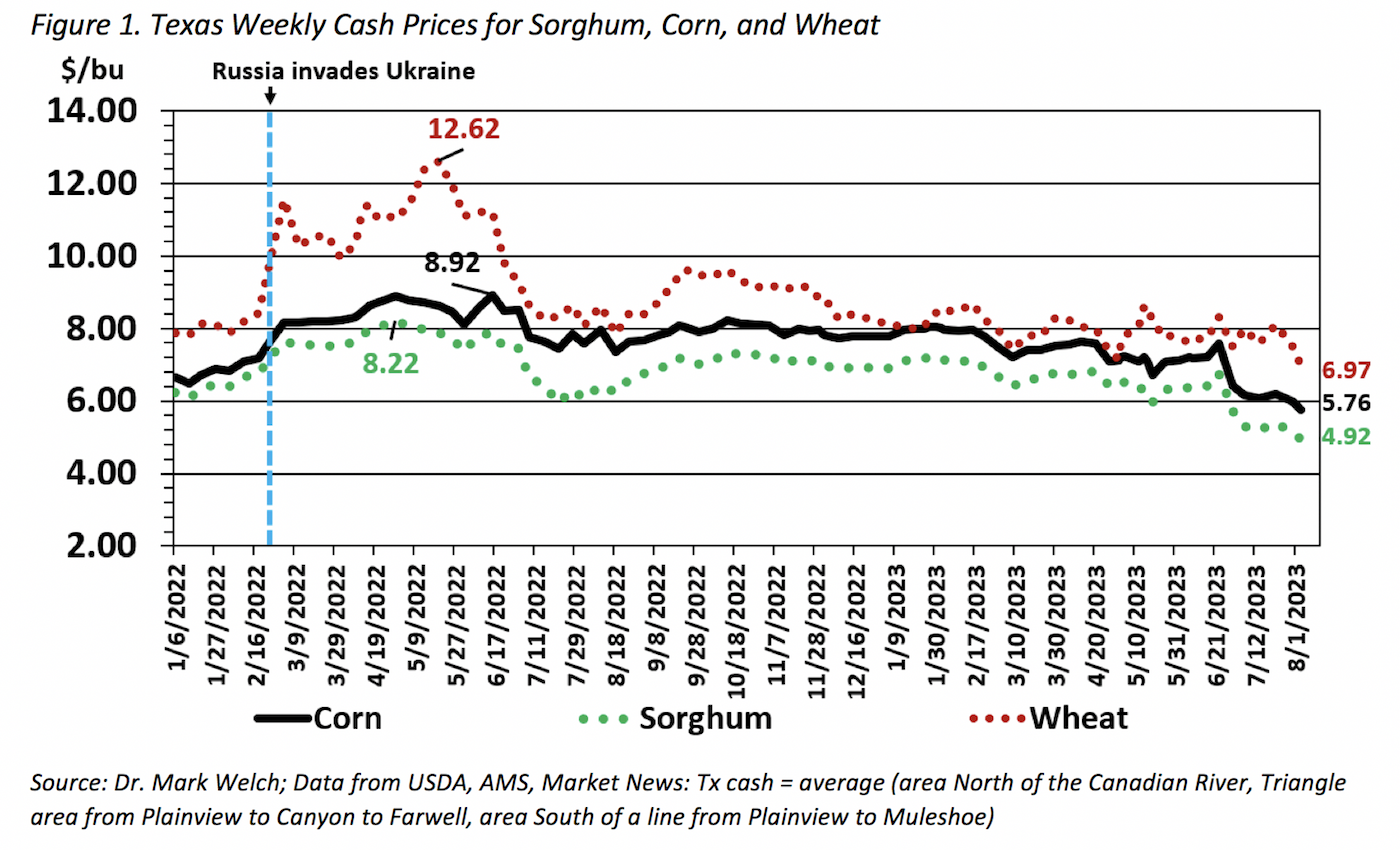

Although still high historically, cash prices for corn, sorghum and wheat have steadily decreased over the last calendar year, as shown in Figure 1. Since August 2022, the cash price for wheat has decreased by about 14%, corn has decreased 24%, and sorghum is down about 23%. At this time, current cash prices for all three commodities have returned to close to where they were in the months just before Russia’s invasion of Ukraine.

United States Supply and Demand Projections

Table 1 summarizes the August WASDE projections for corn supply and use this year, compares those numbers to WASDE estimates for the 2022/23 marketing year, and reports the change in projections for the current crop from July to August. The most significant change in the August report relative to July is the 2.4 bushel per acre decrease in expected yield and the resulting 209 million bushel decrease in expected production. This change was more than enough to offset decreases in expected use so that projected ending stocks for 2023/24 were revised down 60 million bushels. Still, ending stocks for 2023/24 are currently expected to be nearly 800 million bushels larger relative to 2022/23 which helps explain why prices have been trending downward.

The story for sorghum is like that of corn. Compared to 2022/23, production, use, and ending stocks are all higher in 2023/24 relative to 2022/23. Compared to the July projections, ending stocks for sorghum in the August report are revised downward slightly due in part to a reduction in expected yield per harvested acre.

Expectations for 2024/2025

Looking forward to the next season, what can we expect in terms of corn production next year? There’s still a lot of time left for the situation to change, but Dr. Mark Welch with Texas A&M AgriLife Extension points out that there are early signs that point to fewer corn acres and more soybean acres.

Figure 2 looks at how the price of the November 2024 soybean contract has changed relative to the December 2024 corn contract since last February (the blue line tracks the soybean price). Since June, the soybean price has been strong relative to the corn price, which Dr. Welch attributes to an increase in oil demand for renewable diesel. The strength of soybean prices relative to corn could incentivize a shift from corn acres to soybeans next year. Such a shift should have a bullish effect on corn prices.