(Laura McKenzie/Texas A&M AgriLife Marketing and Communications)

Spring and early summer rainfall have relieved Texas drought conditions, improving pastures and forage production. Today we will review the Bid Price for Beef Cows Decision Aid. This tool will help you analyze the key variables determining how much you should pay for a beef cow.

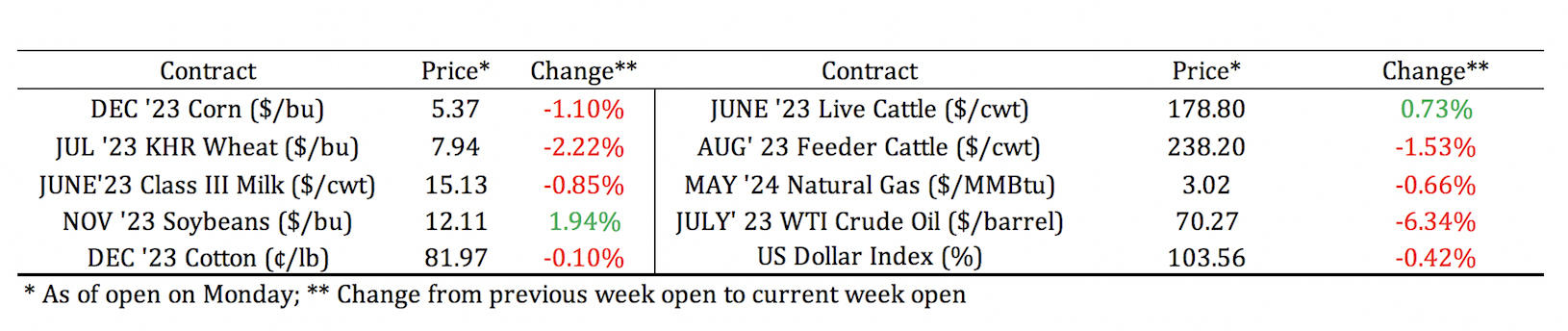

Tulia, Amarillo, Dalhart Average – Cattle Prices by Category 6/8/2023

How to Determine the Right Price for Replacement Cows

Spring and early summer rainfall have relieved Texas drought conditions, improving pastures and forage production. As ranchers, it’s crucial to start planning how to restock our operations to reach our optimal stocking rate. Whether we rely on our own replacement heifers or purchase heifers or cows, it’s essential to consider the best strategy for your specific circumstances.

Today we will review a decision aid called the Bid Price for Beef Cows (https://agecoext.tamu.edu/resources/decisionaids/beef/ ). This tool will help you analyze the key variables determining how much you should pay for a beef cow.

Understanding the Bid Price for Beef Cows Decision Aid

Determining the right bid price for a cow is a question that concerns both the buyer and the seller. The Bid Price for Beef Cows decision aid is a practical tool that facilitates the calculation of the bid amount and allows for “what if” analysis based on your financial and productive expectations. It uses a net present value (NPV) approach to analyze the investment, considering the desired return or discount rate.

Variables to Consider.

Several variables play a significant role in determining the bid price for a cow. These variables include the total debt of your operations, operating costs per cow, estimated future calf prices, cull cow prices, required loan amount, interest rate, number of calves per cow, weaning weight, weaning rate, and more. In this example, we will focus on future calf prices, the future number of calves per cow, and interest rates.

Future Prices and Operating Costs.

In conjunction with operating costs, future calf prices are crucial in determining the bid price. Calf prices have increased in recent years as well as operating expenses.

In this example, we assume an initial increase in calf prices for the first two years, followed by a slight decline. We expect prices to decline when the US cow inventory grows, and US beef production increases (Table 1). Additionally, we consider a conservative 2% annual increase in operating costs, which is lower than the average increase of 7% measured in the SPA database (Beef Cattle Standard Performance Analysis).

Table 1. Expected Future Prices and Operating Costs

Calving Opportunities and Calf-Crop.

The number of calves a cow produces throughout its lifetime significantly impacts profitability and the amount we can pay for the cow. Generally, the more calves per cow, the higher the bid price. However, it’s important to consider the financial implications and the possibility of selling cows earlier to obtain higher prices. In this example, we assume that each cow will produce seven calves in its lifespan, with an average calf crop of 88% (Table 1).

Loan and Interest Rates.

The amount of debt required for cow purchases and the interest rates directly affect the bid price. The higher the debt and interest rates, the lower the amount we can afford to pay. For instance, in our example, a 3% increase in the interest rate reduces the bid price by $200 per head.

Conclusions.

Based on our assumptions and calculations, the bid price for a cow should be lower than $2,080 per head to avoid a financial loss (Table 2). However, it’s important to note that each ranch operation is unique. The bid price will depend on various factors such as costs, debt levels, productivity ratios, and interest rates specific to the ranch operation.

Table 2. Assumptions and Results

Using the Bid Price for Beef Cows tool allows ranchers to analyze different scenarios and understand how much they should pay to restock their operations. Remember to estimate reasonable future prices for your calves and cull animals. By carefully considering these variables, you can make informed decisions and ensure the financial viability of their operations.