Carbon markets have been a trendy topic lately and present producers with a potential new revenue source for their operation. This post briefly describes the basics of what carbon credits are and how carbon markets/contracts are structured. At the end of the post, I provide a set of links to additional articles that provide a more in-depth discussion of some of the legal and economic considerations related to carbon contracts.

Carbon markets have been a trendy topic lately and present producers with a potential new revenue source for their operation. This post briefly describes the basics of what carbon credits are and how carbon markets/contracts are structured. At the end of the post, I provide a set of links to additional articles that provide a more in-depth discussion of some of the legal and economic considerations related to carbon contracts.

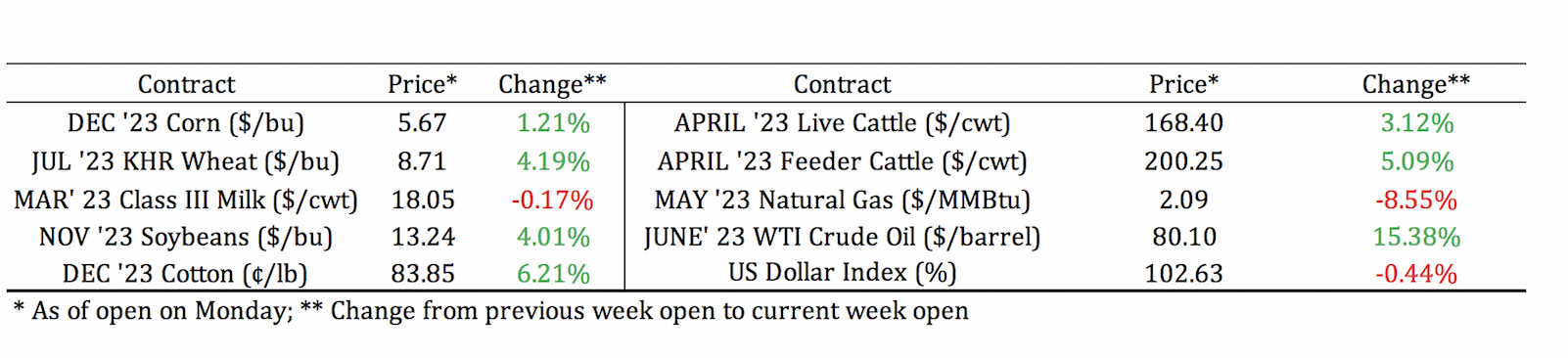

Board Update 4/3/2023

Tulia, Amarillo, Dalhart Average – Cattle Prices by Category 3/30/2023

Dates & Deadlines

4/6/2023 – RWFM Stewardship Webinar Series: Water Law Overview & Update

4/14/2023 – Owning Your Piece of Texas

4/19-21/2023 – Prescribed Burn School

4/25-26/2023 – Hemphill County Beef Conference, Canadian

5/4/ 2023 – RWFM Stewardship Webinar Series: Wild Pigs in Texas

What are Carbon Credits?

A carbon credit is essentially a “permission slip” to emit one metric ton of carbon into the atmosphere. A business, organization, or individual can purchase these credits to offset their carbon emissions. For example, if a business emits 1 ton of carbon, and it purchases 1 carbon credit, its net carbon emissions is zero.

Many businesses, such as Amazon and Walmart, have made pledges to achieve net zero carbon emissions, meaning they will remove one ton of carbon from the atmosphere for each ton they emit, by 2050 or earlier. To achieve net zero emissions, these companies look for partners that can produce carbon credits for them to purchase.

A carbon credit is “produced” when carbon is captured and somehow stored so that it cannot enter the atmosphere. This is how farms and ranches can enter the carbon market. If a farmer or rancher implements practices on their operation that capture carbon and store it in soil, they can enter the carbon market as a seller of carbon credits.

Carbon Market Basics

Carbon markets are similar in concept to the market for any other good or service. The market is made up of a group of buyers that wish to purchase carbon credits and a group of sellers that wish to sell them. The buyers consist of those businesses and other organizations that have made a commitment to reduce their carbon emissions and are willing to pay to purchase carbon credits to meet that commitment. The sellers in the carbon market consist of businesses and organizations that can capture and store carbon and are willing to accept payment to do so.

The purchase and sale of carbon credits in these markets is usually facilitated through contracts that, in many ways, are like the contracts used to sell physical commodities. The seller in the contract agrees to take specific actions to capture and store an agreed upon amount of carbon by a certain date. The buyer in the contract agrees to pay a certain price for each ton of carbon sequestered by the seller.

Should You Sell Carbon Credits?

So, can carbon contracts be profitable for producers on the Texas High Plains? Like most economic questions, the answer to this one is, “it depends.” Most likely, entering into a carbon contract will require a producer to make changes to their existing operation, and the cost of making these changes, in terms of both extra expense and lost revenue, may not be worth the extra payment earned from the contract.

It is also important to remember that a carbon contract is a legally binding agreement. If you enter into one of these contracts, you are committed to fulfilling your contract obligations, and may face legal or financial penalties for noncompliance. Make sure that you read any contract to produce carbon credits carefully so that you know what you are getting into and, if possible, consult a lawyer before signing the contract.

Further Information about Carbon Markets

The ability to capture carbon for sale in carbon markets is a relatively new opportunity for agricultural producers, and navigating these markets can be complicated. If you want to learn more about these markets, the potential risks involved with carbon contracts, and the questions you should ask before entering into a carbon contract, I suggest starting with the following articles.

Texas A&M AgriLife Extension Ag Law Specialist, Tiffany Lashmet, has written extensively about carbon contracts on her Texas Agriculture Law Blog.

- Understanding and Evaluating Carbon Contracts provides a great description of some of the terms, terminology, and legal clauses found in carbon contracts.

- Should I Sell Carbon Credits? A Decision Guide for Ranchers links to a publication that Tiffany helped develop in partnership with King Ranch institute.

Shelley Huguley with Southwest Farm Press has written three short articles in the last month on the legal and economic challenges related to carbon contracts.

- Carbon markets, contracts: Proceed with caution might give you an idea about what you can realistically expect in terms of payments from a carbon contact in this part of the United States.

- Carbon contracts: 8 items to consider before signing and Carbon contracts: Understanding your legal obligations both describe some of the important legal issues you should consider and questions that you should ask before signing a carbon contract.

Finally, Forrest Laws with Delta Farm Press recently published Carbon credits new ‘hot button’ issue for agriculture which highlights some of the companies that are offering carbon contracts to agricultural producers, where these contracts are available, and how these contracts have paid out in the past.