Dryland wheat grain and forage conditions in our area are different from what we were expecting in many cases. The Wheat and Small Grain Decision Aids will help you analyze the best alternative for your wheat fields according to your expected yields, production costs, equipment, and other variables.

Dryland wheat grain and forage conditions in our area are different from what we were expecting in many cases. The Wheat and Small Grain Decision Aids will help you analyze the best alternative for your wheat fields according to your expected yields, production costs, equipment, and other variables.

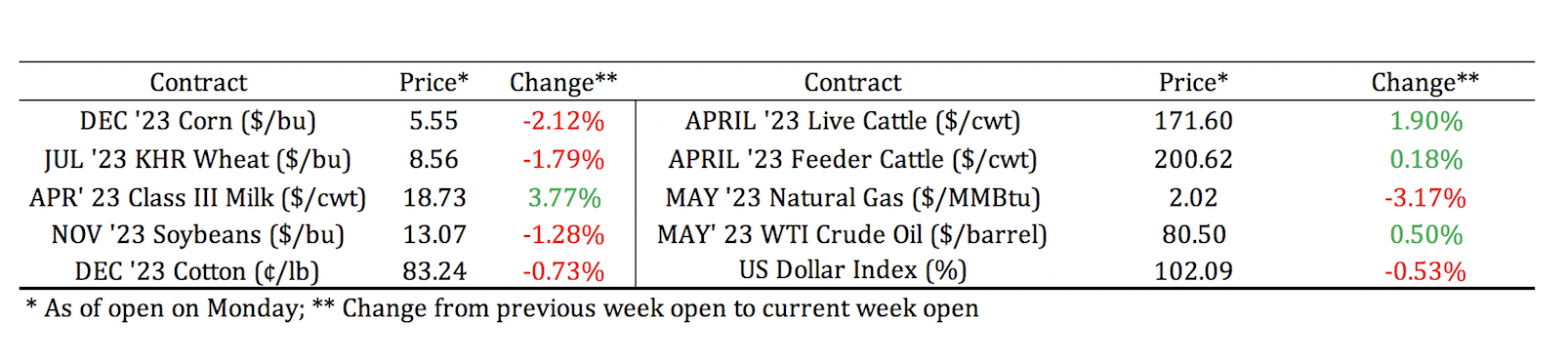

Board Update 4/10/2023

Tulia, Amarillo, Dalhart Average – Cattle Prices by Category 4/6/2023

Dates & Deadlines

4/19-21/2023 – Prescribed Burn School

4/25-26/2023 – Hemphill County Beef Conference, Canadian

5/4/ 2023 – RWFM Stewardship Webinar Series: Wild Pigs in Texas

Dryland Wheat Alternatives.

At this time of the year, when weather conditions are not on our side, we wonder which is the best thing to do with our wheat. There are still chances in many places for a decent crop. However, the lack of rainfall during these last weeks in many areas is getting this probability smaller over time. However, analyzing available alternatives for our wheat is always convenient according to our expected yield, production costs, rotation, available harvest equipment and cost, insurance, etc.

The “Wheat and Small Grain Decision Aids” Excel spreadsheet is a great tool to help you in the economic and financial analysis of those decisions. You can download this decision from our District 3 website (https://vernon.tamu.edu/extension-projects/d3-agricultural-economics/ ).

Given today’s dryland wheat conditions, we will use an example to analyze and compare Wheat Grain Harvest vs. Wheat Bale Hay. For these analyses, we will use District’s 3 Enterprise Budgets and assume a lower expected yield, even if we had invested more. There will be differences in costs between our budgets and your costs. Input costs might differ considering the high volatility of their prices these last months. But your costs will mainly vary according to the technology and agronomic practices used in each field. We assumed that we custom-hire harvesting and baling equipment in all these cases.

hire harvesting and baling equipment.

Wheat Harvest Grain vs. Wheat Bale Hay

We should always consider analyzing these two options given that the best alternative mostly depends on the relative prices of the grain of wheat and the ton of hay when harvesting is an option. Especially this year, when high hay prices are very competitive. Moreover, finishing the wheat earlier might allow us to plant cotton if the crop rotation and soil moisture allow it and if it is more profitable.

To calculate the potential hay production, we consider that the grain yield corresponds to 40% of the total biomass production. Therefore, a 30 bushels/acre wheat yield would produce a total biomass of 2.25 tons per ha. We assume we bale and harvest 76% of the total potential biomass, resulting in a yield of 1.6 tons/acre (Table 2) (Wheat Hay vs. Grain: A comparison of economic opportunity, Reagan Noland, Bill Thompson, and Clark Neely). Estimating your grain and hay yield potential is key to comparing these options.

In the example below, hay bailing is a better option when grain production is not high enough. However, this highly depends on the prices you are planning to get on your wheat bales (Table 1). Hay production will be a better option, with prices above $167/ton. In this case, we assume machinery is hired for harvesting and baling. Keep in mind that in those farms that have their own equipment for harvesting grain or baling hay, these results may be different.

Table 1. Wheat Grain Harvest vs. Wheat Bale Hay Profitability

The other way to use this information is to see at what price we must sell our hay to have a similar wheat grain profit margin. The Decision Aid will use your data and costs to calculate these hay breakeven prices (Graph 1). We might consider baling our wheat if we can sell our hay production above the hay breakeven price for a given wheat price and expected grain yield. For example, for an estimated yield of 30 bu/acre and a price of $8/bu, we would only want to bale our wheat if the net price per ton of hay is greater than $167 (As long as we have a production of 76% of the estimated total biomass, which is equivalent to 1.04 ton per acre).

Graph 1. Breakeven Hay Prices.

Wheat Hay and Dryland Cotton

In addition, we consider baling our wheat and planting cotton. Finishing the wheat earlier might allow us to grow cotton. This decision will depend on many variables other than the profitability of our cotton crop, crop rotation, soil moisture, and crop insurance. We might increase our risk exposure if we cannot have an adequate insurance policy and risk management tools.

The Wheat and Small Grain Decision Aids is an economic and financial tool to help every farmer decide from that point of view. Using your own data, yield expectations, and costs is essential to better analyze these alternatives. These examples reflect today’s wheat conditions and expectations. We hope to see higher soil moisture and better crop conditions will affect these decisions soon.