The 2023 crop and livestock budgets for District 1 are posted, and the budgets will soon be available for all districts on the AgriLife Extension Agricultural Economics website. Today, we take a look at the expected costs and returns from coarse grains in the High Plains.

The 2023 crop and livestock budgets for District 1 are posted, and the budgets will soon be available for all districts on the AgriLife Extension Agricultural Economics website. Today, we take a look at the expected costs and returns from coarse grains in the High Plains.

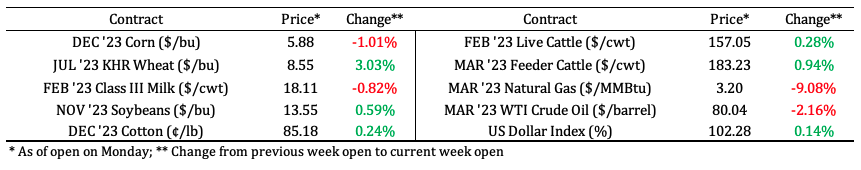

Board Update 1/31/2023

Tulia, Amarillo, Dalhart Average – Cattle Prices by Category 1/31/2023

Dates & Deadlines

1/31/2023 – Cattle

2/9/2023 – Parmer County Cotton Conference – Bovina

2/8-9/2023 – Southwest Beef Symposium – Retained Ownership and Feed Costs

2/17/2023 – 2023 Angora Goat Testing – Initial Weigh Day and Shearing

2/21/2023 – Soil Health Clinic – Olton

2/23/2023 – Vernon Master Marketer Program

2/28/2023 – Spring Mini Ag Conference – Groom/Claude

4/25-26/2023 – Hemphill County Beef Conference, Canadian

What We’re Reading

Owning Your Piece of Texas event dates set for 2023 – AgriLife Today

JBS USA to implement artificial intelligence to maximize carcass value – Morning Ag Clips

First-of-its-kind research identifies $400 million in unrealized soybean value – Morning Ag Clips

Capture economic pluses through expansion – Prairie Farmer

No magic rate for nitrogen – Prairie Farmer

New crop insurance option for 2023 irrigated sorghum available now – Kansas Farmer

Did your marketing plan work? – Farm Futures

2023 Feed Grain Outlook: High prices, high costs, tight margins – Southwest Farm Press

A Look at the 2023 Corn & Sorghum Budgets

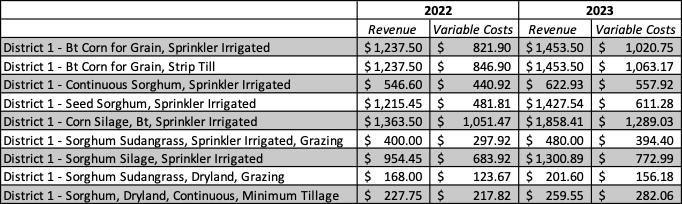

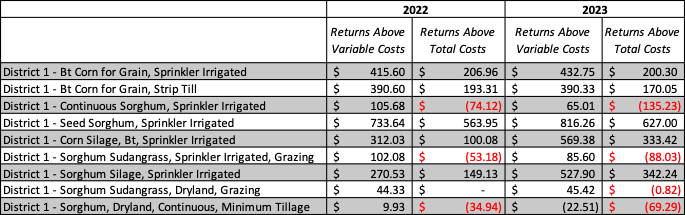

Texas A&M AgriLife Extension economists around the state are in the process of completing and posting annual budgets. These budgets provide an expectation of production expenses, revenues, and profits. Table 1 summarizes the revenue and variable cost numbers on a per-acre basis in the 2022 and 2023 extension budgets for various corn and sorghum production options in District 1 in 2022 and 2023.

Table 1. Corn & Sorghum Returns ($/acre)

In the budgets, a 17.5% increase in the expected price of corn from $5.50/bu. in 2022 to $6.46/bu. in 2023 is more than offset by a 24.2% expected increase in the cost of production. Similarly, the expected price of sorghum is projected to rise 14% year-over-year, from $9.11/cwt in 2022 to $10.38/cwt in 2023. However, expected net returns are pressured further in sorghum than in corn, with variable costs increasing 26.5%.

The budgets project that operating costs for all coarse grains will increase in 2023, but why is sorghum projected to see a greater increase? Even though corn is more expensive to produce than sorghum in absolute terms, the comparative rate changes between corn and sorghum prices and production expenses matters. Where the price for both commodities did increase year-over-year, corn price increased relatively more, and where the cost of production increased for both year-over-year, they increased relatively more for sorghum. Some of the loss in price strength for sorghum are the result of a loss in Chinese demand (Figure 1), which brought the sorghum/corn price ratio out of historic norms. For an in-depth explanation for why input costs might increase this year, check out our post from two weeks ago.

Figure 1. Chinese Feed Grain Imports

USDA, FAS, PSD 1/12/2023; Compiled by Dr. Mark Welch

As a result of the expected increase in variable costs, the expected returns from corn and sorghum grain are lower in 2023. However, there are some bright spots in expected returns for derivatives of coarse grains. Table 2 compares the expected per-acre returns above variable costs (ROVC) and returns above total costs (ROTC) for different coarse grain enterprises in District 1.

Table 2. Expected Per-Acre ROVC and ROTC

From Table 2 you can see that, despite being lower, ROVC and ROTC remain positive for corn grain. The increased expenses of sorghum production coupled with a loss in price support, relative to corn, have driven returns into the red for both irrigated and dryland production. However, there are a few crops worth paying attention to that are not crops for grain. Table 2 shows that both corn and sorghum silage returns have increased dramatically year-to-year.

The increase in silage value is largely demand driven. More dairy cattle on the high plains increases the need for locally sourced forages. Reports from around the region suggest that, because of this increased demand, silage has broken away higher from its historic relationship with grain priced on the board. Historically, we’ve set the price of corn silage per ton by multiplying the value of corn grain per bushel by a factor of nine and adding one to that total. For example, in 2022 the expected price of corn was $5.50/bu., which yielded an expected corn silage price of $50.50/ton. However this year we are being told by cattle raisers and farmers that the relationship between corn and corn silage is more likely between 10x or 11x, and in some cases we’ve heard values as high as 13x. As a result, we set the price of corn silage per ton locally by multiplying the expected price of corn per bushel by 10.5 and adding 1, for a price of $68.83/ton. Keep in mind that transportation can severely limit some of the returns to silage production, but even over long distances production of silage might pay in 2023.

Breakeven Prices for 2023

One important value to be aware of in an enterprise budget is the commodity’s breakeven price. This is the price at which you can expect revenue to exactly equal costs, given the expected level of production in the budget. Table 3 lists the breakeven prices to cover both the variable costs and the total costs reported in the 2023 budgets.

Table 3. Breakeven Prices to cover ROVC and ROTC

Using pivot irrigated sorghum in as an example, the expected yield per acre in the budget is 60 cwt. If this yield is achieved, then an acre of pivot irrigated sorghum will break even on its variable costs at a price of $9.30/cwt. and will break even on its total costs at a price of $12.64/cwt. Using the expected prices in the budget, it appears that, with the exception of sorghum for grain, and irrigated sorghum sudangrass coarse grain enterprise should largely break even on their variable costs in 2023. Keep in mind that in some parts of the panhandle irrigated sorghum yields can exceed 80 cwt/acre and even 100 cwt/acre, which would influence those breakeven calculations to the positive side.

Some Final Comments on the Budgets

There are a couple of things to keep in mind as you use this information and as you use the budgets for your district. First, the numbers in these budgets are general guidelines for corn and sorghum enterprises in their respective districts and will not represent every operation perfectly. To build a budget that better represents your operation, AgriLife offers tools to help you build your own budgets on our website. One other thing to keep in mind is that the outlook for the 2023 coarse grain market is not yet fully formed. See the article attached in the “What we’re reading” section to learn more about the outlooks for corn and sorghum.

To stay up to date on the latest grain marketing information, make sure to check out Dr. Welch’s website. While there, make sure to sign up for his weekly email newsletter as well.

Expectations for ARC/PLC Payments

Expected prices are still well above the effective reference price for PLC and unless severe yield challenges present this will eliminate ARC-CO payment possibilities too, so both corn and sorghum prices are once again unlikely to trigger a payment under either of these programs this year. The maximum 2024 corn reference price is $3.98/bu and the maximum 2024 sorghum reference price is $4.06/bu. If you are considering enrolling in either of these programs in 2023, the Agricultural and Food Policy Center at Texas A&M University has a decision tool you can use to help you understand the probability of receiving a payment. The deadline to enroll in these programs is March 25, 2023.