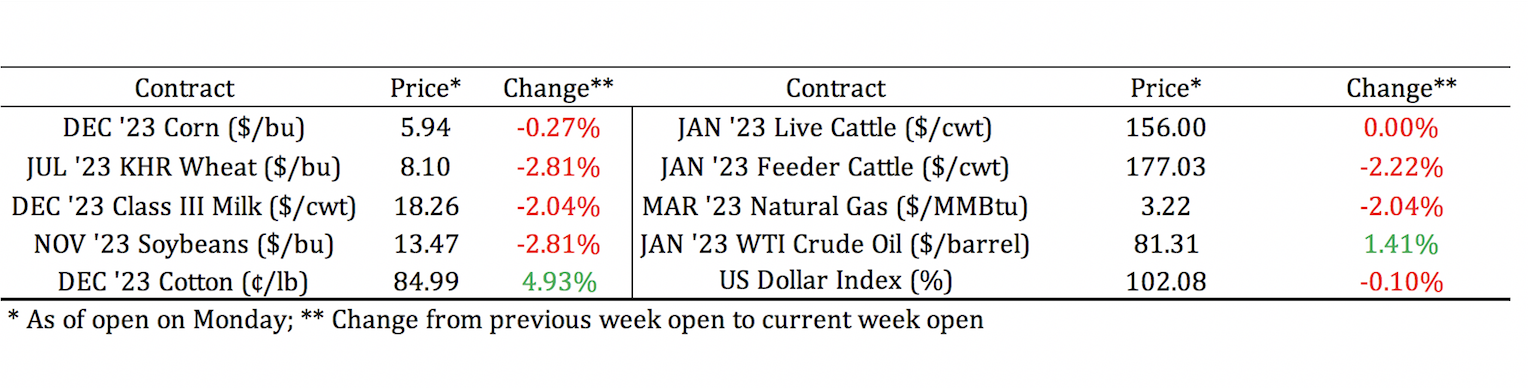

The 2023 crop and livestock budgets will soon be available for all districts on the AgriLife Extension Agricultural Economics website. Compared to the numbers in the 2022 budgets, revenue from cotton enterprises is expected to remain largely unchanged, while costs are expected to increase.

The 2023 crop and livestock budgets will soon be available for all districts on the AgriLife Extension Agricultural Economics website. Compared to the numbers in the 2022 budgets, revenue from cotton enterprises is expected to remain largely unchanged, while costs are expected to increase.

Board Update 1/23/2023

Tulia, Amarillo, Dalhart Average – Cattle Prices by Category 1/19/2023

Dates & Deadlines

1/25/2023 – Top of Texas Cotton Conference, Pampa

1/25/2023 – Randall County Pre Plant Meeting, Canyon

1/26/2023 – Northwest Panhandle Ag Conference, Dalhart

1/27/2023 – High Plains Cotton Conference, Spearman

2/9/2023 – Parmer County Cotton Conference – Bovina

2/9/2023 – Southwest Beef Symposium – Retained Ownership and Feed Costs

2/17/2023 – 2023 Angora Goat Testing – Initial Weigh Day and Shearing

2/21/2023 – Soil Health Clinic – Olton

2/23/2023 – Vernon Master Marketer Program

2/28/2023 – Spring Mini Ag Conference – Groom/Claude

What We’re Reading

Uncertainty in input prices likely to continue in 2023 – Southwest Farm Press

Record low hay stocks this winter – Southwest Farm Press

Economists in WSJ Survey Still See Recession This Year Despite Easing Inflation – WSJ

Heifers on feed indicate long-term liquidation still occurring – Beef

Report reveals steady food behaviors through economic change – Morning Ag Clips

Welcome Andrew Wright to the Blog

We have a new author joining the blog this week for his first post. Andrew Wright, Ph.D. is our new Texas A&M AgriLife Extension Economist for District 2, located in the Lubbock Center. Andrew comes to us from San Angelo State University where he was a professor responsible for teaching a variety of courses across the agricultural economics discipline. We’re particularly excited to have a third author lend his insights and new skill set to the blog. Andrew is originally from Lubbock and we look forward to his contributions to the High Plains Ag Week team. If you have any questions for Andrew you can find him at andrew.wright@ag.tamu.edu.

A Look at the 2023 Cotton Budgets

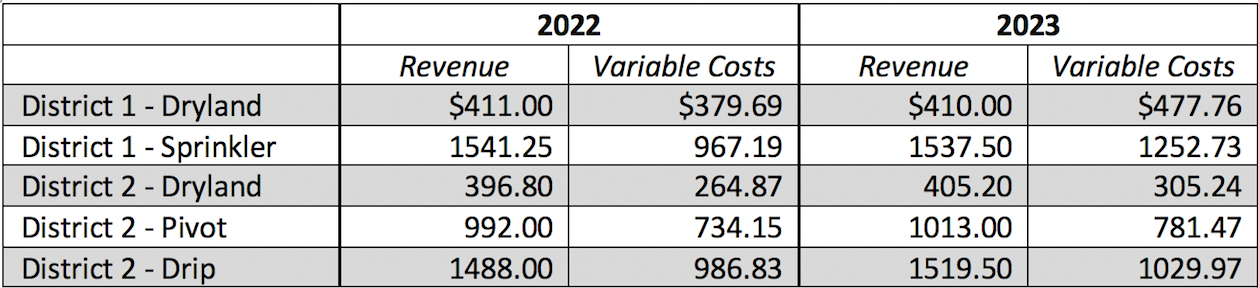

Table 1 summarizes the revenue and variable cost numbers on a per-acre basis in the 2022 and 2023 extension budgets for dryland and sprinkler irrigated cotton in district 1, and for dryland, pivot, and drip irrigated cotton in district 2.

In the budgets, a slight decrease in the expected price of cotton lint from $0.85/lb. in 2022 to $0.80/lb. in 2023 is offset by an expected increase in the price of cotton seed. For this reason, the budgets project that revenues from cotton enterprises in district 1 will remain close to 2022 levels and that revenues in district 2 may increase slightly.

On the cost side, the budgets project that operating costs for cotton will increase in 2023. For an in-depth explanation for why input costs might increase this year, check out last week’s post.

As a result of the expected increase in variable costs, the expected returns from cotton are lower in 2023. Table 2 compares the expected per-acre returns above variable costs and returns above total costs for different cotton enterprises in districts 1 and 2.

There are three values I want to highlight in this table. The first two are the returns above total costs for dryland cotton in both district 1 and district 2. While not ideal, the fact that these values are negative does not mean that planting dryland cotton this year is a bad idea. Keep in mind that total costs in the crop and livestock budgets include fixed costs that must be paid regardless of how much is produced. The rule of thumb is that if you can cover your variable costs, you are better off producing something and using the revenue you earn to pay at least part of your fixed costs. This brings us to the returns above variable costs for dryland cotton in district 1, which is negative. Unless prices increase above expectations or costs decrease below expectations, it might not make economic sense to plant dryland cotton this year if you’re in district 1.

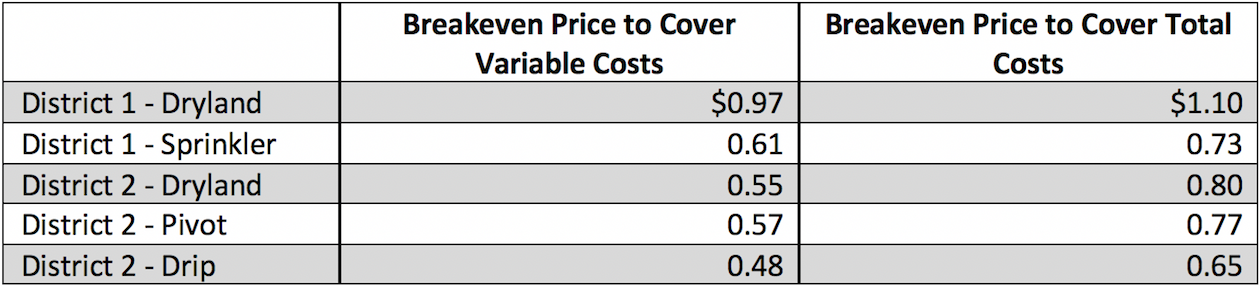

Breakeven Prices for 2023

One important value to be aware of in an enterprise budget is the commodity’s breakeven price. This is the price at which you can expect revenue to exactly equal costs, given the expected level of production in the budget. Table 3 lists the breakeven prices to cover both the variable costs and the total costs reported in the 2023 budgets.

Using pivot irrigated cotton in district 2 as an example, the expected yield per acre in the budget is 1000 lbs. of cotton lint. If this yield is achieved, then an acre of pivot irrigated cotton will break even on its variable costs at a price of 0.57/lb. and will break even on its total costs at a price of $0.77/lb. Using the expected prices in the budget, it appears that, with the exception of dryland cotton in district 1, cotton enterprises in districts 1 and 2 will have no trouble breaking even on their variable costs in 2023; however, the prices to break even on total costs is close to the expected price in the budgets for sprinkler irrigated cotton (district 1) and for dryland and pivot irrigated cotton (district 2).

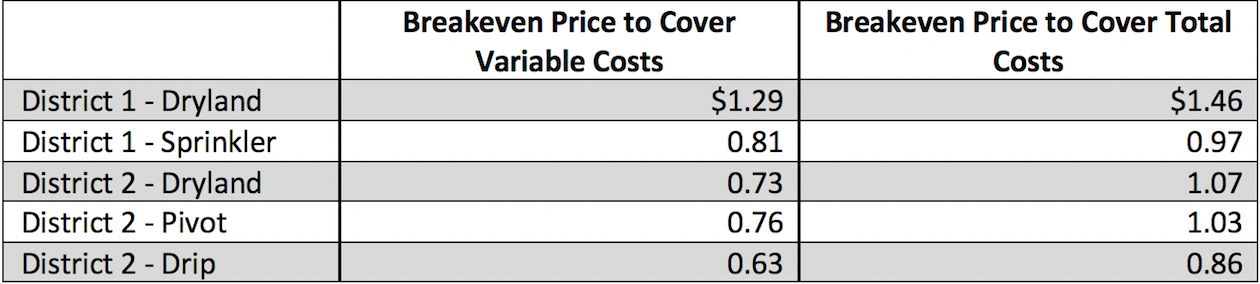

Of course, the breakeven prices listed in Table 3 assume that a cotton enterprise will achieve the yield projected in the budget. To see how sensitive those values are to changes in yield, Table 4 reports the breakeven prices for cotton in districts 1 and 2 when yield per acre is reduced to 75% of the value in the budgets.

Once again using pivot irrigated cotton in district 2 as an example, if the expected yield per acre is decreased by 75% from 1000 lbs. to 750 lbs. of cotton lint, the prices necessary to break even on variable and total costs increase to $0.76/lb. and $1.03/lb. respectively. Perhaps the key takeaway here is that that sprinkler irrigated cotton in district 1 and all cotton enterprises in district 2 should break even on their variable costs at the budgeted price of $0.80/lb. even if yields are lower than expected; however, these enterprises may have trouble breaking even on their total costs if yields are less than expected in the budgets.

Some Final Comments on the Budgets

There are a couple of things to keep in mind as you use this information and as you use the budgets for your district. First, the numbers in these budgets are general guidelines for cotton enterprises in their respective districts and will not represent every operation perfectly. To build a budget that better represents your operation, AgriLife offers tools to help you build your own budgets on our website.

One other thing to keep in mind is that the outlook for the 2023 cotton market is not yet fully formed. According to John Robinson of Texas A&M University, there is less consensus right now than normal about how many acres of cotton will be planted this year, which means that predictions at this time about 2023 supplies are less certain. On the demand side, Dr. Robinson tells me that while some indicators are showing signs of strengthening demand, it is too early to tell if demand will truly strengthen this year relative to 2022. In short, there is still a lot we don’t know about the 2023 cotton market currently. Hopefully, next month’s WASDE report will shed some light on these questions.

To stay up to date on the latest cotton marketing information, make sure to check out Dr. Robinson’s cotton marketing website. While there, make sure to sign up for his weekly email newsletter as well.

Expectations for ARC/PLC Payments

Expected prices are still well above the reference price for the ARC-CO and PLC programs, so cotton prices are once again unlikely to trigger a payment under either of these programs this year. If you are considering enrolling in either of these programs in 2023, the Agricultural and Food Policy Center at Texas A&M University has a decision tool you can use to help you understand the probability of receiving a payment. The deadline to enroll in these programs is March 25, 2023.