The current downward trend in wheat prices continues to impact wheat production in our area.

The current downward trend in wheat prices continues to impact wheat production in our area.

The prices are currently at or below the economic breakeven levels calculated for various regions

within our districts. Additionally, higher costs and an expected dry season due to another La

Niña year are increasing the risk for ranchers this year.

Although the world wheat reserves have been diminishing these last years, U.S. stocks have increased since 2022, contributing to lower prices.

Analyzing the Texas Cash Grain Prices since August 2020, we have observed cash prices as low as in late 2020 but with higher production costs (Graph 1). Market volatility emerged in July and August 2023 due to uncertainties surrounding Black Sea exports, leading to a steady price decline.

Graph 1. Texas Cash Grain Prices. August 2020 – August 2024.

Estimated Wheat Budgets

Farmers decide whether to graze their wheat, harvest only, or pursue mixed strategies in the Southern Rolling Plains, where wheat production includes grain and forage grazing. Today, we will analyze various budgets, including Wheat Dryland – No-Till, Wheat Dual Stockers 700 Lbs., Wheat Dual Stockers 800 Lbs., and Wheat Grazed Out (Table 1). While production costs are slightly lower than last year, mainly due to lower fertilizer prices, net margins have also decreased. The breakeven prices are lower than this region’s 2025 wheat market prices.

Table 1. Wheat Budgets Summary

Estimated Results

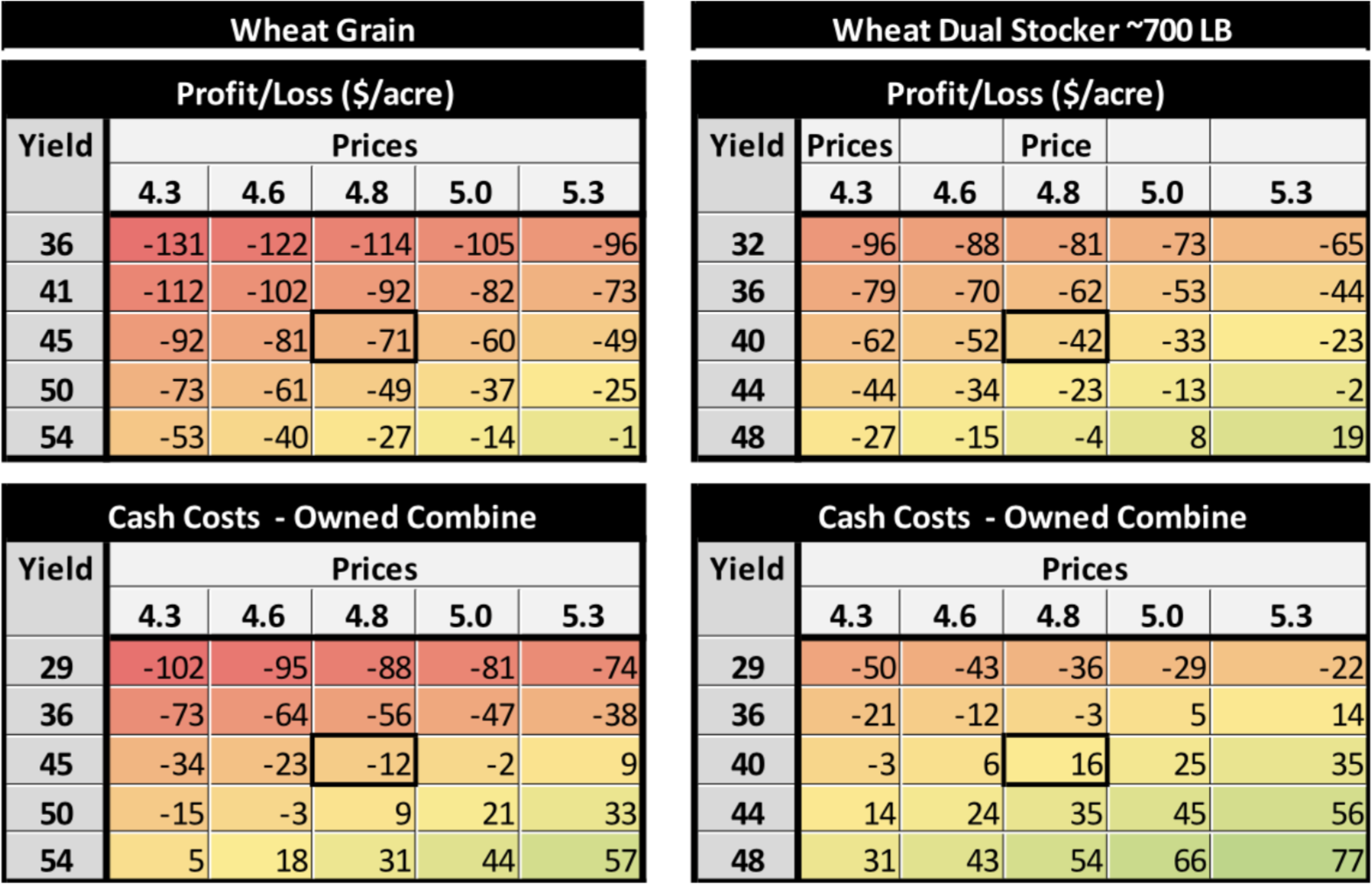

A preliminary assessment of these budgets indicates a negative outcome for non-till wheat grain-only production when accounting for all variable and non-variable costs, such as depreciation and interest in equipment. Based on a yield of 45 bu/acre and a wheat price of $4.8/bu, the breakeven price for covering total costs is $6.4/acre. The breakeven yield at these anticipated wheat prices is 55 bu/acre to cover all costs (Table 2). For those owning all machinery, considering only financial costs, this indifference yield drops to 46 bu/acre, though not accounting for future amortization costs.

In the dual-purpose wheat production scenario (Wheat Dual Stocker ~700 Lb), pulling cattle before March 1st and harvesting the entire planted area, a five bu/acre yield drag was considered due to grazing effects. With an estimated grazing production of 80 pounds per acre, the breakeven price is $5.9/bu. This result reflects a slightly improved outcome due to grazing income at $0.85 per pound of gain.

Table 2: Price and Yield Sensitivity Analysis (Part I)

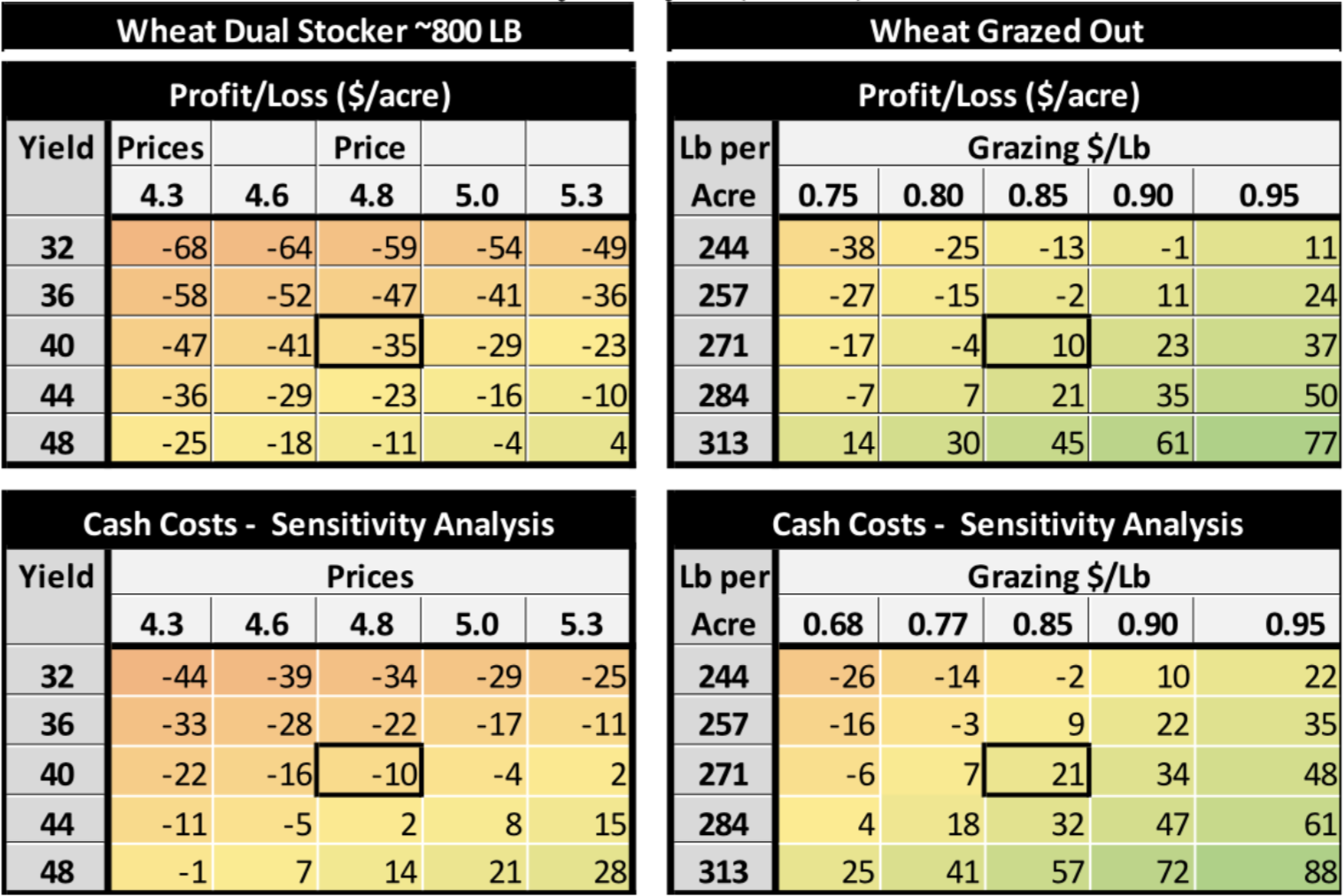

The Wheat Dual Stocker ~800 Lb scenario, representing a system keeping stockers from early grazing through May 1st, requires approximately 33% of the planted area for late grazing, which will not be harvested. Despite a decrease in breakeven price to $5.4/bu, net results closely mirror the grain-only wheat scenario due to the additional grazing income hardly offsetting the lower harvested area.

In the Wheat Grazed Scenario, additional cattle were assumed during the second grazing phase to optimize forage use and increase the total pounds gained per acre. With an estimated total production of 271 pounds per acre, the enterprise’s net income amounted to $10/acre. The grazing breakeven price to cover full costs was $0.82/lb. Like last year, this scenario has the potential to be the most profitable alternative in the region.

Table 2: Price and Yield Sensitivity Analysis (Part II)

Conclusions

Preliminary total breakeven prices have fallen below wheat grain prices for wheat grain alternatives. Wheat Grazing is the only alternative that is still showing profits with these estimated costs, even though it still has a high breakeven price of $0.82 per pound of gain. As always, we encourage farmers to create customized budgets considering their technology, equipment, hired services, soil type, and expected yields. Variations in these factors across our diverse region can significantly impact outcomes. At this early season stage, we assumed average yields and production.

Please feel free to contact us if you have any questions or need guidance using our “Wheat and Small Grain Decision Aids” Excel spreadsheet, available here

(https://vernon.tamu.edu/extension-projects/d3-agricultural-economics/ ).