Cotton on the Texas A&M AgriLife Farm in Snook, Texas on Sept. 9, 2021. (Sam Craft/Texas A&M AgriLife Marketing and Communications)

How does cotton quality impact the price someone pays for it? In this post, we discuss how cotton is classed and how the classification of upland cotton might inform cotton prices.

Cotton Lint Classification Parameters

Cotton classification refers to the measurement of cotton lint according to a set of standards related to the lint’s quality. Ideally, these standards communicate to growers what qualities the industries that use cotton value most. For cotton buyers, classing information provides objective data about the quality of cotton in each bale that is sold.

Cotton is classed according to eight parameters:

- Fiber length refers to the length of individual cotton fibers. Length impacts how easily cotton lint is processed into yarn and the quality of the fabric that is woven from the yarn.

- Length uniformity describes how similar in length individual cotton fibers are to one another. In general, greater uniformity is associated with higher quality and easier processing.

- Fiber strength refers to the amount of force that is required to break a set of cotton fibers. Stronger fibers are less likely to break during the yarn production process.

- Micronaire measures the fineness or thickness of cotton fibers. Micronaire that is too high or too low is difficult to process and results in a fabric that lacks the “feel” that consumers desire.

- Color describes the brightness of and the amount of pigmentation (yellowness) present in a set of lint fibers. Cotton that is brighter and has less pigmentation is easier to dye and easier to blend with cotton from other bales.

- Trash, leaf, and extraneous matter each measure the amount of non-lint materials found in a bale of cotton. These materials must be removed before the lint is processed into yarn, which incurs a cost on the processor.

For more information on how each of these parameters is measured, refer to this Cotton Incorporated publication.

Cotton Quality and Loan Value

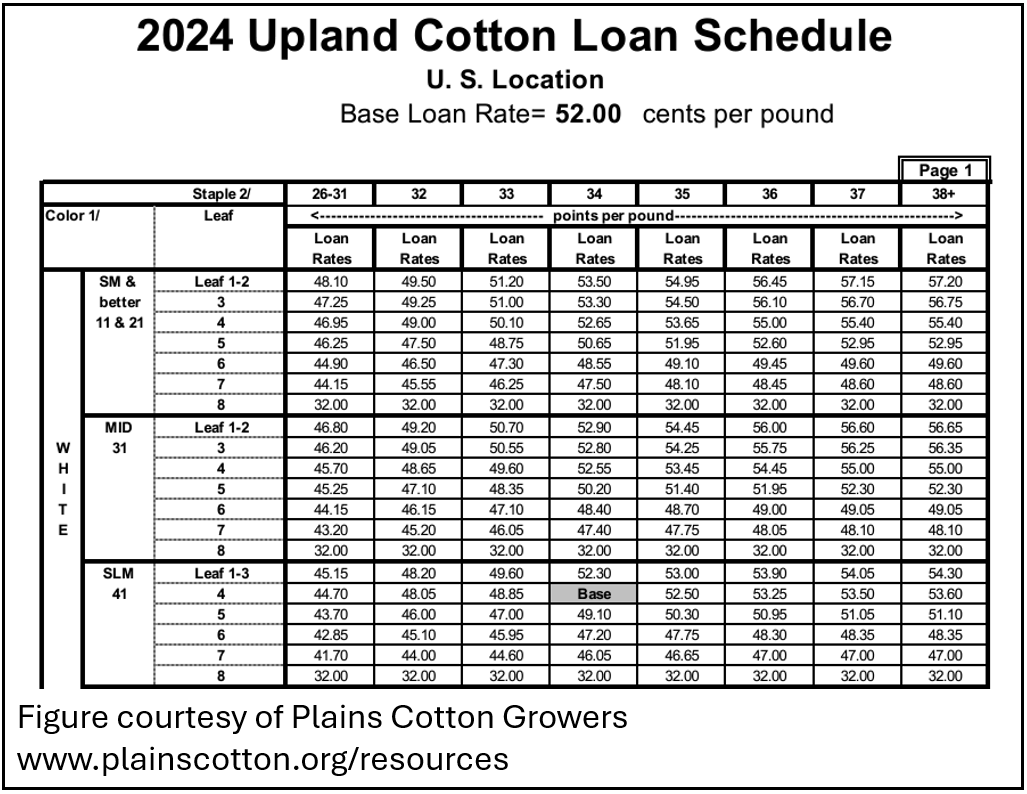

Depending on how it is classed, cotton may have a premium or a discount applied to its loan value for the purposes of USDA’s Marketing Assistance Loan Program. Currently, the base rate for upland cotton is $0.52 per pound. Each year, USDA determines how premiums are added to, or discounts subtracted from, this value and publishes this information on the Commodity Loan Rate web page. Figures 1 and 2 provide examples of two charts that describe these premiums and discounts for upland cotton. You can find the full loan schedule for upland cotton on the resources page of Plains Cotton Growers website.

Figure 1 shows the 2024 premiums and discounts for fiber (staple) length, color, and leaf. Cotton with a color grade of 41, staple length of 34, and leaf grade of 4 receives the base loan rate of $0.52 cents per pound. Cotton that has longer fiber length (moving to the right on the chart), a better color grade (for example, moving from 41 to 31 in color), or less leaf (moving up with in a color grade) receives a premium. Moving to the left or down results in a discount.

Figure 1. Part of the 2024 Upland Cotton Loan Schedule

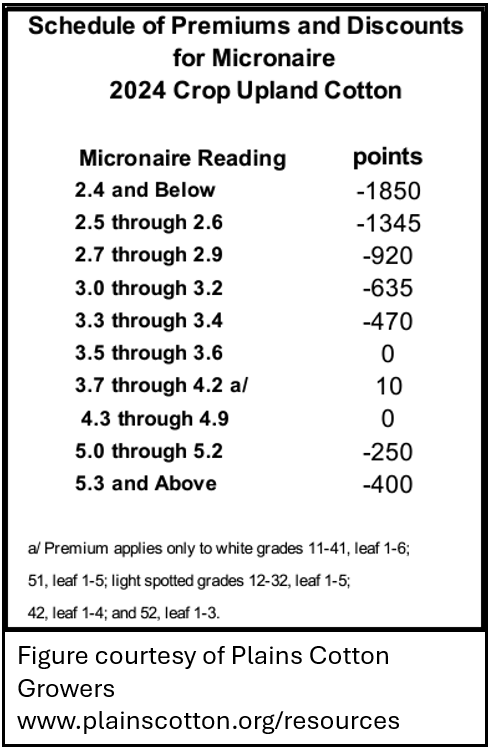

Figure 2 reports the 2024 premiums and discounts for micronaire. In the schedule cotton earns a premium for micronaire readings between 3.7 and 4.9. Cotton earns discounts for readings less than 3.5 or greater than 5.0. Note that the chart gives premium and discount values in points and not cents per pound. In this chart, 100 points equals $0.01. In other words, a micronaire reading between 3.7 and 4.2 results in a premium of one-tenth of one cent per pound. A micronaire reading between 5.0 and 5.2 results in a discount of two and half cents per pound.

Figure 2. 2024 Premiums and Discounts for Micronaire

Loan Value and Lint Price

So how does the loan value impact the price paid for cotton in the market? Or does the loan value impact price? To help answer that question, we can look at trading statistics for cotton provided by The Seam® Cotton Trading Monitor. This site provides real-time data on cotton trading, including information on the grade, loan rate, and market price for cotton bales sold on a given day.

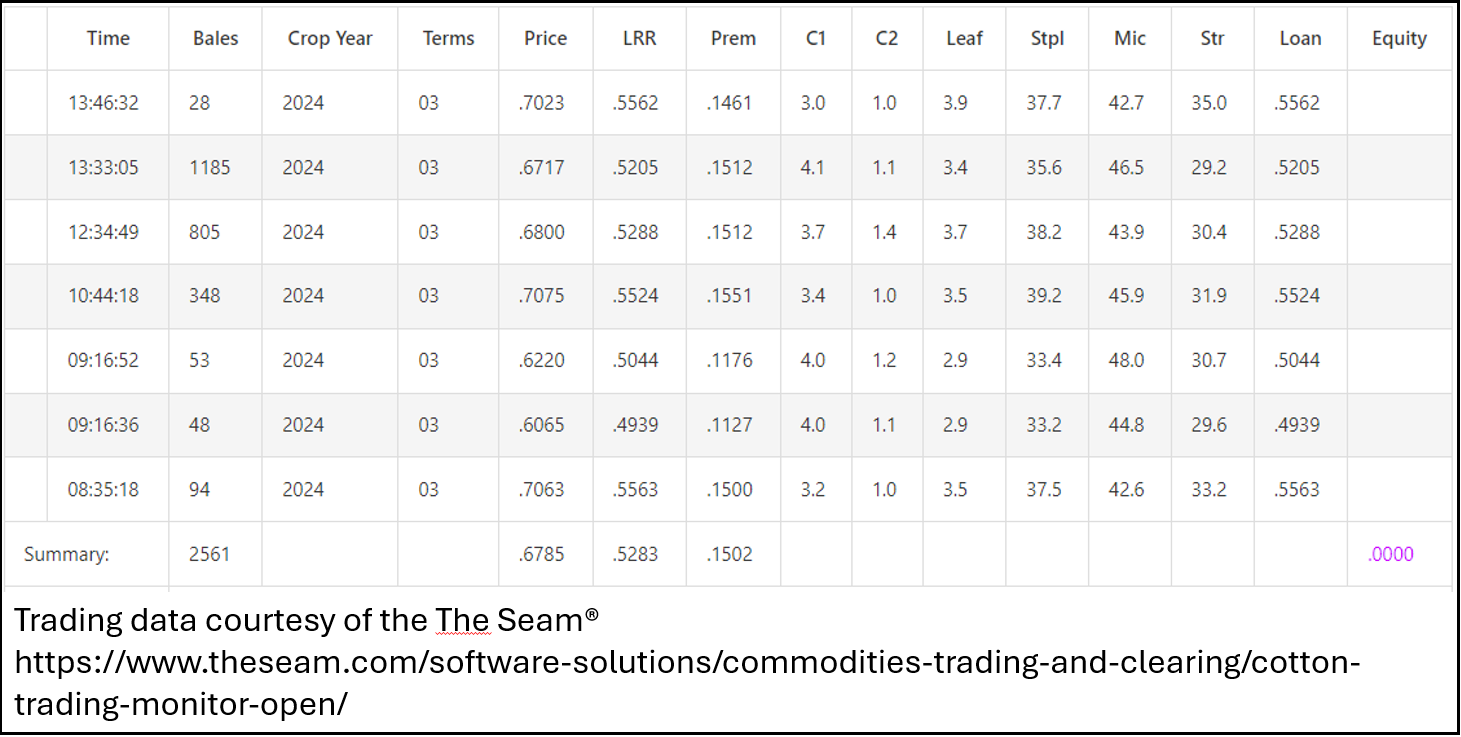

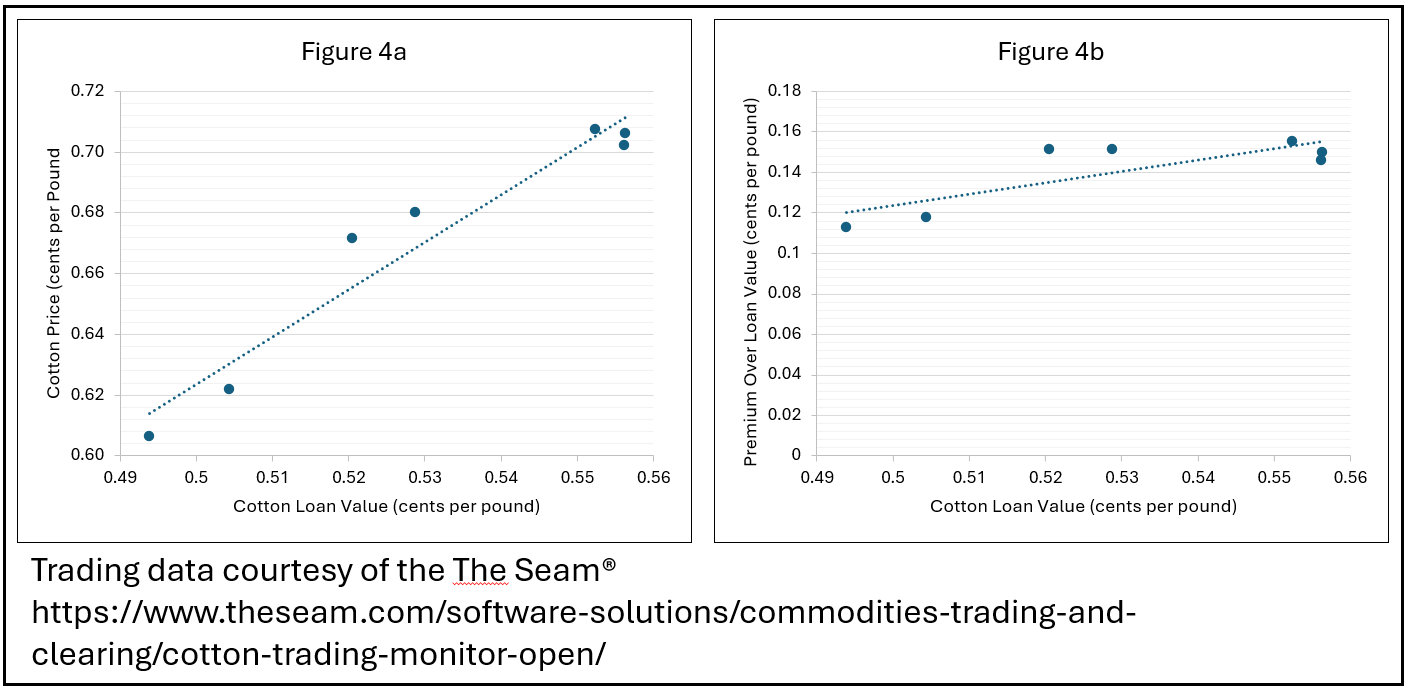

Figure 3 shows these statistics for October 2, 2024. Of interest to use are the columns titled Price, LRR, and Prem. The price column reports the price per pound that the cotton sold for. The LRR column indicates the cotton’s loan value. The Prem column lists the difference between the cotton’s price and its loan value. In the figure, cotton with a higher loan value also tends to receive a larger premium. Figure 4 also illustrates this relationship, which plots the loan rate against the cotton price Figure 4a) and the loan rate against the premium. Based on this information, it appears that we can at least associate a higher loan rate with a higher price.

Figure 3. Trading Data for October 2, 2024, from The Seam®

Figure 4. Cotton Price and Premium Over Loan Value Plotted Against Loan Value