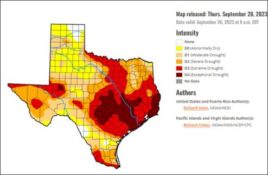

The USDA’s Pasture, Rangeland, and Forage Insurance (PRF) has shown to be an essential tool that supports ranchers during these times. Today, we will review how this insurance works, with an example from Wise County.

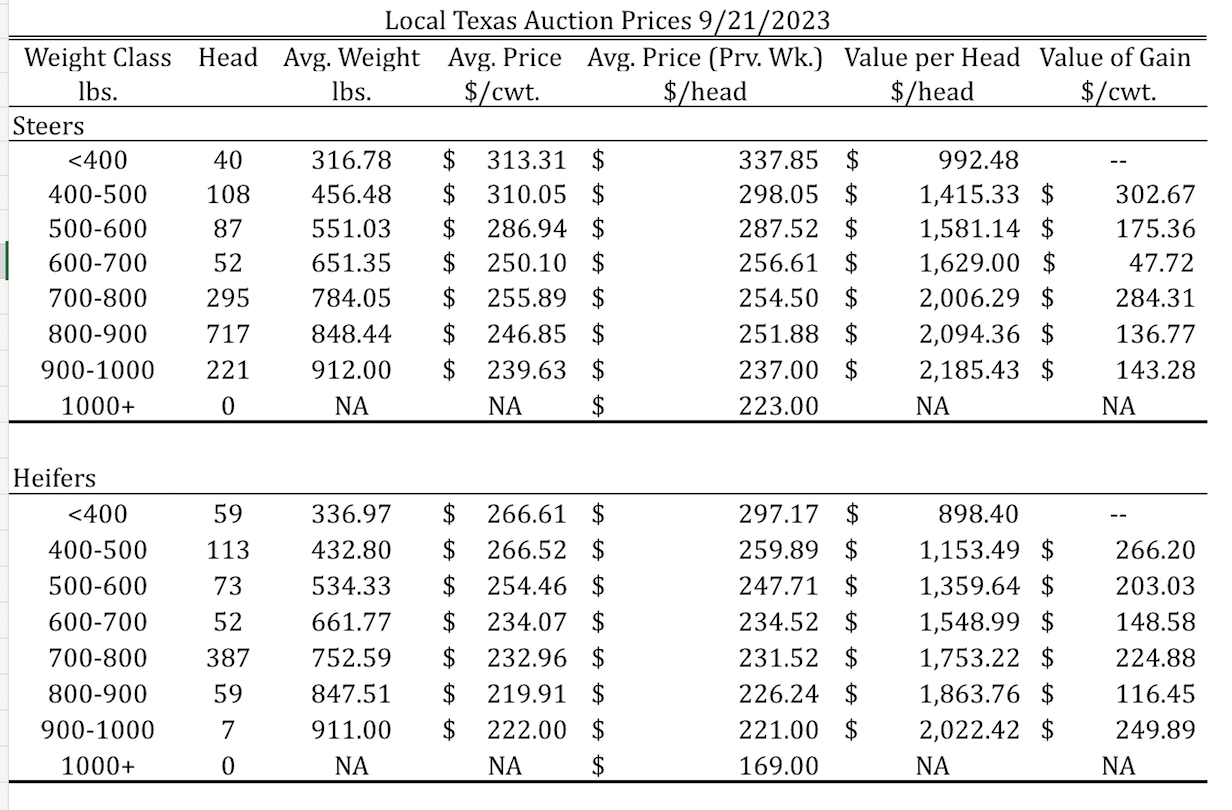

Tulia, Amarillo, Dalhart Average – Cattle Prices by Category – 9/21/2023

Pasture, Rangeland, and Forage Insurance Program Review

The deadline for the USDA’s Pasture, Rangeland, and Forage Pilot Insurance Program (PRF) is December 1st. This program, better known as rainfall insurance, was developed to reduce the economic impact of a lack of rainfall. It was designed to provide insurance coverage on grazing pastures, rangeland, and forage acres with or without irrigation.

The most exciting factor of this program is that it showed positive net benefit of indemnities over premiums in many cases. But most importantly, it generated significant payments in those years when it was needed most.

How does it work?

The program does not directly measure the drought effect or the severity of the drought. It only measures the lack of rainfall compared to an average index for that area. The National Oceanic and Atmospheric Administration (NOAA) developed a rainfall index to determine the lack of precipitation in a specific area or grid.

The index compares the actual rainfall with the average rainfall for that grid. Each grid NOAA uses has approximately 17 by 17 miles (if located at the equator). Indemnities are triggered when the actual rainfall is below the average historical rainfall.

PRF Example

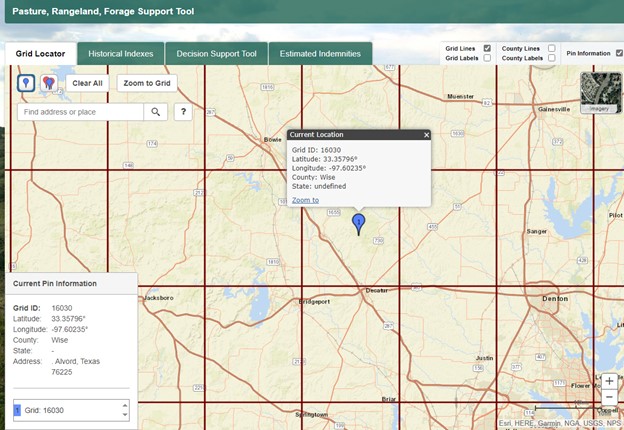

For this example, we will use the USDA support tool (https://prodwebnlb.rma.usda.gov/apps/prf)

that will help us understand how it works, estimate premium costs, and estimate results since 1948.

For this case, we will use a 100-acre farm as an example (to make it easy). Last year, we used a ranch in Dickens County as an example. This year, we will take as an example a ranch in Wise County (Grid ID: 16030, Image 1).

Image 1. Pasture, Rangeland, Forage Support Tool. (USDA-RMA)

First, after selecting the farm’s location, we need to choose the intended use of the insured acres (Grazing or Haying), the production systems (irrigation, organic), and the coverage level (70%, 75%, 80%, 85%, 90%). We will use the default coverage level of 90% and a productivity factor of 100%. However, the program will enable you to assign a productive factor to match your farm productivity in that area better.

We also need to select a sample year. Since 2023 has yet to finish, we won’t be able to use it as an example. We will use results from 2022 as the sample year when we were in a drought.

Second, we must choose how to allocate the insurance during the year using bi-monthly intervals. There are several strategies that you can discuss with your insurance broker. In this case, we will use one of the most common strategies. We will spread our insurance during the months when forage production is critical. During that period, a loss in forage production will significantly impact production and economic results.

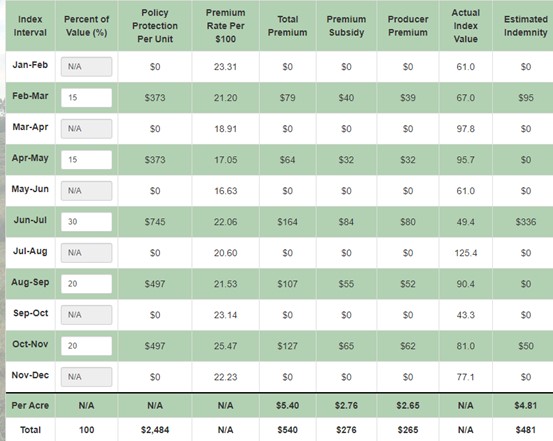

We will distribute the insurance throughout the year using the following percentages: 15% for the Feb-March interval, 15% April-May, 30% June-July, 20% Aug-Sept, and 20% Oct.-Nov. The total percentage selected should add up to 100% (Table 1).

Table 1. Protection Table (USDA-RMA)

The tool will show the results for the 2022 year sample. The producer premium was $2.65 per acre. The estimated Indemnity payment for 2022 resulted in $4.81/acre, which resulted in a net gain of $2.65/acre. Assuming a stocking rate of 15 acres per cow, the net payment per cow was $32.

There might need to be more than these indemnities to cover all the extra costs and hard work during a severe drought. Still, they will help pay for our additional feeding costs when needed most.

Historical Estimated Indemnities and Net Results

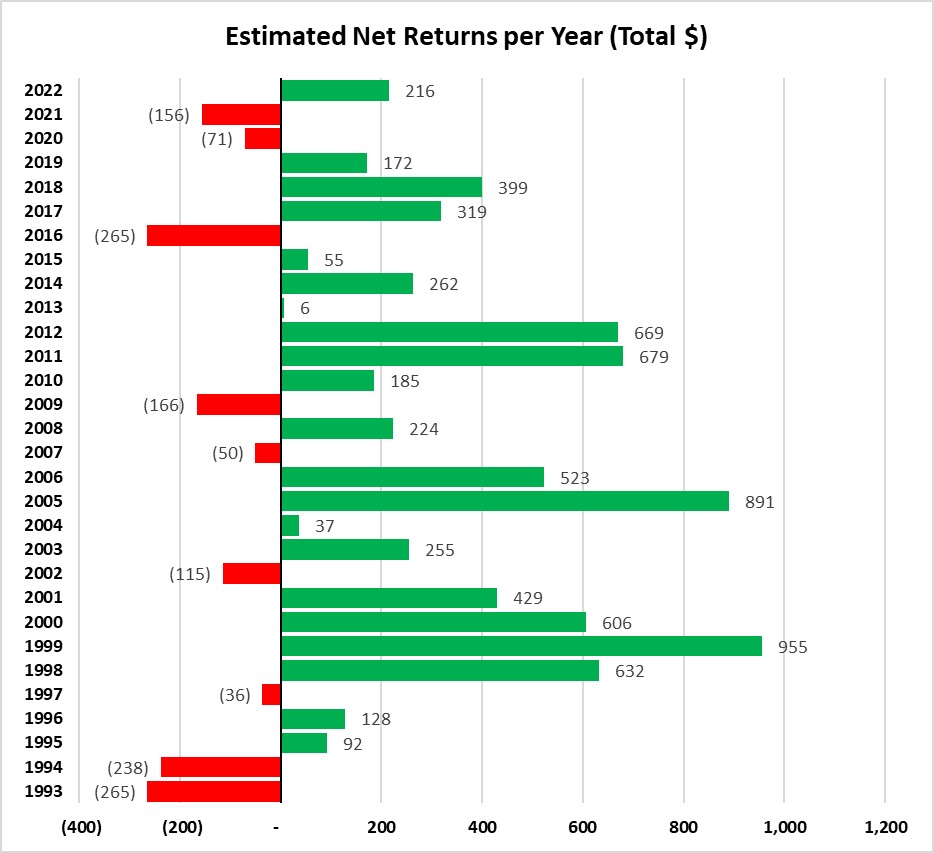

One of the most interesting features of the USDA tool is the estimated historical results. We can go back to 1943 and check how much the insurance would have paid in the past. For example, results for the last 30 years had an average net payment of $2.12 per acre above premium costs (Table 2). Indemnities did not compensate paid premiums during this period, only nine years out of 30. More interesting, only twice the producer had to pay whole premiums.

The highest payments were in 1999, 2005, 2011, and 2012. During these years, the estimated net payments range from $6.5 to $9.5 per acre.

Table 2. Historical Indemnities and Net-Results.

The Pasture, Rangeland, and Forage Pilot Insurance Program (PRF) is a great program to support producers when rainfall is below average. But most importantly, it supports ranchers to cover extra and higher feeding costs when precipitation is lower than usual.