(Sam Craft/Texas A&M AgriLife Marketing and Communications)

With summer approaching, it’s time to consider the Dual-Purpose Annual Forage Insurance Program for our next season’s wheat operations (deadline: July 15). The program has shown long-term positive results for wheat producers in many places in Texas. In today’s blog, we’ll discuss the features and advantages of this program, highlighting how it can benefit farmers across the state.

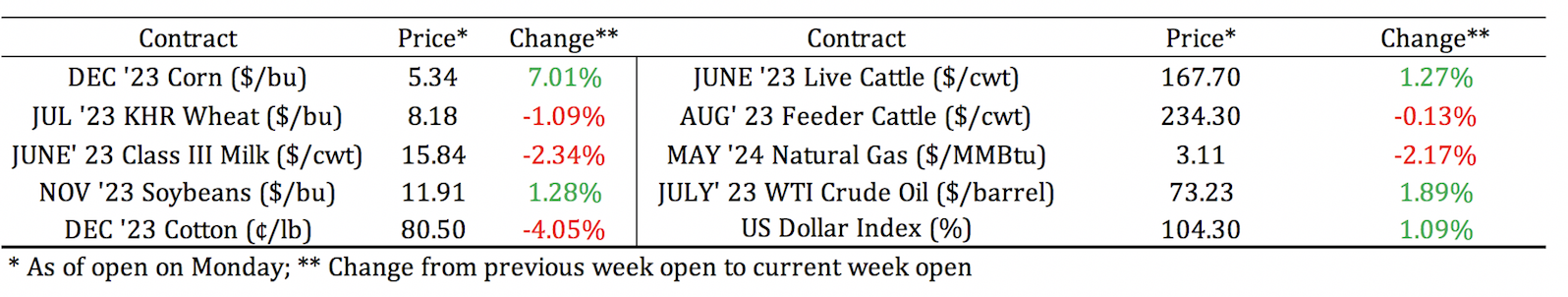

Board Update 5/30/2023

Tulia, Amarillo, Dalhart Average – Cattle Prices by Category 5/25/2023

Dates & Deadlines

6/1/2023 – RWFM Stewardship Webinar Series: Algal Blooms and Management

6/1/2023 – Ranch Raised Beef Conference

6/28/2023 – 2023 Angora Goat Testing – Final Weigh Day and Shearing

7/6/2023 – Ranchland Friend or Foe?

8/1 -8/2/2023 – 2023 Grain Grading Workshop

Dual Purpose Annual Forage Insurance

Agricultural operations face numerous risks, including fluctuating weather events, drought, and market conditions. Dual-purpose wheat producers face the risk of harvesting their grain and forage production during the grazing period. To mitigate these uncertainties, the United States Department of Agriculture (USDA) offers an insurance program known as the Annual Dual Purpose Insurance Program.

In this article, we will explore the characteristics and benefits of the Annual Dual Purpose Insurance Program, demonstrating how it helps operations across Texas.

The program enables farmers and ranchers to proactively manage risks associated with the annual forage production of their dual-purpose crops, such as wheat. It helps maintain stable operations and minimizes the impact of losses by providing financial assistance during drought periods.

How does it work?

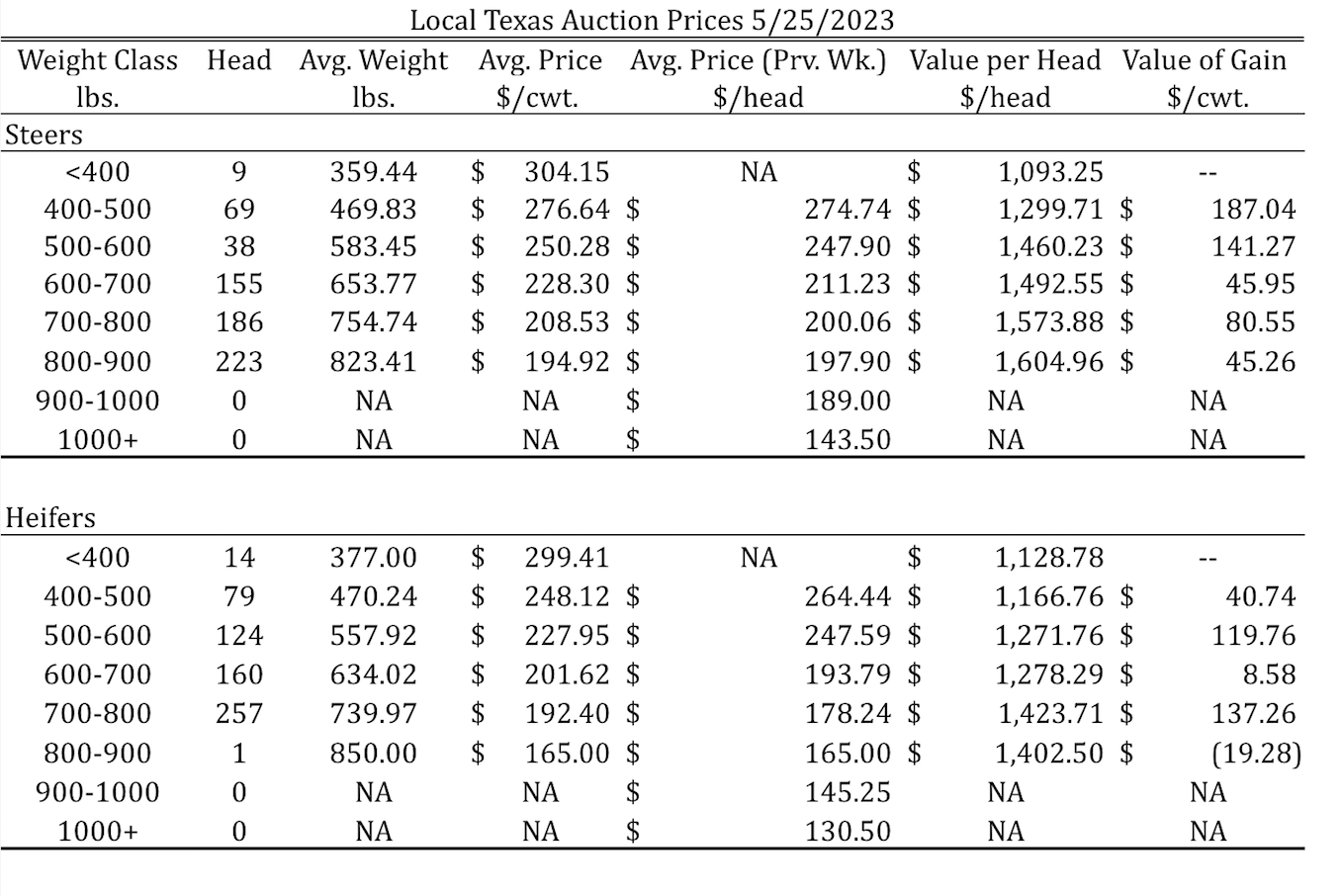

Instead of directly measuring the drought effect, the program assesses the lack of rainfall. The National Oceanic and Atmospheric Administration (NOAA) developed a rainfall index to determine the lack of precipitation in a specific area or grid (Figure 1). Indemnities are triggered when the actual rainfall is below the average historical rainfall.

To illustrate how the program works, we will utilize the USDA support tool available at http://af.agforceusa.com/ri. This tool will help you understand the program, estimate premium costs, and check past indemnities for their selected area. For this example, we will focus on the grid where Locket, Texas, is located (Grid ID: 16923, Figure 1).

Figure 1. Annual Forage – Grid Locator. (USDA-RMA)

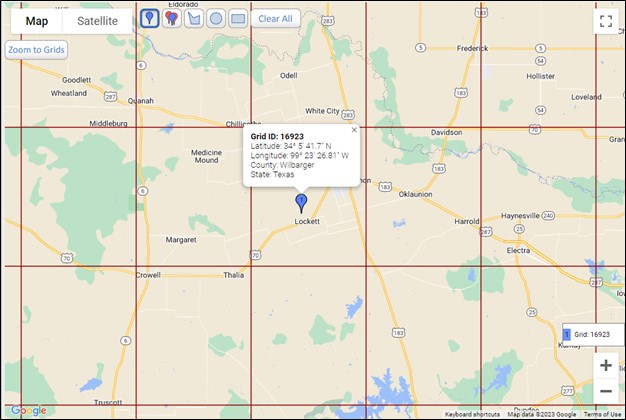

First, we must choose the planting date after selecting the farm’s location. We checked in dual purpose for this example, your field’s coverage level and productivity factor. The program will enable you to assign a productive factor to match your farm productivity in that area better. We will use the default coverage level of 90% and a productivity factor of 100% (Figure 2).

Second, using bi-monthly intervals, we must choose how to allocate the insurance during the year. There are several strategies that you can discuss with your insurance broker. In this case, we will use one of the most common strategies. We will spread our insurance when rainfall is considered critical for forage production. During that period, a loss in forage production will significantly impact production and economic results.

We will distribute the insurance throughout the year using the following percentages: 30% for the interval Oct-Nov, 30% Dec-Jan, and 40% Feb-March. The total rate selected should add up to 100%.

Figure 2. Decision Support Tool (USDA-RMA)

Estimated Results

Based on the selected parameters, the estimated premium per acre amounts to $12.57. The estimated indemnity payment for 2022 totals $43.52 per acre, resulting in a net payment of $30.95 per acre. While these costs may not cover all grazing income losses during a drought, they will help cover expenses.

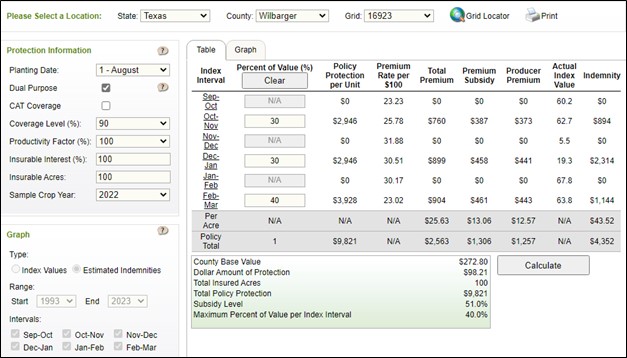

Historical Estimated Indemnities and Net Results

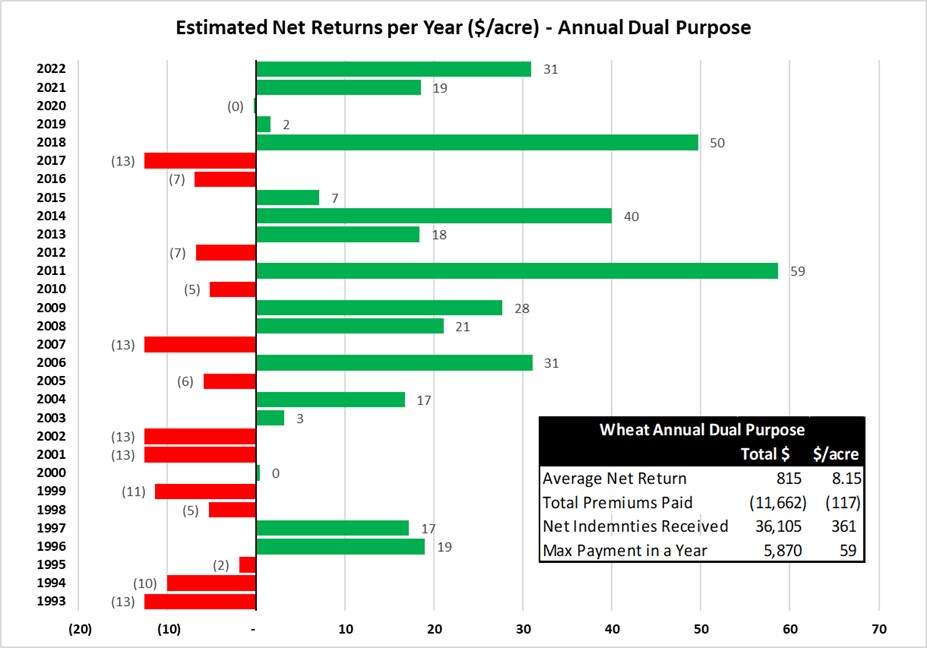

The USDA tool will also provide you with estimated indemnities since 1948. Results for the last 20 years calculate an average net payment of $8.15 per acre above premium costs (Figure 3). In the previous 30 years, a farm in this grid would have paid indemnities only 13 times. Although only 5 times in the last 30 years, the operations would have paid the entire premium.

Figure 3. Historical Indemnities and Net-Results.

Conclusions

The Dual Purpose Annual Forage Insurance has proven to be an essential tool to support farmers during drought. It showed a positive net benefit of indemnities over premiums in many cases. But most importantly, it generated significant payments in drought years when farmers needed them most.