Last week, USDA released its May WASDE report which includes USDA’s first projections for the 2023/24 crop year. Today we will review what this report has to say about wheat, corn, sorghum, and cotton this year.

Last week, USDA released its May WASDE report which includes USDA’s first projections for the 2023/24 crop year. Today we will review what this report has to say about wheat, corn, sorghum, and cotton this year.

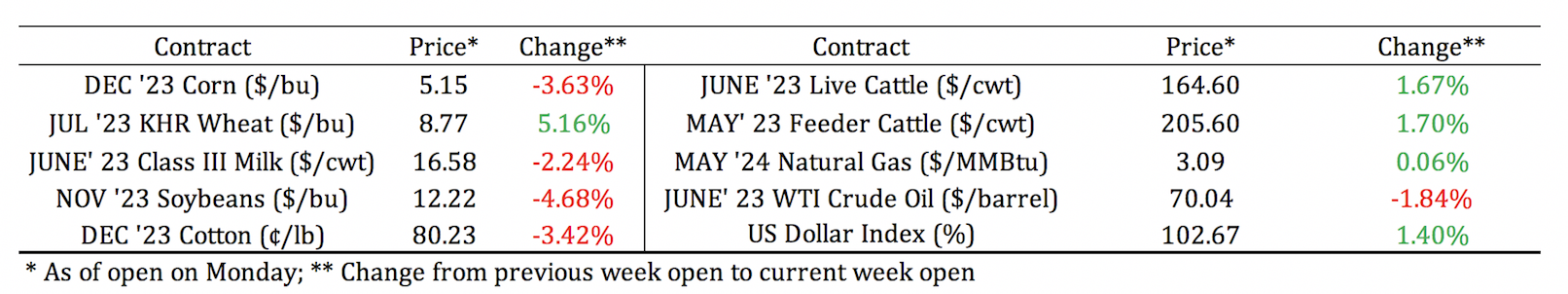

Board Update 5/15/2023

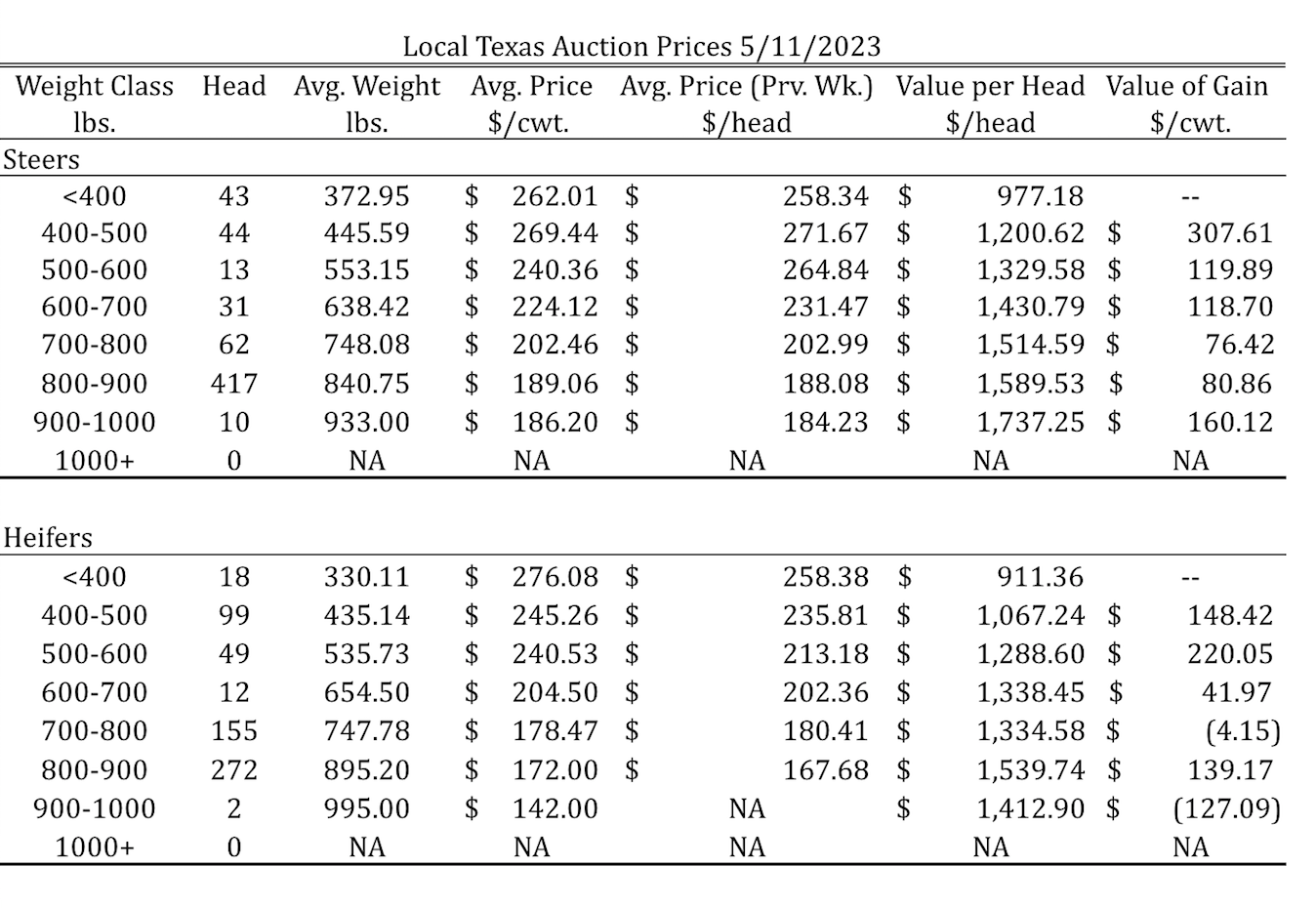

Tulia, Amarillo, Dalhart Average – Cattle Prices by Category 5/11/2023

Dates & Deadlines

5/4/ 2023 – RWFM Stewardship Webinar Series: Wild Pigs in Texas

6/1/2023 – RWFM Stewardship Webinar Series: Algal Blooms and Management

6/1/2023 – Ranch Raised Beef Conference

6/28/2023 – 2023 Angora Goat Testing – Final Weigh Day and Shearing

7/6/2023 – Ranchland Friend or Foe?

8/1 -8/2/2023 – 2023 Grain Grading Workshop

Wheat

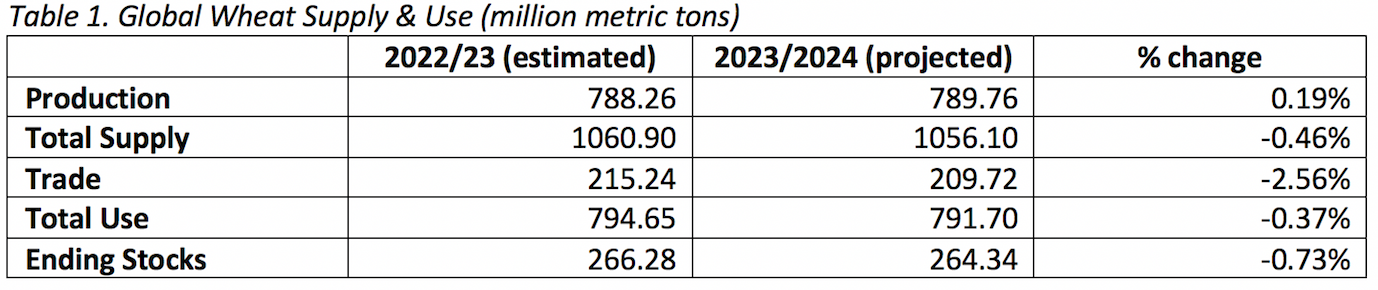

Table 1 compares global wheat supply and demand for the 2022/23 and the 2023/24 crop years. Global wheat production is expected to increase by about 1.5 million tons in 2023/24 relative to the previous year; however, beginning stocks this year are projected to be about 6.4 million tons less. As a result, total supplies this year are projected to decrease by about 4.9 million tons, which is a 0.46 percent decrease from 2022/23. On the demand side, wheat use is also expected to decrease globally from 794.65 million tons in 2022/23 to 791.7 million tons in 2023/24. Ending stocks are projected to be about 1.94 million tons less this year compared to last year.

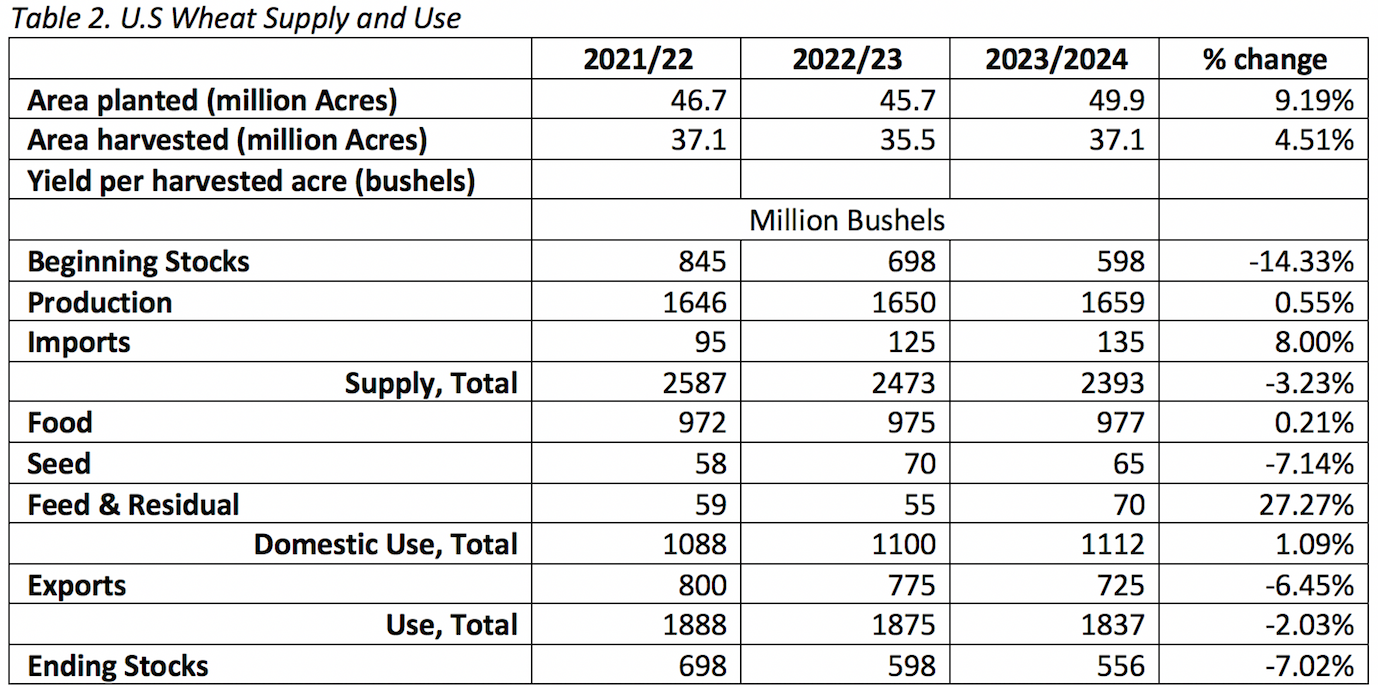

Domestically, the report projects an increase in both the area planted and the area harvested this year, along with slightly lower yields and smaller beginning stocks. Domestic use is expected to increase by about 12 million bushels, driven largely by feed and residual use, and 2023/24 ending stocks are projected to be about 42 million bushels less than 2022/23. Table 2 shows the WASDE projections for 2023/2024 wheat supply and use in the United States.

Corn

The global outlook for corn is increased production, use, and ending stocks. Worldwide corn production is expected to increase by about 6%, with increases in the United States, the European Union, China, and Argentina offsetting decreases in Ukraine, Canada, and Brazil. Corn use is expected to increase by about 4% this year, and ending stocks are projected to increase by about 5.2%.

In the U.S., WASDE projects that the 2023/2024 area planted, area harvested, and yield per acre will all increase relative to 2022/23, as shown in Table 3. As a result, production is expected to increase by about 11%. This increase combined with larger beginning stocks is projected to lead to fewer imports of corn into the U.S. this year. United States corn use is projected to increase by about 5% and ending stocks are expected to increase by 57%.

Sorghum

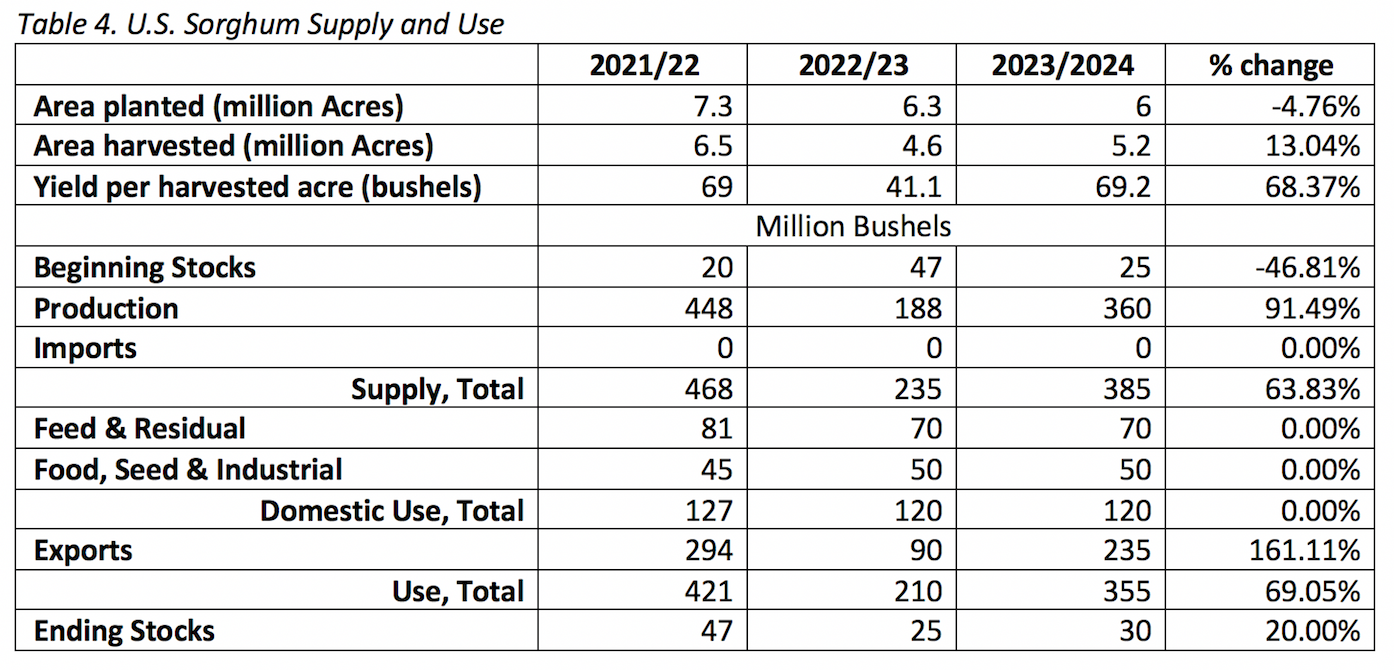

WASDE projects less acres of sorghum planted in the U.S. this year, but more acres harvested and larger yield per acre harvested (Table 4). Based on these projections, U.S. sorghum supplies are expected to increase significantly this year. Domestic use of sorghum is not projected to change, but exports of sorghum from the U.S. are projected to increase by about 161%. If these projections hold, U.S. sorghum ending stocks should increase slightly above last year but will still be significantly less than ending stocks in 2021/22.

Cotton

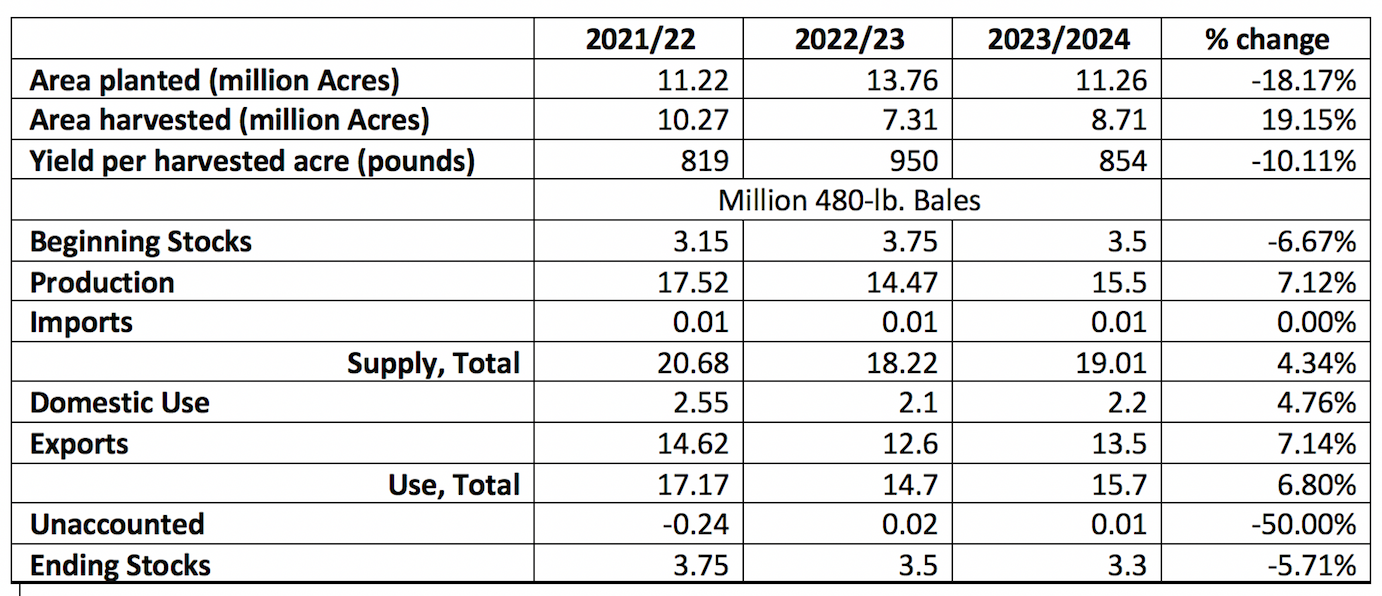

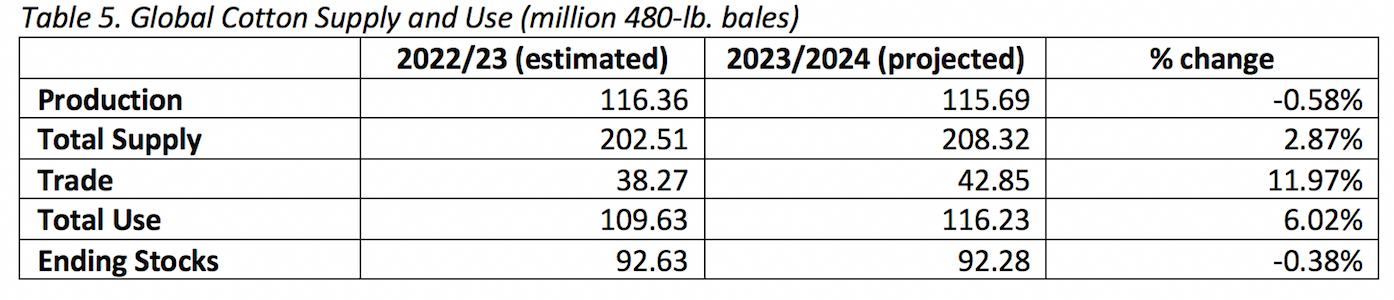

USDA expects both world cotton supplies and use to increase this year, but that ending stocks for 2023/24 will be similar to ending stocks last year (Table 5). Total worldwide production is expected decrease this year; however, when China is not included, world production increases by almost 3%.

In the United States, planted acres are expected to be about 2.5 million acres less this year relative to 2022/23 but harvested acres are expected to increase by about 1.5 million acres (Table 6). As a result, domestic production is expected to increase by about 1 million bales. Domestic cotton consumption is not expected to change this year, but exports are projected to increase by about 1 million bales. Ending stocks are projected to decrease slightly to 3.3 million bales, compared to 3.5 million bales in 2022/23.