In this post, we look at commodity basis and discuss how understanding a commodity’s basis can help you as you develop a marketing plan.

In this post, we look at commodity basis and discuss how understanding a commodity’s basis can help you as you develop a marketing plan.

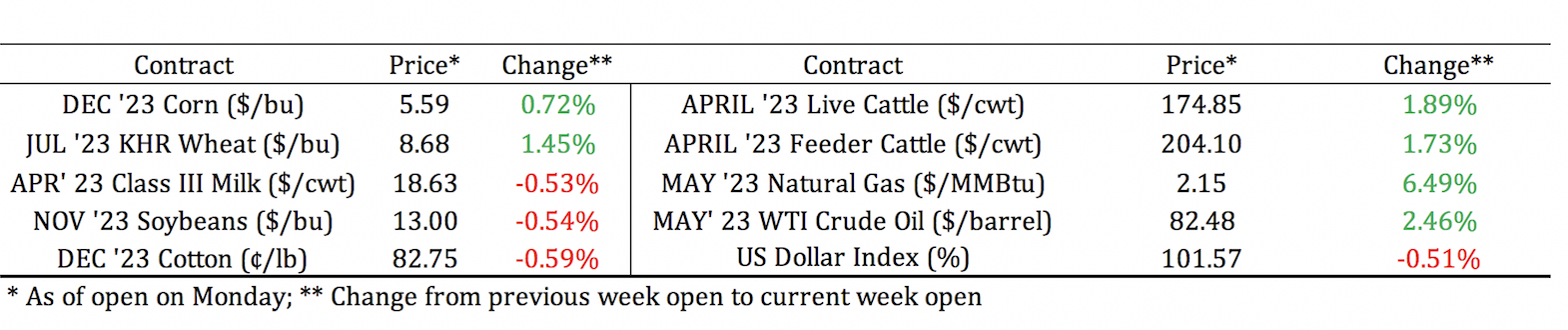

Board Update 4/17/2023

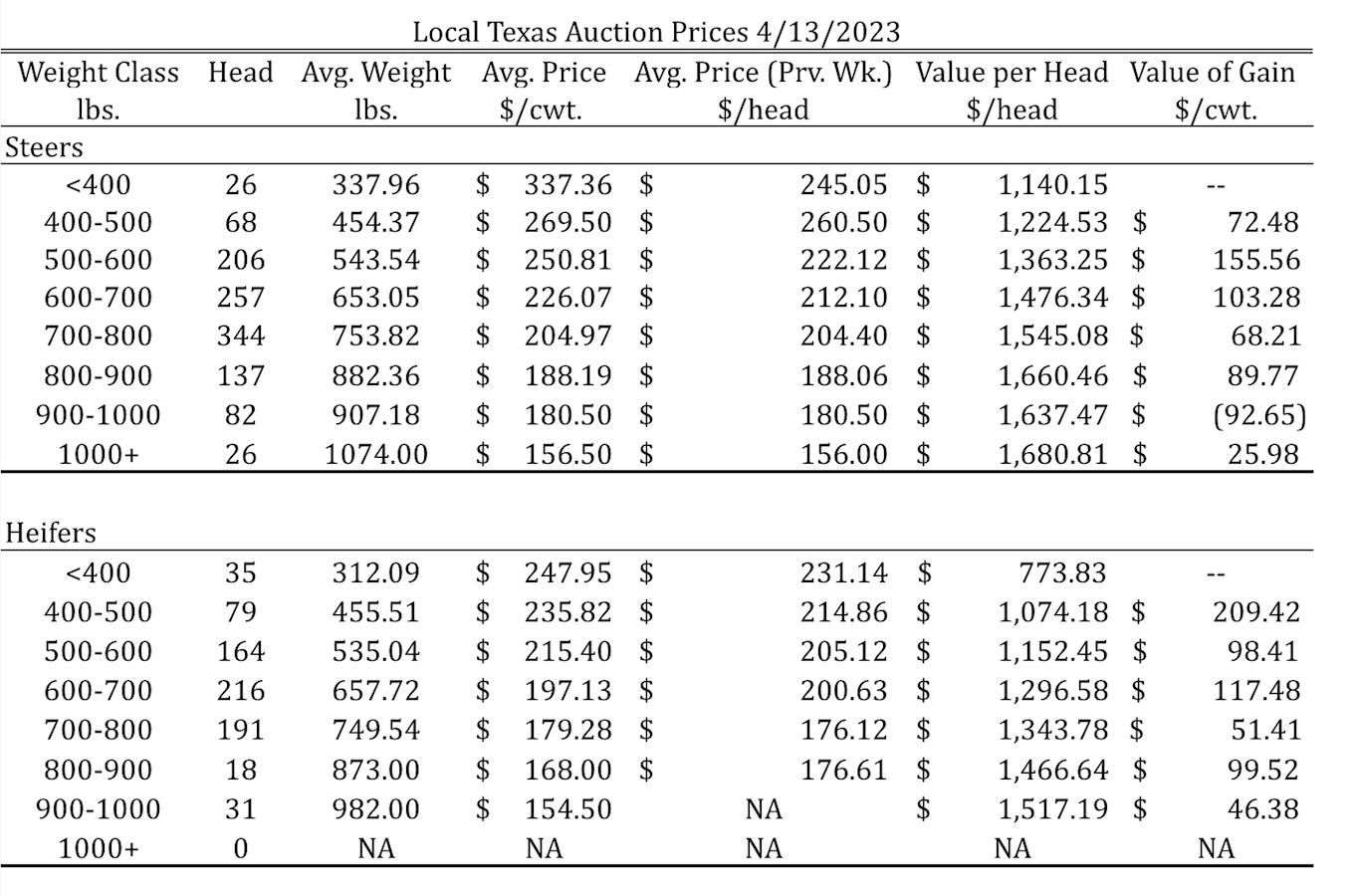

Tulia, Amarillo, Dalhart Average – Cattle Prices by Category 4/13/2023

Dates & Deadlines

4/25-26/2023 – Hemphill County Beef Conference, Canadian

5/4/ 2023 – RWFM Stewardship Webinar Series: Wild Pigs in Texas

6/1/2023 – RWFM Stewardship Webinar Series: Algal Blooms and Management

What is Basis?

Commodity basis is the difference between a commodity’s price in a local cash market at a specific time and its price in a futures contract. We can express that relationship using this formula:

Basis = Cash Price – Futures Price

Table 1 illustrates this calculation for both cotton and wheat in the South Plains using data from Texas A&M AgriLife Extension’s basis website. According to the data, on January 4, 2022, cotton was selling in the Lubbock cash market for about $1.04 per pound. At the same time, a March 2022 cotton futures contract was priced at about $1.16 per pound. The basis at this time was the difference between these two prices, that is −$0.12 per pound. On January 5, 2022, wheat was selling in the southwest Panhandle area for about $7.76 per bushel, a March 2022 Kansas City wheat futures contract was priced at $7.69 per bushel, and the basis for wheat in this area was +$0.07 per bushel.

Basis is normally calculated using the nearby futures contract, which is the contract that is currently closest to expiration. However, for storable commodities like cotton and grain crops, basis can be calculated using any futures contract. If you’re using basis to make marketing decisions a good rule of thumb would be to use the contract month that is nearby to the date you plan to deliver the commodity to the local cash market. For example, if you plan to sell cotton in January or February of 2024, then use the March 2024 futures contract to compute the basis.

Using Basis to Create Price Expectations

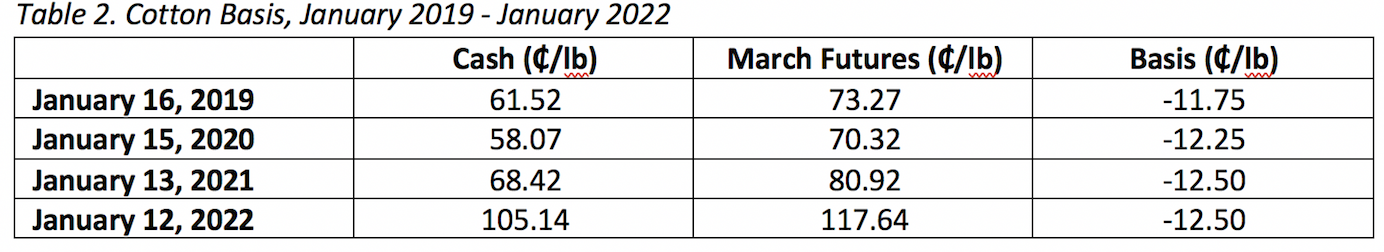

One reason to track a commodity’s basis along with its cash and futures prices is that basis tends to follow consistent patterns from year to year and tends to vary less than cash or futures prices. Table 2 illustrates this using cotton basis in Lubbock, TX on about the second week of January for the last four years. As you can see from the table, the cash and the nearby futures price vary quite a bit from year to year, but the basis remains relatively stable over the same period. A basis that is stable from year to year is valuable from a marketing perspective because it allows you to predict what a commodity’s cash price will be in the future.

To predict a commodity’s cash price, you would first need to create an expectation for what the basis will be on or around a certain date. You can do this by taking an average of 3-5 years of basis data for the time period you’re interested in. For example, if I want to create an expectation for the cotton basis in Lubbock, TX on or around January 15, I could use the average of the basis values in Table 2, that is −12.25 cents per pound. In other words, I expect that the cash price for cotton in Lubbock, TX on or around January 15 to be about 12.25 cents per pound less than the price quoted in the nearby March contract.

Once you have an expectation for the commodity basis, use this formula to calculate your expectation for the cash price:

Expected Cash Price = Futures Price + Expected Basis

Let’s say that the price of cotton in the March 2024 cotton contract is 83.22 cents per pound. Using my expected basis of −12.25, I would predict that the cash price of cotton in Lubbock, TX on or around January 15 will be 70.97 cents per pound.

Keep in mind that this is not a perfect prediction of what the cash price will be. A lot could happen between now and mid-January 2024, and the March 2024 futures contract price could climb above or fall below where it is currently sitting. The Lubbock basis could also change. Some of the factors that impact basis are local supply and demand fundamentals, transportation costs, storage costs, and interest rates. If any of these factors were to vary much from their historically normal levels, that change would be reflected in the basis. As you make predictions, make sure to revisit them from time to time during the year. Ask yourself whether any of the assumptions that you based the prediction on have changed significantly. If the answer to that question is yes, then consider how that change might impact your prediction and whether you should revise your marketing plan in response to the change.

Using Basis to Improve Your Marketing Plan

For storable commodities, understanding basis provides many benefits beyond predicting prices. For example, changes in the basis can tell you something about local supply and demand fundamentals. A basis that is weaker than normal (that is, less positive or more negative than normal) indicates weak demand in the area, and that you might receive a higher price later if you can store the commodity until it is wanted. On the other hand, a basis that is stronger than normal (that is, more positive or less negative than normal) indicates strong demand for the commodity, so you may benefit from selling it for cash in the present rather than storing it for later.

Understanding commodity basis can also help you to evaluate a contract that you are offered. Some commodity contracts will quote their price relative to the nearby futures price. For example, a grain contract might offer to pay a price that is 10 cents over the nearby futures price at the time of delivery.

If the historical basis at that time of year is usually less than what is offered in the contract, then you are likely to receive a better price with the contract than you would selling in the local cash market. If the historical basis is usually more than what is being offered, then the cash market might result in a better price than the contract. For contracts that use price quotes instead of basis quotes, you can compare the contract price to the expected local cash price to decide if the contract is worth signing.

If you’re interested in learning more about basis and how to use basis to improve your marketing plan, I suggest that you sign up for AgriLife’s Master Marketer Program the next time it is offered in your area. And of course, you can always contact us with any questions you have about this or any other marketing issues.