(Courtney Sacco/Texas A&M AgriLife Marketing and Communications)

Producers across the United States are increasingly adopting the Livestock Risk Protection Program, commonly known as the LRP, to protect themselves against falling cattle prices. Today, we will discuss the benefits of adopting this risk management tool in your operation.

What are the benefits of using USDA’s Livestock Risk Protection Program?

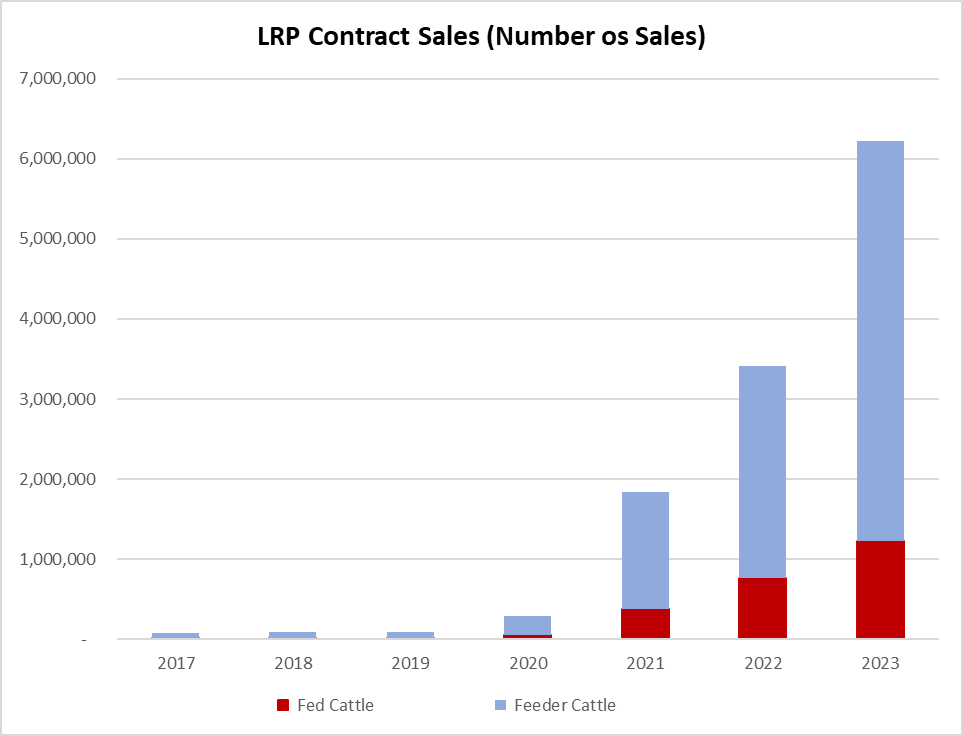

Producers across the United States are increasingly adopting the Livestock Risk Protection Program, commonly known as the LRP. This program was designed to protect ranchers against falling cattle prices. From a mere 71 thousand heads covered in 2017, the usage of LRP has increased rapidly to 6.2 million heads by 2023 (Figure 1). This increase aligns with the changes to the LRP program done by the USDA and the significant improvement in the market feeder and live cattle prices.

Figure 1: LRP Usage

During the summers of 2019 and 2021, the USDA introduced several modifications to the LRP program. These changes reduced the premiums paid by ranchers and allowed them to defer premium payments until the end of the endorsement period, making it accessible across all states and counties. The option to pay premiums at the program’s period offers ranchers a considerable cash-flow advantage compared to purchasing Put Options in the futures market.

The rise in cattle prices has also emphasized the importance of implementing a solid price risk management plan. The LRP helps minimize financial losses, secure profit margins, and reduce the risk of business failure, particularly in the face of higher investment levels. The increased adoption of LRP reflects a growing number of ranchers who have included risk management plans to protect their operations. These ranchers significantly reduce the threat of business failure by setting a floor price for their cattle.

Another benefit of the LRP program is its accessibility. It doesn’t require a minimum number of cattle to be insured, meaning even small ranchers with just one cow can take advantage of its benefits. Most importantly, cow-calf and stocker operations can LRP to protect their prices.

Although LRP premiums are often cheaper compared to Put Options due to the level of subsidy, premium costs depend on the expected end price, the coverage level, and the endorsement length. One disadvantage of operating with LRP is that once you purchase the insurance, there is no option to offset that position at any time, as we might be used to operating options in the future market.

Below is an example of a 21-week endorsement that will match the Future August contract at CRM, but you can also work with 13- or 17-week endorsements.

August 2024 Stockers Example

The following table shows the cost of purchasing LRP for stockers that a rancher plans to sell in August 2024, with 800 Lbs./head of weight (Table 3). Producer’s premium and price insurance were estimated using the USDA-RMA Cost Estimator tool (https://ewebapp.rma.usda.gov/apps/costestimator/).

Table 3. LRP Example for August 2024 Stockers

At a 100% coverage level, the program’s target price was $255.93/ CWT, with a net producer’s premium after the subsidy of $6.23/CWT. If the USDA reported prices fell below $255.93/CWT at the end of the endorsement period, an indemnity is triggered and paid to the producer. If prices are higher, no indemnities are paid.

The value for a Put option for a similar price was $11.10/CWT (https://www.cmegroup.com/markets/agriculture/livestock/feeder-cattle.html). Remember that both tools have pros and cons and must be analyzed.

More Information on LRP

For more information and further details on LRP, please check the USDA Fact Sheet (Livestock Risk Protection Fed Cattle | RMA (usda.gov)). The USDA website lists approved livestock agents and insurance companies if you want to buy the insurance.