Dorper sheep on Friday, Nov 10, 2023 in Sonora, Texas. (Michael Miller/Texas A&M AgriLife Marketing and Communications)

What can producers expect from sheep markets this year? To answer that question, we turn to guest author Dr. Jeffrey Wright. In this post, Jeff walks us through the important characteristics of international sheep markets and how they impact the domestic price of lamb and mutton here in the United States.

What We’re Reading

Texas A&M AgriLife Hemphill County Beef Conference April 23-24 – AgriLife Today

Bringing back native grasslands after wildfire – AgriLife Today

Owning Your Piece of Texas workshop set for April 23 in San Angelo – AgriLife Today

Baughman assumes director role April 1 – Southwest Farm Press

Sorghum production expected to increase – Southwest Farm Press

Cow and Cow-Beef Prices Booming – Southern Ag Today

Tax Reporting for Crop Insurance – Southern Ag Today

Welcome Dr. Jeffery Wright to the Blog

Today’s post features a guest author for the blog. Dr. Jeffrey Wright is our new Texas A&M AgriLife Extension Economist for District 7, located in San Angelo, TX. Jeff is a recent graduate of the Agricultural Economics Ph.D. program at Texas A&M University in College Station. If you have questions for Jeff, you can contact him at jeffrey.wright@ag.tamu.edu.

International Sheep Markets

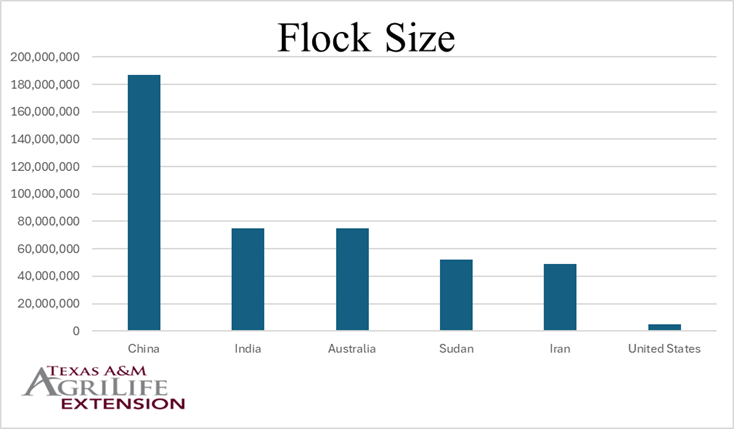

Today’s post will focus on international sheep production, which plays an important role in the United States’ market. Figure 1 shows the flock size in each of the top five global sheep producing countries, as well as in the U.S. As the figure shows, the U.S. is a small producer of sheep globally. In fact, the U.S. imports about 74% of the lamb and mutton it consumes from other nations. Thus, while analysts expect the United States flock size to decrease about 2% this year, this change is not likely to impact domestic prices. A two percent decrease in production here in the U.S. can easily be offset by production increases in other countries.

Figure 1. Flock Size for the five largest sheep producing nations and the U.S.

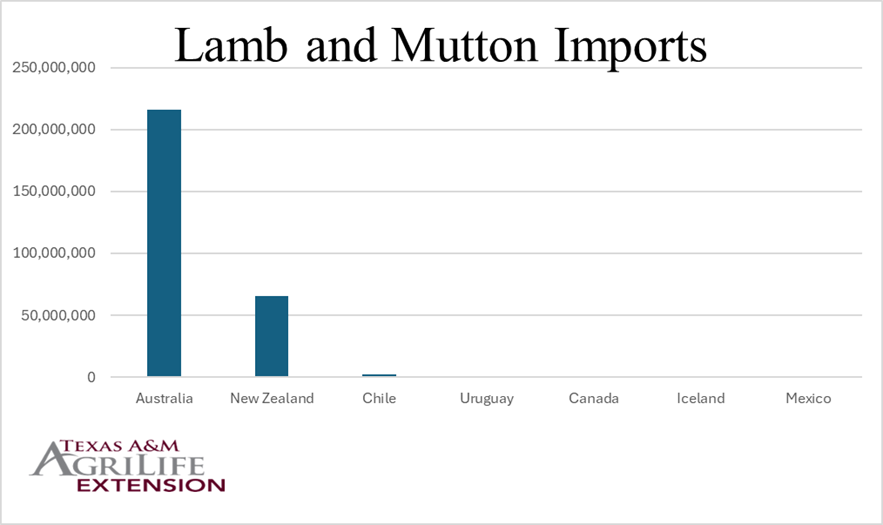

So where do all those lamb and mutton imports to the U.S. come from? Figure 2 shows the amount lamb and mutton (in pounds) imported into the U.S. during 2023 by country. Most of U.S. sheep and mutton imports come from Australia, with New Zealand coming in a distant second. In fact, while Australia is only the third largest producer of sheep globally, it is the world’s largest exporter of lamb and mutton. Part of the reason for this is Australia’s low cost of production. While labor in Australia isn’t especially cheap, sheep production in that country is highly efficient. Australian ranchers can produce sheep with only a small amount of labor. This makes Australian producers very competitive in international markets.

Figure 2. Amount of lamb and mutton imports (lb.) to the United States, by nation

Over the last three years, Australian has increased its production of sheep. In 2023, Australia reported its largest flock in twenty years, and Australia’s supply of sheep to world markets in 2024 is expected to be above average. So far, U.S. consumers have welcomed this increase in production. U.S. lamb imports in January were up 4,324,000 pounds from one year ago with the bulk coming from Australia. Expect increased international supplies of lamb and mutton to bring down domestic prices as we proceed through the year.

Protection for U.S. Producers?

The question of whether sheep producers should receive more government protection from international imports is a hotly debated topic. The American Sheep Industry Association (ASI) has regularly pushed for more protection and has initiated or assisted with three trade investigations in the last six years.

Last fall, the R-CALF USA Sheep Committee petitioned Katherine Tai, a U.S. Trade Ambassador, for relief from lamb and mutton imports. The petition claimed imports were causing a high level of injury to the American sheep industry. It also argued that American producers are placed at a disadvantage since they must meet more exacting production standards than producers in other countries. Predator control, for instance, is a major issue in the United States. U.S. producers cannot use sodium fluoroacetate, commonly referred to as compound 1080, to poison predators. However, compound 1080 is legal in Australia, which helps reduce production costs in that country relative to in the U.S.

The sheep committee hoped to pursue a trade case based on violations of trade law concerning countervailing duty or anti-dumping regulations. In December of 2023, the ASI consulted international trade lawyers to determine if there was sufficient cause to move forward with the case. Research, however, did not uncover evidence of dumping and the costs of bringing the case forward would have been substantial. So, acting on the legal advice it received, the ASI opted not to pursue the case at this time.

While the ASI may not be currently seeking protection from imports this remains a contentious issue that is sure to keep resurfacing. For producers, domestic prices are influenced by the supply of lamb and mutton primarily from the U.S. Australia and New Zealand. Keeping an eye on international as well as domestic markets gives a more complete perspective on the industry and should lead to more accurate price predictions.