The 2018 Farm Bill has been extended through September 30, 2024. This means that producers may enroll in Title I programs as a part of their risk management plan this year. This post will explain how two of these programs protect farms against price and/or revenue losses.

The 2018 Farm Bill has been extended through September 30, 2024. This means that producers may enroll in Title I programs as a part of their risk management plan this year. This post will explain how two of these programs protect farms against price and/or revenue losses.

What We’re Reading

Proposed Safety Net Choice Could Add Risk to Farmers – Southern Ag Today

Cotton Acreage and Relative Prices – Southern Ag Today

Farming to Break Even – Southern Ag Today

Cover crops can pay despite challenges – Southwest Farm Press

Input prices a mixed bag in 2024 – Southwest Farm Press

AgriLife Extension updates producers on utilizing dicamba products – AgriLife Today

Profitability spreadsheet workshops for producers set in South Plains – AgriLife Today

Overview of the ARC-CO Program

The County Agriculture Risk Coverage program (ARC-CO) protects farms against revenue losses at the county level. If the actual county crop revenue for a covered commodity falls below the revenue guaranteed by the program, a payment is triggered. On a per-acre basis, the program guarantees 86% of the county’s ARC-CO benchmark revenue for the commodity. Calculate the payment that producers receive under ARC-CO using this formula:

Payment = 0.85 × base acres × (ARC-CO Guarantee – County Revenue).

ARC-CO caps payments at 10% of the county’s benchmark revenue.

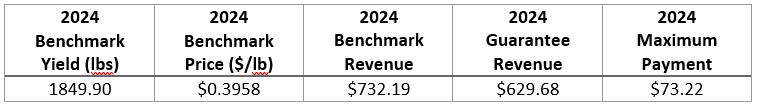

As an example, Table 1 reports the ARC-CO benchmark revenue, guaranteed revenue, and maximum payment for irrigated seed cotton in Lubbock County (ARC/PLC Program Data, USDA FSA). The benchmark yield and benchmark price are calculated as the Olympic average of the previous 5 years of county yields and market year average (MYA) prices, respectively. Note that both seed cotton yield and price are based on the combined yield and price for cotton lint and cottonseed. The benchmark revenue is calculated as the benchmark yield multiplied by the benchmark price. The guaranteed revenue is 86% of the benchmark while the maximum payment per base acre is 10% of the benchmark.

Table 1. 2024 ARC-CO payment information for irrigated seed cotton in Lubbock County, TX

During the 2024 program year, if actual irrigated seed cotton county revenue in Lubbock County falls below $629.68, ARC-CO payments will trigger. For example, if county revenue is $600 even then ARC-CO pays $29.68 per base acre ($629.68 – $600.00 = $29.68). If a Lubbock County producer has 100 base acres enrolled in ARC-CO, their total payment is $2,522.80:

Payment = 0.85 × 100 × $29.68.

The payment received by the producer increases as actual county revenue falls until county reaches $556.46. At this point, ARC-CO payments max out at $73.22 per base acre.

Overview of the PLC Program

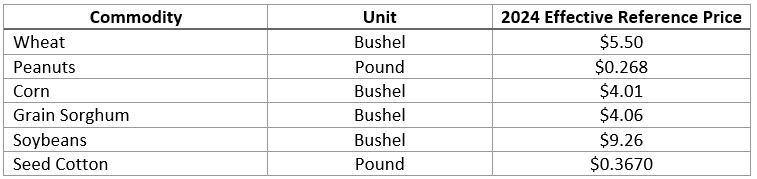

The Price Loss Coverage (PLC) program protects farms against price decreases during the program year. If the MYA price for a covered commodity falls below the PLC reference price, a payment is triggered. PLC payments reach their maximum on a per-unit basis when the MYA price is less than or equal to the national average loan rate for the commodity in question. Table 2 lists the 2024 PLC reference prices for common crops grown in the Texas Panhandle and Southern High Plains as reported in the ARC/PLC Program Data published by USDA FSA.

Table 2. PLC reference prices for selected crop commodities

Calculate the payment received from the PLC program as follows:

Payment = 0.85 × base acres × (Reference Price – Effective Price) × Payment Yield

Using seed cotton as an example, PLC payments trigger when the seed cotton MYA price falls below $0.367/lb. If a producer has 100 base acres enrolled in PLC, a payment yield of 1500 lbs./acre, and the MYA price is $0.35/lb., their payment from the PLC program is $2,167.50. That is:

0.85 × 100 × ($0.367 – $0.350) × 1500 = $2167.50.

Making Safety Net Decisions in 2024

Will either ARC-CO or PLC payments trigger this year? The Agriculture Food Policy Center at Texas A&M offers a 2024 ARC-CO/PLC Decision Aid that can help answer that question. Producers can enter information for their farm and the tool will predict the expected payment amount they might receive from both programs this year. In addition, the tool estimates the likelihoods for different possible payment amounts that a farm might receive. Producers should consider both the size of the expected payment and the likelihood of receiving a payment as they consider which program to enroll in this year.

Producers should also consider how enrolling in ARC-CO or PLC will impact their crop insurance choices this year. Anyone who enrolls in ARC-CO is not eligible for the Supplemental Coverage Option (SCO) or the Stacked Income Protection Plan (STAX). Producers who enroll in PLC are eligible for SCO but are ineligible for STAX. Keep these restrictions in mind and evaluate the potential payments from these insurance tools alongside the potential payments from ARC-CO and PLC. The deadline to sign up for both the ARC-CO and PLC program is March 15.