(Laura McKenzie/Texas A&M AgriLife Marketing and Communications)

Early-season wheat prices and winter wheat crop conditions have shown record highs and lows during this planting season. In today’s Wheat Market Update we reviewed the main market drivers for the following season.

Dates & Deadlines

11/14/2022 – Kent and Stonewall Ag Support Program – Jayton, Texas

11/29 /2022 – 12/1/2022 – Amarillo Farm & Ranch Show

01/24/2023 – 03/09/2023 – Master Marketer, Vernon, Texas.

What We’re Reading

New publication to help livestock producers manage risks – AgriLife Today

Utilizing cornstalks in beef cow diets – BEEF

Groups sue EPA over delayed CAFO actions – BEEF

AFBF establishes 2023 farm bill priorities – Morning Ag Clips

Just how much would a rail strike hurt farmers? – Feedstuffs

Wheat Market Update

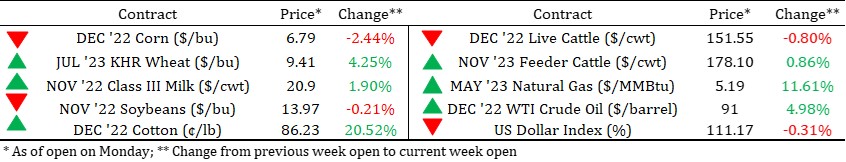

The same variables that affected the wheat market last season will remain relevant in the next one. Tight-ending stocks, weather, geopolitical conflicts, and the slowdown in the economy will continue to be the most important variables for commodity prices. The effect of the La Niña weather event will play a significant role in the market this year, given the low level of ending stocks. Consecutive droughts caused by the effect of La Niña have reduced U.S. and worldwide ending stocks during these last years.

The increase in commodity prices, in general, began in the fall of 2020 due to the drought that mainly affected corn production in Brazil. Around the last semester of 2021, wheat cash prices sharply increased, given a sharp decline in the U.S. ending stocks due to lower production. In mid-February of this year, we saw another increase in cash and future wheat prices after Russia invaded Ukraine, jeopardizing wheat supplies. This upward trend was over by the end of this summer when cash and futures prices returned to the pre-Russia invasion level (Graph 1).

In recent months cash and future wheat prices have risen due to the increased conflict with Russia and the drought affecting much of the wheat production in the United States and other exporting countries. The volatility we saw last week is a clear example of how the market reacts to Russian threats to cut off Ukraine’s exports.

Graph 1. KC HRW Cash and July 2023 Contract. Source: Barchart.com

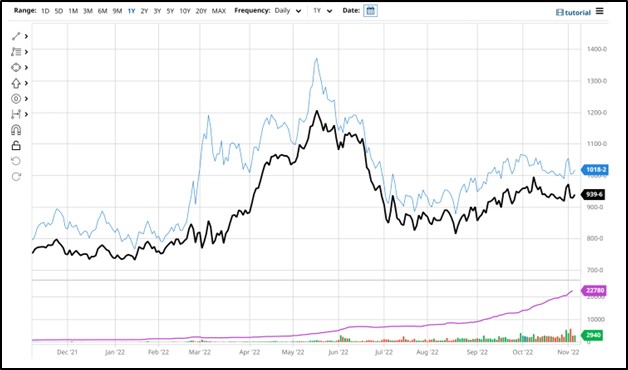

La Niña Weather Event

Like last year, the Niña weather event plays a significant role in market price, given the low level of ending stocks. This unprecedented event is the third consecutive Niña period in many decades.

The October 2022 CPC/IRI Official Probabilistic ENSO Forecast forecasted a Niña until approximately the end of this winter (Graph 2). The Niña weather event is usually associated with less rainfall in the Rolling Plains and most winter wheat areas from the U.S.

It is also associated with drought in Argentina and some regions of Brazil. The drought has already affected wheat production and can decrease future corn production, supporting prices for feed grains.

Graph 2. October 2022 CPC/IRI Official Probabilistic ENSO Forecast

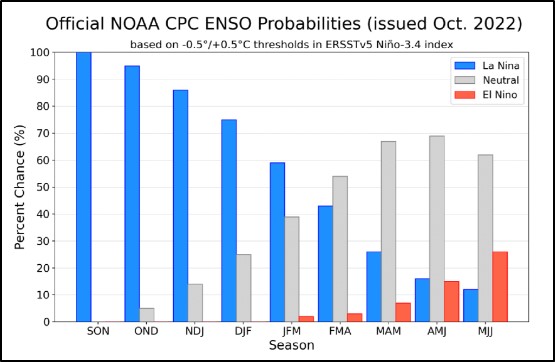

Early Wheat Crop Conditions

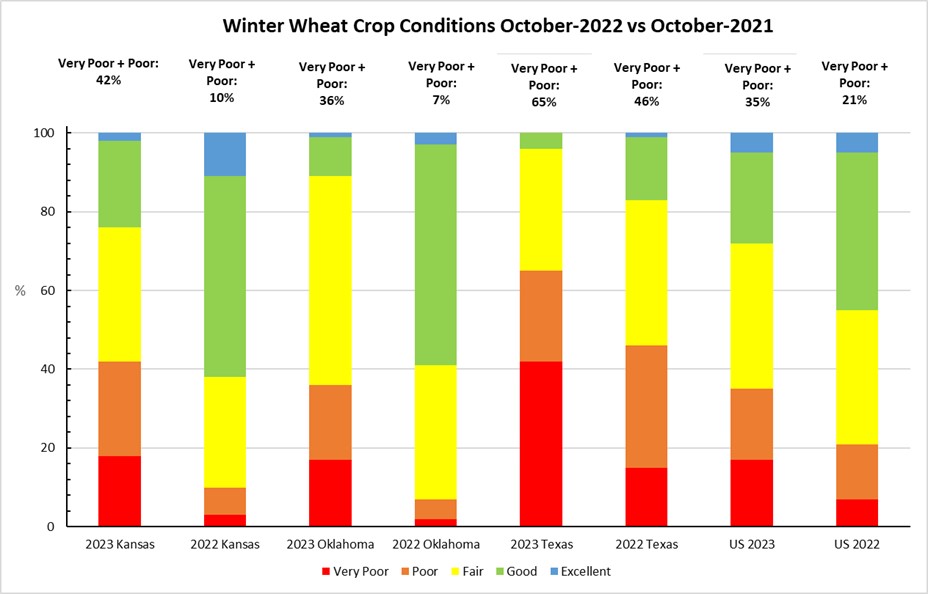

The first Wheat Crop Condition report was released last week. According to Dr. Mark Welch from Texas A&M, the starting crop conditions for this season are the worst in the previous 35 years. Drought conditions in most wheat areas have progressed during the last months. On November 1st, 2022, the winter wheat area under drought was about 74% in the U.S. (Graph 3).

Graph 3. Winter Wheat Areas in Drought (USDA).

Texas crop conditions rated poor and very poor are 65 percent for this season (Graph 5). Last year, Texas Crop conditions rated very poor, and poor during the beginning of the season was 46%. The U.S. early winter wheat crop condition rated very poor, and poor is 35%, a 67% increase compared to 21% from last year (Graph 4).

Graph 4. Winter Wheat Conditions. Source – USDA Crop Progress.

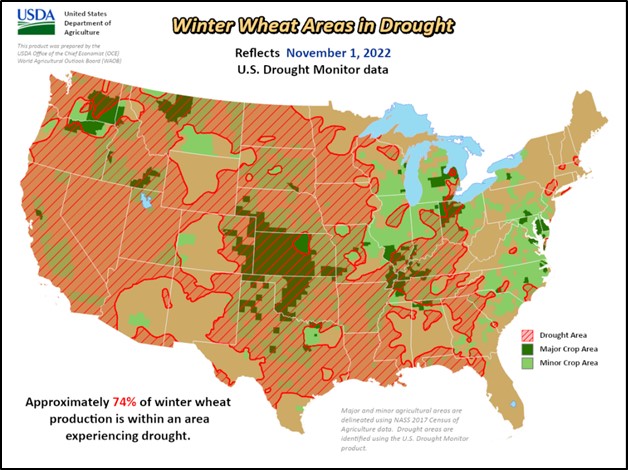

U.S. Supply and Demand – Projections

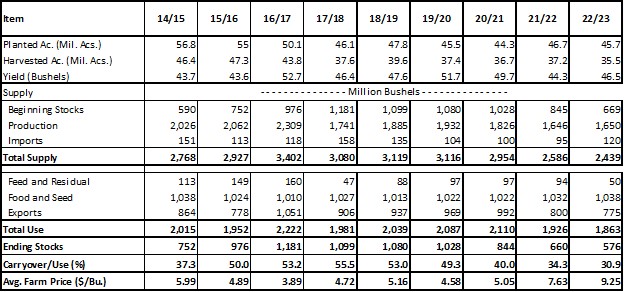

U.S. wheat production and acreage have been declining for many years. Ending stocks almost decreased by half in the last five years. October WASDE report estimates 2022/23 ending stocks of 576 million bushels (Table 1). These are the lowest ending stocks from the previous ten years.

Table 1. U.S. Wheat Supply and Demand. Source: USDA – WASDE Oct 2022

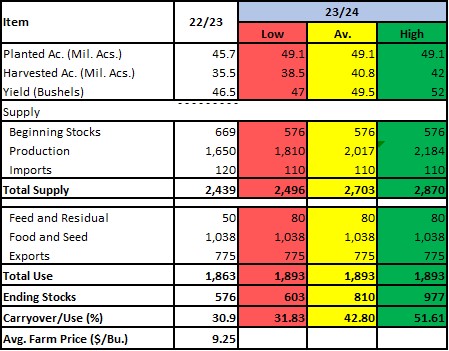

USDA Long Term projection from October 2022 estimated an increase in acreage of approximately 7% from last year (49.1 million acres). Suppose we assume a higher harvested acreage percentage than last season, a similar level of exports, and a higher average yield of 49.1 bu/acre. In that case, the projected ending stocks will still be tight by the end of next season (Table 2). Given this weather pattern, there are high chances to continue to see low-ending stocks next season due to lower harvested acreage or yields.

Table 2. Projected 2022/23 Ending Stocks.

Worldwide Market Drivers

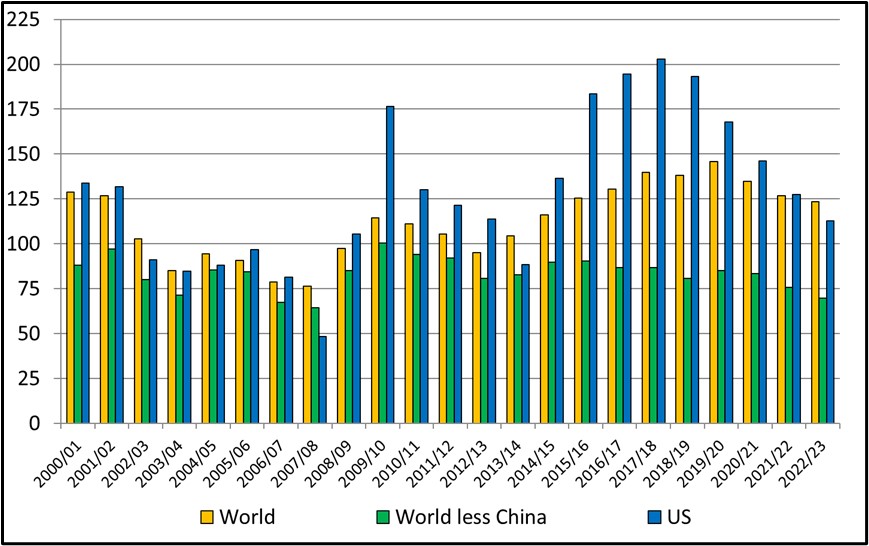

Ending stocks in the United States and the world have reduced in the last five years. World wheat demand has increased at a higher level than production. The WASDE report from October estimates a lower production in the EU, India, Ukraine, and Argentina. Higher production in China, Russia, and Canada partially compensates for this lower production. Overall, 2022/23 world production is estimated to be slightly lower than 2021/22.

World Less China Days of Use on Hand (Graph 5) available decreased from 146 days in 2019/20 to 124 days this last season. The reduction of Days of Use on Hand in the United States was even more significant. Since 2017/18, the Days of Use on Hand have decreased by almost 50% (203 to 113 respectively in the last six years).

Graph 5. World Wheat: Days of Use on Hand

What can we expect for next season?

The risk of lower wheat production in the U.S. due to lower yields, tight ending stocks, drought, and the Russia-Ukraine conflict will continue supporting strong prices during this new season.

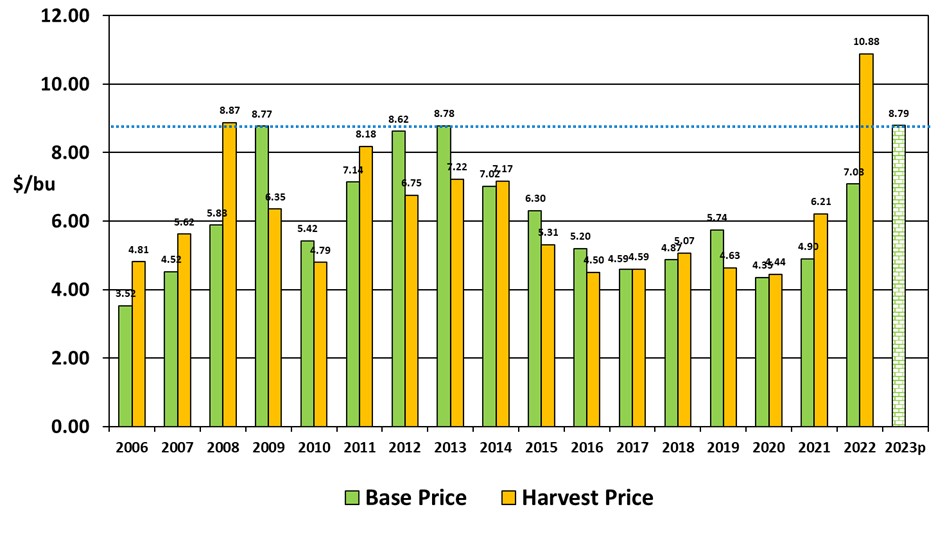

The wheat base price for this planting season ($8.79/bu) is the highest we have had for many years (Graph 6). It is higher than the 2013 and 2009 seasons. During this period, few times harvest prices have been higher than planting prices for many consecutive seasons. We must work on our marketing plan and use the best tools to capture some of these marketing opportunities.

Graph 6. RMA Wheat Prices (Source: Mark Welch – Texas A&M AgriLife Extension)

The Russia and Ukraine war might add more volatility to the market, potentially increasing price premiums over fundamentals while the conflict lasts. On the other hand, higher worldwide production and lower demand due to the worldwide recession might have a downward effect on future wheat prices.