(Laura McKenzie/Texas A&M AgriLife Marketing and Communications)

As we come to the end of the year, what do the fundamentals for the cotton market look like? In this post, we look at how cotton prices have moved in 2023, the current supply and demand outlook for the 2023/24 crop, and the macroeconomic picture heading into the new year.

Cotton Prices in 2023

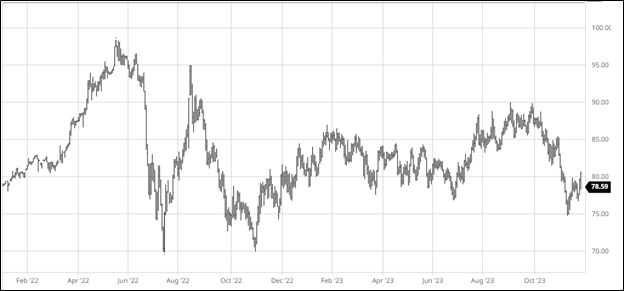

Figure 1 shows changes in the price of the ICE December ’23 contract since January 1, 2022. After a year marked by large up and down price movements in 2022, the December ’23 contract settled into a range-bound trading pattern for most of 2023. The contract price traded between $0.80/lb. and $0.85/lb. in the year’s first half, then between $0.85/lb. and $0.90/lb. for about three months, from August through October.

Figure 1. ICE December ’23 Contract Price

Source: Barchart.com

More recently, the December ’23 contract saw a two-week downslide from the end of October through the beginning of November to about $0.75/lb. before rebounding back to $0.80/lb. on November 24.

The year-to-date cash price, according to Barchart.com, has fluctuated between a high of $0.88/lb. on January 26 and a low of $0.72/lb. on November 8. Currently, cash cotton is priced in the mid-seventy cent range.

Cotton Supply & Demand Outlook

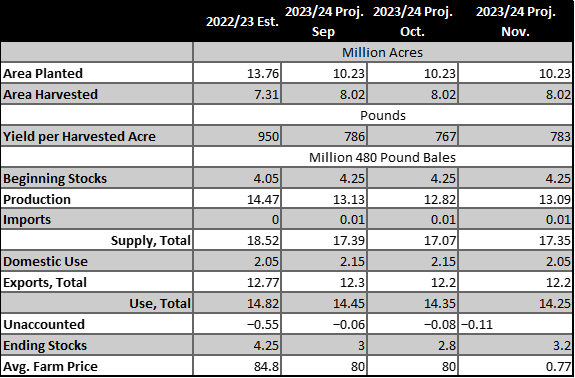

So, what can we expect from the 2023/24 crop heading into the new year? In the most recent WASDE report, released on November 9, USDA continues to revise its projections for both production and use (see Table 1). On the supply side of the balance sheet, production was increased by 270,000 bales, bringing projections back in line with the September forecast. On the demand side, USDA continues to decrease their projections for total use, reducing their estimate in the November report by 100,000 bales. These changes amount to a roughly 400,000 bale increase in expected ending stocks. This is a somewhat bearish report, and USDA revised their expectation for the 2023/24 season average farm price down by three cents to $0.77/lb.

Table 1. WASDE Estimates for Cotton Supply and Use, November 9, 2023

Source: World Agriculture Supply and Demand Estimates, November 9, 2023

Macroeconomic Conditions Heading into 2024

Future macroeconomic conditions represent potential hindrances to cotton prices in 2024. Cotton is a major input into many goods consumers can forgo purchasing during periods of slow economic growth and/or high prices. Thus, when demand for these goods is low, demand for cotton also tends to be low.

World economic growth is projected to slow in 2024, down from 3.0% in 2023 to 2.9%. While this is not catastrophic by any means, without more robust growth, it is hard to predict that demand for cotton will increase next year.

Another possible area of concern is interest rates. Inflation in the United States has decreased significantly since this time last year, down from about 7.7% in October 2022 to 3.2% in October 2023; however, this is still above the Federal Reserve’s stated target of 2% inflation. To combat inflation, the Federal Reserve has increased the federal funds rate from near zero to its current level between 5.25% and 5.50%. In general, interest rates and commodity prices share an inverse relationship, so higher interest rates will tend to lower the prices of commodities like cotton. At the same time, higher interest rates tend to increase the value of a nation’s currency, which reduces international demand for the commodities it produces.

It remains to be seen what the Federal Reserve will do in terms of monetary policy in 2024. After raising the federal funds rate to its current level in July, Fed officials chose to keep interest rates unchanged in both its September and October/November meetings. That said, at least some Fed policy makers have signaled a willingness to raise rates further if need be. For now, it seems to be a safe assumption that interest rates will remain at least where they are and may in fact increase in 2024.