Continuing with our fall market updates this week, we reviewed the peanuts market. Less harvested acreage this season will potentially lower ending stocks and support future prices.

Continuing with our fall market updates this week, we reviewed the peanuts market. Less harvested acreage this season will potentially lower ending stocks and support future prices.

Dates & Deadlines

11/29 /2022 – 12/1/2022 – Amarillo Farm & Ranch Show, Amarillo

12/13/2022 – Armstrong County Fall Producers Meeting, Claude

01/18/2023 – 01/19/2023 – Red River Crop Conference, Childress.

01/24/2023 – 03/09/2023 – Master Marketer, Vernon.

What We’re Reading

November WASDE: USDA raises corn, soybean yields – FarmFutures

Rise in partisanship complicates Farm Bill – Southwest Farm Press

USDA releases nationwide farmer, rancher and forest manager survey – Morning Ag Clips

Traditional holiday baking costs up – AgriLife Today

AgriLife Extension offers educational highlights at the Amarillo Farm and Ranch Show – Morning Ag Clips

Peanuts Market Update

Lower harvested acreage and expected yields will reduce peanut production this season compared to last year. More than 90% of the peanuts area has been harvested so far. Due to the drought, the latest Crop Progress report in Texas showed the worst crop condition in the last five years. However, better production in other states will compensate for the lower expected yields from Texas. Overall, the U.S. Crop conditions were better, with more than 90% rated between fair and excellent (Graph 1).

Graph 1. Peanuts Crop Progress Report

Even with higher contract peanut prices during the beginning of the season, 2022 planted acreage decreased by 2.5%. High cotton and corn prices explain much of the acreage loss. Many farmers chose to grow those two crops which showed higher profitability then.

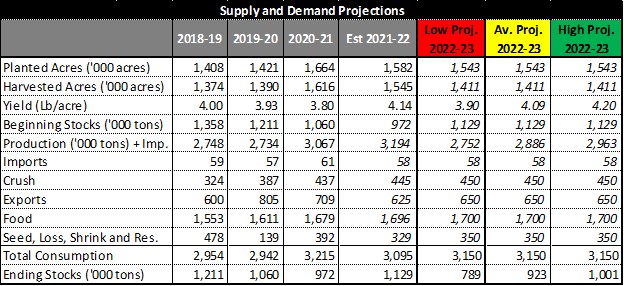

Further, harvested acres decreased substantially compared to last year (Table 1). Expected harvested acres are 8.7% lower this year (1.411 million acres). Due to the severe drought, Texas suffered a decline in harvested acres. Other states that showed fewer significant acres were Georgia, Florida, and Alabama.

Table 1. Peanut Harvested Acres

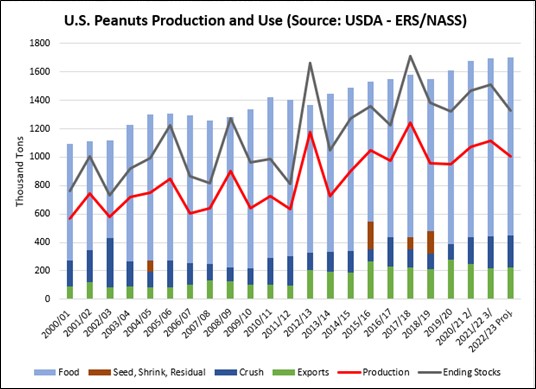

Even though projected yields for the harvested area are high at 4,090 Lb/acre, the lower harvested acreage reduced this season’s potential production. USDA estimates production of 2,886 thousand tons for the current season, about 9.7% lower than last year (Graph 2).

Graph 2. Peanut Production

Given this production level, U.S. ending stocks are expected to decrease again to the 2020-21 level (923 thousand tons). Consumption of Shelled Peanuts (Raw Basis) Used in Primary Products and In Shell Peanuts increased by 0.3% for 2021-22, showing another consecutive increase in demand for peanut products. Peanut candy and in-shell peanuts led to U.S. demand growth. However, the U.S. total peanut disappearance decreased this last year due to lower exports to China.

Graph 3. Peanuts Production and Use

Prices

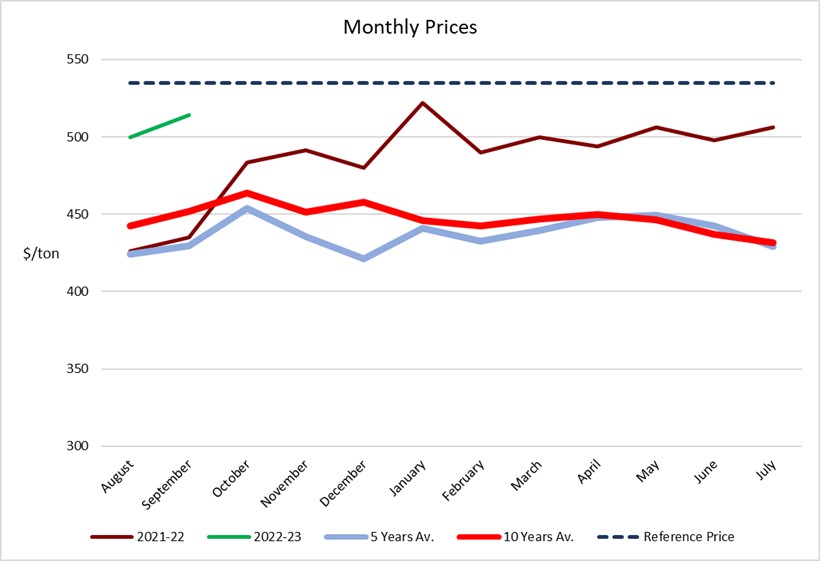

The 2021-22 average price of $486/ton has been significantly higher than last year, the 10-year average price of $447/ton, and the five years average price of $437/ton. These prices reflect the competition in the area that has taken place in recent years, with record prices for cotton and corn (Graph 4).

Graph 4. Monthly Peanut Prices (Source: USDA – NASS)

Projected Production

Projected U.S. ending stocks for the 2022-23 crop can still vary depending on the final yield obtained in the following months and the expected level of U.S. demand and exports. Assuming an average harvested yield of 4.09 Lb/acre and a total consumption like last year, ending stocks will decrease below 1 million tons, like 2020-21 ending stocks (Table 2). The remaining question is whether U.S. consumption demand will stay at the current level and exports will recover. On the other hand, the high-level prices of corn will still compete for acres in many regions and help support peanut prices for next season.