(Laura McKenzie/Texas A&M AgriLife Marketing and Communications)

The USDA’s Livestock Risk Protection (LRP) program is a useful tool to help producers manage price risk. In this post, we will explain what LRP does and how it works, and we will discuss two important decisions that producers who wish to use this tool must make.

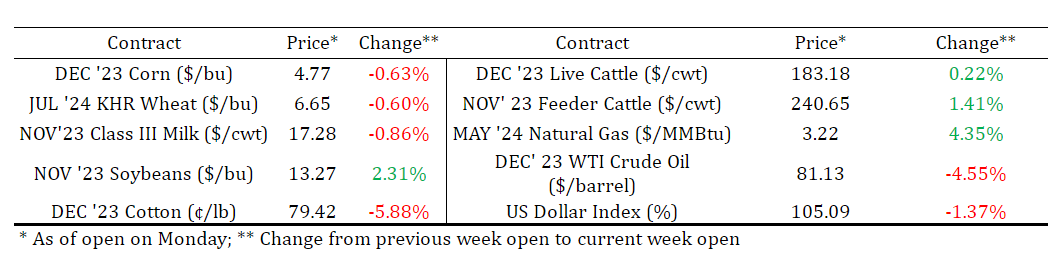

Board Update 11/6/2023

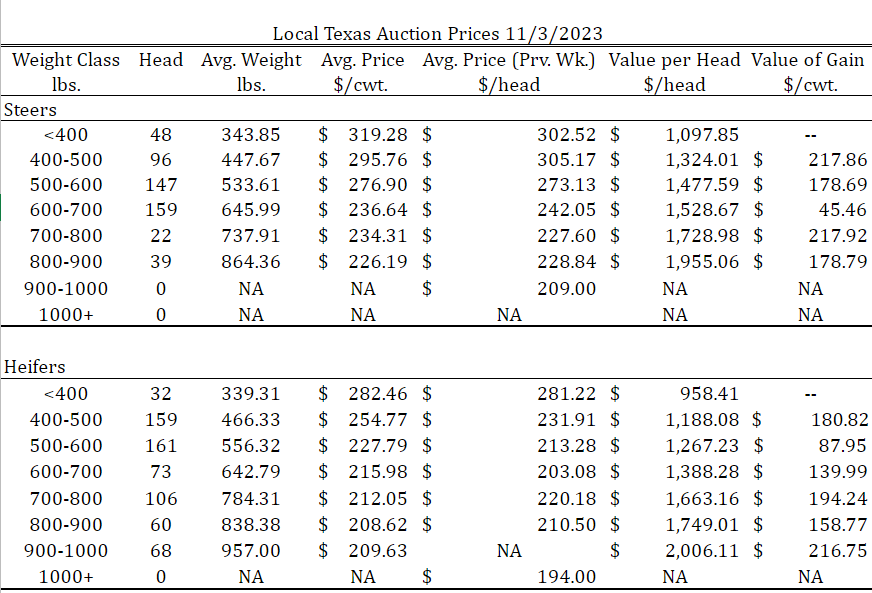

Tulia, Amarillo, Dalhart Average – Cattle Prices by Category !1/3/2023

What is LRP?

Livestock Risk Protection (LRP) is a price risk management tool that is available year-round for producers of fed cattle, feeder cattle, and swine through USDA’s Risk Management Agency (RMA). LRP protects producers against declines in regional or national market prices. This means that LRP does not establish a guaranteed cash price for a producer’s livestock. Instead, LRP guarantees a payment when a regional or national price index, essentially an average cash price for a region on a specific date, falls below the coverage price in the policy. The payment received by the producer makes up the difference in the coverage price and the index price. To put this another way, LRP would not protect a producer from local price declines but will protect against price declines that affect the entire (regional or national) market, such as those caused by a major disease outbreak or weather event.

How LRP Works

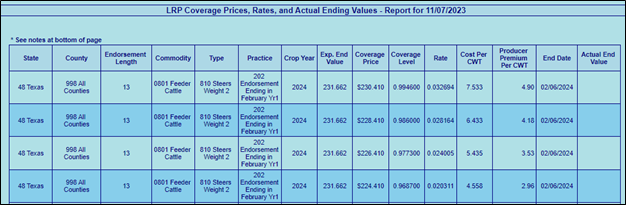

When a producer signs up for LRP, they decide on the length and level of coverage that they wish to purchase. The length of coverage for an LRP policy ranges from 13 to 52 weeks. The level of coverage ranges from 70% to 100% of the policy’s expected ending value, which is the expected livestock price when the policy expires. This price is based on the nearby CME futures price to a policy’s end date and changes daily based on movements in the futures price. LRP expected ending values, coverage prices and levels, and premium values are published daily on the RMA website. Figure 1 gives an example of this report for November 7, 2023.

Figure 1. Example LRP Report

In Figure 1, we see four possible coverage levels for a 13-week policy on feeder cattle weighing between 600 and 1000 lbs. The expected ending value for the policy is $231.662/cwt, which is based on the price of a March 2024 feeder cattle futures contract. The four possible coverage levels shown in the figure are 99.46%, 98.60%, 97.73%, and 96.87%.

If a producer chose the 98.6% coverage level, the row outlined in black in Figure 1, the LRP coverage price in their policy is $228.41/cwt. That is:

Coverage Level = Coverage Price ÷ Exp. End Value = $228.41 ÷ $231.662 = 0.986.

The coverage rate, which determines the cost per cwt for this level of coverage, is 2.86164%. Multiplying the coverage rate by the coverage price results in the policy’s total cost per cwt:

Cost per CWT = Coverage Price × Coverage Rate = $228.41 × 0.0286164 = $6.433/cwt.

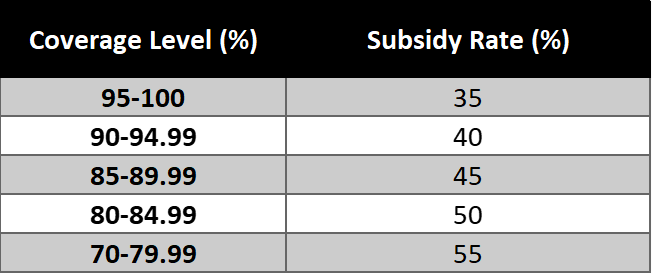

The premium paid by the producer for this policy is subsidized by the RMA. The subsidy rates paid by RMA for different levels of coverage are listed in Table 1 below. In this case, the coverage level is between 95% and 100% so 35% of the policy’s cost is subsidized. The producer pays 65% of the policy’s cost as a premium:

Premium = (1 – Subsidy Rate) × Cost per CWT = 0.65 × $6.433 = $4.18/cwt.

If a producer owned 50 head of cattle which they planned to sell approximately 13 weeks from now at a weight of 7 cwt (700 lbs.), they would pay a total premium of about $1,463. That is:

Total Premium = 50 × 7 × $4.18 = $1,463.

Table 1. LRP Subsidy Rates

If a producer purchases this policy, its end date is February 6. Based on that date, RMA determines the policy’s actual ending value (the blank column in Figure 1) using an index for cash prices received, such as the CME feeder cattle index. If the actual ending value is greater than or equal to the policy’s coverage price, no payment is made by the policy. If the actual ending value is less than the policy’s coverage price, then the policy will pay the difference between the coverage price and the actual ending value. In this example, if the actual ending value for February 6 is $230/cwt then no payment is made. On the other hand, if the actual ending value is $215/cwt then the policy will pay an indemnity of $13.41 per cwt sold by the producer. That is:

Indemnity per CWT = Coverage Price – Actual Ending Value = $228.41 – $215 = $13.41/cwt.

Important LRP Decisions

When a producer applies for LRP, there are two important decisions that they must make. First, the producer must decide on the length of coverage that they wish to purchase. To make this decision, consider when you plan to sell the livestock. LRP requires that the person who applies for the policy must have an ownership stake in the livestock and must maintain ownership until at least 60 days prior to the sale of the livestock covered by the policy. For this reason, it’s best to pick a coverage length that matches with when you plan to sell the livestock covered by the policy. Coverage lengths for LRP are 13, 17, 21, 26, 30, 34, 39, 43, 47, or 52 weeks.

The second decision a producer must make is what coverage level to purchase. Coverage prices in LRP policies range from 70% – 100% of the expected ending value. Lower levels of coverage provide less protection against price declines but are subsidized at higher rates by RMA. As you choose your level of coverage, consider how much price risk you face, how comfortable you are with that risk, and how much coverage you can afford to purchase.

Additional Information and Useful Links

To purchase LRP insurance, you must first fill out a one-time application to the program. Then you can purchase a specific policy from a private insurance agent.

For more information on LRP, consider the following links:

- Information on all livestock insurance plans provided by the RMA (USDA RMA website)

- LRP-feeder cattle policy fact sheet

- LRP-fed cattle policy fact sheet

- Daily report for LRP coverage prices, rates, and actual ending values

- Agent locator tool for approved livestock agents and insurance companies