Continuing our fall market updates this week, we reviewed the peanuts market. We discuss this season’s recent USDA Crop Progress report data, market trends, and market challenges.

Continuing our fall market updates this week, we reviewed the peanuts market. We discuss this season’s recent USDA Crop Progress report data, market trends, and market challenges.

Crop Progress and Acreage

The latest USDA Crop Progress Report brings news of concern for farmers nationwide. Crop conditions have taken a hit over the past two months, marking the worst in five years. Of particular interest to peanut producers, the 2023 season is estimated to yield approximately 3.910 pounds per acre, showing a slight 3% drop compared to the previous year.

One key observation is that despite its larger acreage, Texas is experiencing conditions like those in 2022. The state planted 44% more acres this season.

Graph 1: Crop Progress and Condition

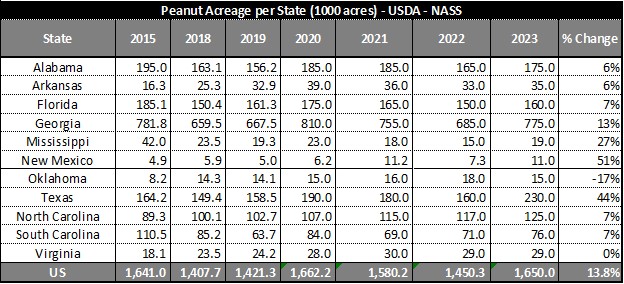

The increase in acreage this season can be attributed to a favorable market scenario. Higher contract prices for peanuts at the start of the season, coupled with lower cotton prices, prompted a surge in planting. This season, 1,650 thousand acres were planted in the U.S., marking a substantial 13.8% increase over the previous year.

Most of this growth was concentrated in Georgia, with an additional 90 thousand acres, and Texas, which saw a significant 44% rise, planting 70 thousand more acres than last year.

Table 1. Peanut Acreage

US Production and Exports

U.S. peanut production is set to be marginally higher than the previous season due to the yield expectations, as per the USDA’s estimates. A total production of 3,124 thousand tons is anticipated, about 1% higher than the previous year.

Graph 2: Peanut Production

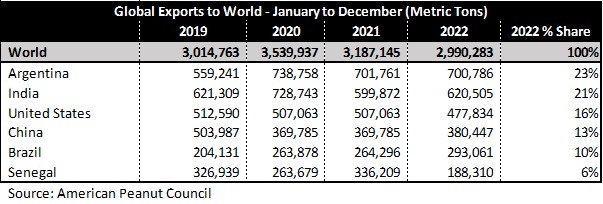

Regarding global peanut exports, the United States ranks third worldwide, falling behind India and Argentina but surpassing China in volume.

Table 2: Global Exports

In 2022, the U.S. witnessed a 6% decrease in peanut exports, mainly because of reduced shipments to China. China reduced global peanut imports by 34%, and U.S. exports to China dropped by 45%.

Table 3: US Export Statistics

Domestic Demand

Domestic peanut consumption in the United States shifted in 2022-23. While peanut candy, snacks, and other peanut products experienced a 9% decrease in consumption, peanut butter, and in-shell peanuts saw a rise of 6%, effectively balancing the overall demand.

Graph 3: Primary Peanuts Products Consumption

Peanut Prices

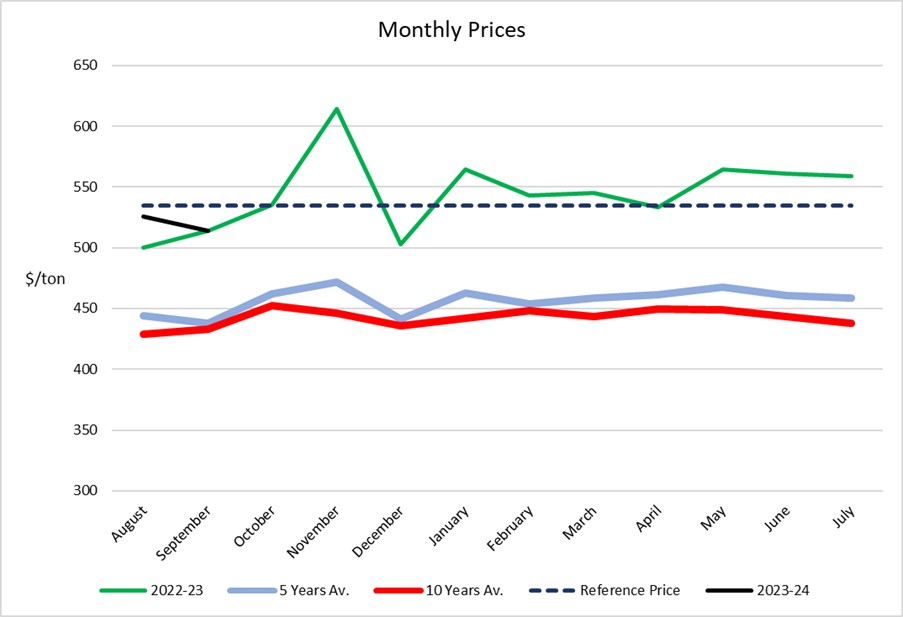

The average price for peanuts in the 2022-23 season is $545 per ton, marking the highest prices in the last decade. This is significantly higher than the 10-year average of $443 per ton and the five-year average of $457 per ton. These prices reflect the competitive market conditions, with record prices for cotton and corn.

After several years of prices falling below the reference price of $535 per ton, the USDA-FAS projects a 2022-23 MYA price of $545, which surpasses the reference price, which will not trigger PLC payments for the 2022-23 season.

Graph 4: Monthly Peanut Prices (Source: USDA – NASS)

Projected Production and Ending Stocks

The projected U.S. ending stocks for the 2023-24 crop season are still uncertain and subject to change. These projections depend on the final yield achieved in the coming months and the anticipated U.S. demand and export levels. Assuming an average harvested yield of 3.91 pounds per acre and consistent consumption levels, ending stocks are expected to increase above one million tons.

Table 4. Supply and Demand Projections