(Laura McKenzie/Texas A&M AgriLife Marketing and Communications)

Wheat prices in our Texas region have been decreasing month by month, lowering profitability expectations for producers in our area. Today, we will compare and analyze what may be more convenient: wheat grain or grazing.

Wheat Grain vs. Grazing?

Unfortunately, wheat prices in our Texas region have been decreasing month by month, lowering profitability expectations for producers in our area. This decline has once again pushed Texas Cash Wheat prices below the breakeven price (Figure 1).

Figure 1. Texas Cash Wheat vs Breakeven Prices, July 2020 – January 2024

On the other hand, grazing prices remain more competitive with production costs. Today, we will analyze what may be more convenient, grain or grazing, for those who can choose between these alternatives considering today’s wheat and grazing.

In this analysis, we will use the “Wheat and Small Grain Decision Aids” Excel spreadsheet to compare these two options. This tool is valuable for economic and financial analysis in decision-making. You can download this tool from our District 3 website (https://vernon.tamu.edu/extension-projects/d3-agricultural-economics/).

This tool can compare various systems, such as grazing until March 1, grazing out everything, and others. However, in today’s example, we will compare two alternatives: wheat for grain and wheat for grazing.

We will use the production costs from the district’s 3 Enterprise Budgets. Remember that these are average costs, providing a general business idea. I recommend utilizing the same Excel spreadsheet later, adjusting the numbers to reflect your specific costs, yields, beef production, and prices for a tailored analysis for your business.

Wheat Grain Harvest vs. Wheat Grazed Out

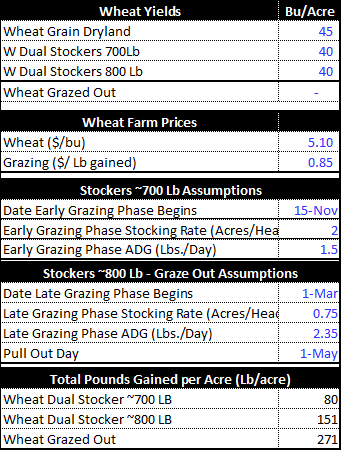

In contrast to the previous year, and with lower estimated harvest prices, the grazing-out option has a better economic outlook. Assuming you have water, fences, adequate forage production, and you can get the necessary number of animals required to maximize beef production. The breakeven price for wheat harvest is $6.5/bu to cover all direct and indirect expenses (depreciation, interest, etc.) (Table 1). This breakeven price is above the estimated future harvest price in our example for this area, which is $5.1/acre. The breakeven grazing price to cover all costs is $0.83/Lb, just below the assumed price for this example, which is $0.85/Lb.

Table 1. Wheat Grain vs Wheat Grazed Out Profitability

In this example, we assumed a grazing period starting on November 15 and finishing on May 1. We also took an average daily gain (ADG) of 1.5 Lb./head until March 1 and an ADG of 2.5 Lb/head until May. For wheat harvest, we assumed a yield of 45 bu/acre. It is crucial to estimate your own production assumptions that better reflect your field conditions and expectations for beef production and wheat yield.

Table 2. Assumptions

The decision aid can also be used to compare these alternatives from economic (Table 1) and financial (Table 3) points of view. We can analyze from a cash-flow perspective which alternative might be better.

In this example, we can see that if one has their own harvester, the margins of both scenarios get closer. But when one has to hire a harvester and other services, the margin for grazing is still higher.

Table 3. Wheat Grain vs. Wheat Grazed Out Cash Comparison

The Wheat and Small Grain Decision Aids is an economic and financial tool to help every farmer with decision-making. Using your data, yield expectations, and costs is essential to analyze these alternatives better. These examples reflect today’s wheat conditions and expectations.