How will input costs change for crop enterprises on the Texas High Plains? Today, we look at three key inputs to crop production and discuss expectations for the price of these inputs this year.

How will input costs change for crop enterprises on the Texas High Plains? Today, we look at three key inputs to crop production and discuss expectations for the price of these inputs this year.

What We’re Reading

Are interest rate hikes in the rearview mirror? – Southwest Farm Press

No new farm bill… now what? – Southwest Farm Press

Making the ARC/PLC Election for 2024 – Southern Ag Today

AgriLife Extension Budgets

A new year means updated crop and livestock budgets from Texas A&M AgriLife Extension. These budgets represent AgriLife Extension economists’ best forecasts of input costs, commodity prices and fixed costs for a variety of crop and livestock enterprises during the coming year. Each AgriLife Extension district has its own set of budgets, with each budget representing what an “average” farm in that district can expect in terms of costs and returns from a specific crop or livestock enterprise. Once the new budgets are finalized, they will be published here.

Changes in Key Input Costs

An important component within every extension budget is an estimate of input costs for the coming year. In total, input costs are highly variable from one commodity to the next, and between production methods for a given commodity; however, costs for specific inputs tend follow trends that hold across commodities and production methods.

For the major crops grown on the Texas High Plains (corn, sorghum, wheat, and cotton), three major drivers of input costs are expenditures on fertilizer, energy, and chemicals. Due to the size of these expenditures – and their importance to production – producers need to consider how prices for these inputs might change as they make plans for the coming year.

Fertilizer

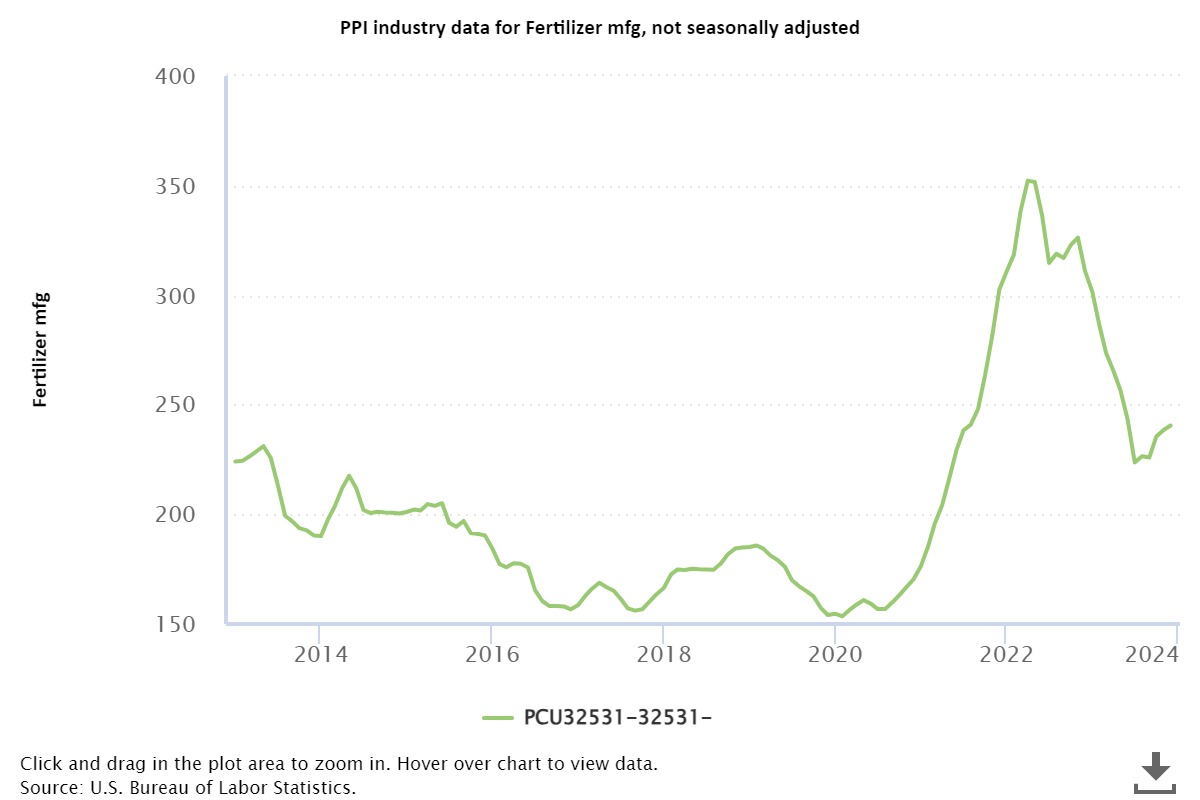

Fertilizer prices increased rapidly in 2021 and 2022, reaching historically high levels around May 2022 (see Figure 1). Three things drove this rapid rise:

- Strong commodity prices led to increases in crop production worldwide, which increased demand for fertilizer.

- China began to restrict its exports of fertilizer to the rest of the world in 2022, and continues to do so, which limits supplies.

- The Russia/Ukraine war disrupted supply chains, limiting supplies.

Figure 1. Change in the Producer Price Index for Fertilizer Manufacturing, 2013-2023

After reaching their peak in 2022, fertilizer prices have fallen steadily in part because supply chain issues have been resolved and in part because a mild winter in Europe last year resulted in low natural gas prices (natural gas is an input in the production of many fertilizers). The current forecast is for fertilizer prices to continue to decrease in 2024; however, there is ample room for uncertainty in that prediction. China continues to limit exports of fertilizer, which places upward pressure on prices. While the Russia/Ukraine war continues, the possibility exists that supply chains could be disrupted again. Finally, a colder winter in Europe would likely increase natural gas prices, making fertilizer production more expensive.

Energy

On-farm energy expenditures come primarily from three sources: energy used to pump water for irrigation, gasoline, and diesel fuel. The current short-term energy outlook from the U.S. Energy Information Administration indicates that energy costs in 2024 will remain at or near their 2023 levels. EIA predicts an average Henry Hub spot price of $2.66/MMBtu for natural gas in 2024, which is a $0.12 increase over the average 2023 price but much lower than the $6.42/MMBtu average price in 2022. For gasoline and diesel fuel, EIA predicts average retail prices of $3.36/gal and $3.92/gal respectively. Both these predictions reflect an expectation that fuel prices will decrease in 2024 relative to 2023.

Chemicals

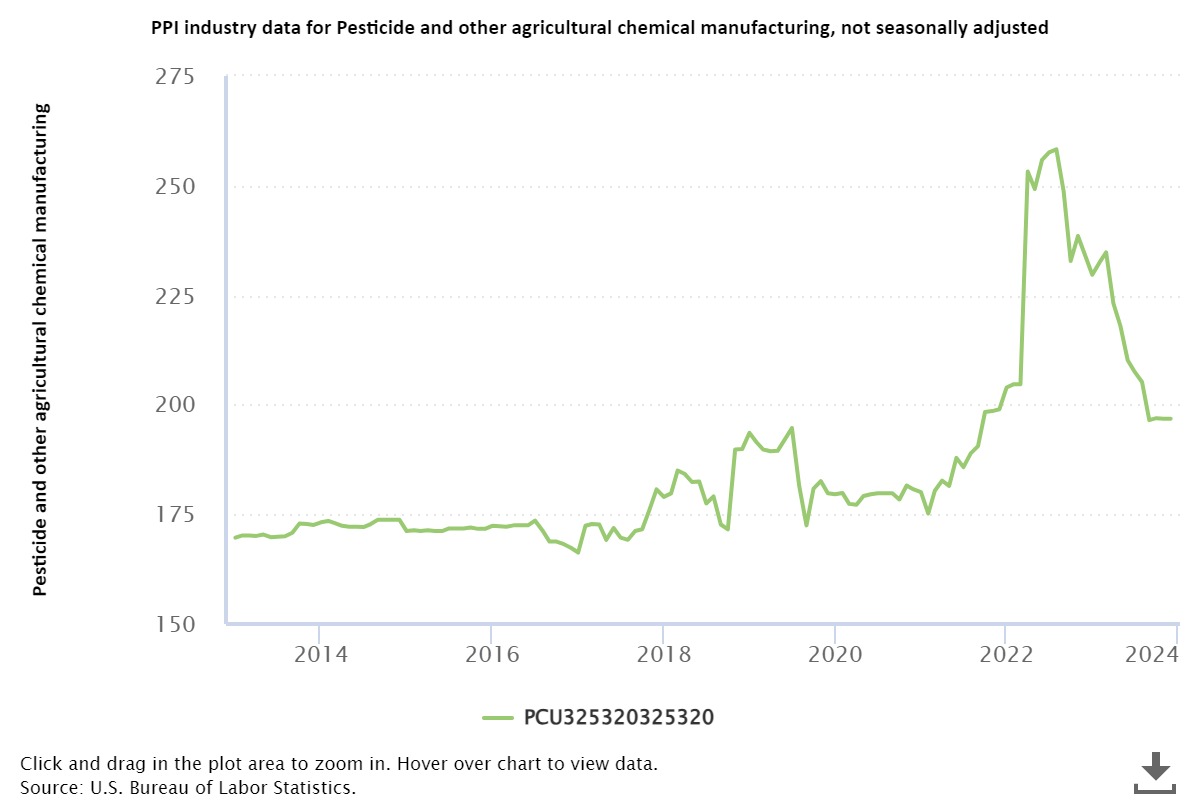

Chemical costs are more difficult to track than energy or fertilizer due to the variety of chemicals available, the variety of brand names under which they are available, and the number of different delivery systems that a producer might use. According to data from the Bureau of Labor Statistics, chemical costs increased rapidly in 2022, and then fell throughout 2023 (see Figure 2). Currently, USDA projects lower chemical costs in 2024 relative to 2023.

Figure 2. Change in the Producer Price Index for Pesticide and Other Agricultural Chemical Manufacturing, 2013-2023

Managing Input Costs in 2023

It appears that input costs will be lower in 2024 relative to recent years, based on lower fertilizer and chemical prices; however, producers should keep in mind that commodity prices are expected to be lower this year as well. For this reason, producers should continue to make every effort to focus on efficiency as they manage their input use and input expenditures. One temptation to resist will be to hold off on purchasing inputs today if you see input prices decreasing because you’re hoping for a lower price tomorrow. Don’t wait for low prices that may never arrive. If you see a price that is affordable, go ahead and make the purchase.