The Livestock Forage Disaster program sign-up deadline is coming by the end of January. Last year’s drought triggered significant payments in most counties of Texas. Read the article for more information about your county’s program and eligibility.

Board Update – 1/9/2023

Dates & Deadlines

1/13/2023 – Pioneer Spring Crop Meeting, Panhandle

1/17/2023 – Pioneer Spring Crop Meeting, Hereford

1/18/2023 – Moore County Ag Meeting on Rebuilding the Herd, Dumas

1/18/2023 – Southeast Panhandle Ag Conference, Claude

1/18-19/2023 – Red River Crops Conference, Childress

1/19/2023 – Pioneer Spring Crop Meeting, Plainview

1/19/2023 – Texas Alliance for Water Conservation Annual Water College, Lubbock

01/24/2023 – 03/09/2023 – Master Marketer, Vernon.

1/24/2023 – Crop Profitability Conference, Perryton

1/25/2023 – Top of Texas Cotton Conference, Pampa

1/26/2023 – Northwest Panhandle Ag Conference, Dalhart

1/27/2023 – High Plains Cotton Conference, Spearman

What We’re Reading

Strong 2022 profits lift farmer sentiment – Feedstuffs Daily

Forage sorghums growing in importance across High Plains – AgriLife Today

Solar power offsets energy cost on your irrigation pivot – Farm Progress Daily

2023 begins with continuing drought – BEEF

The Year Ahead: Forces That Will Shape the U.S. Rural Economy in 2023 – CoBank

Livestock Forage Program – USDA Program to Support Drought Losses

Last year’s drought has produced significant losses to many ranchers in the State of Texas. The USDA’s Livestock Forage Disaster (LFP) program is an excellent tool to help ranchers cape those financial losses generated by the drought. This program does not require premiums payments or previous enrollment. However, the sign-up deadline for last year’s drought is January 30, so I recommend you go to your FSA office if you still haven’t done it.

How does it work?

LFP provides payments to eligible livestock owners and contract growers who have livestock and are producers of grazed forage acreage or certain crops explicitly planted for grazing that have suffered a loss of grazed forage due to a qualifying drought. A livestock owner or contract grower producing owned or leased forage crops is eligible for payments from LFP.

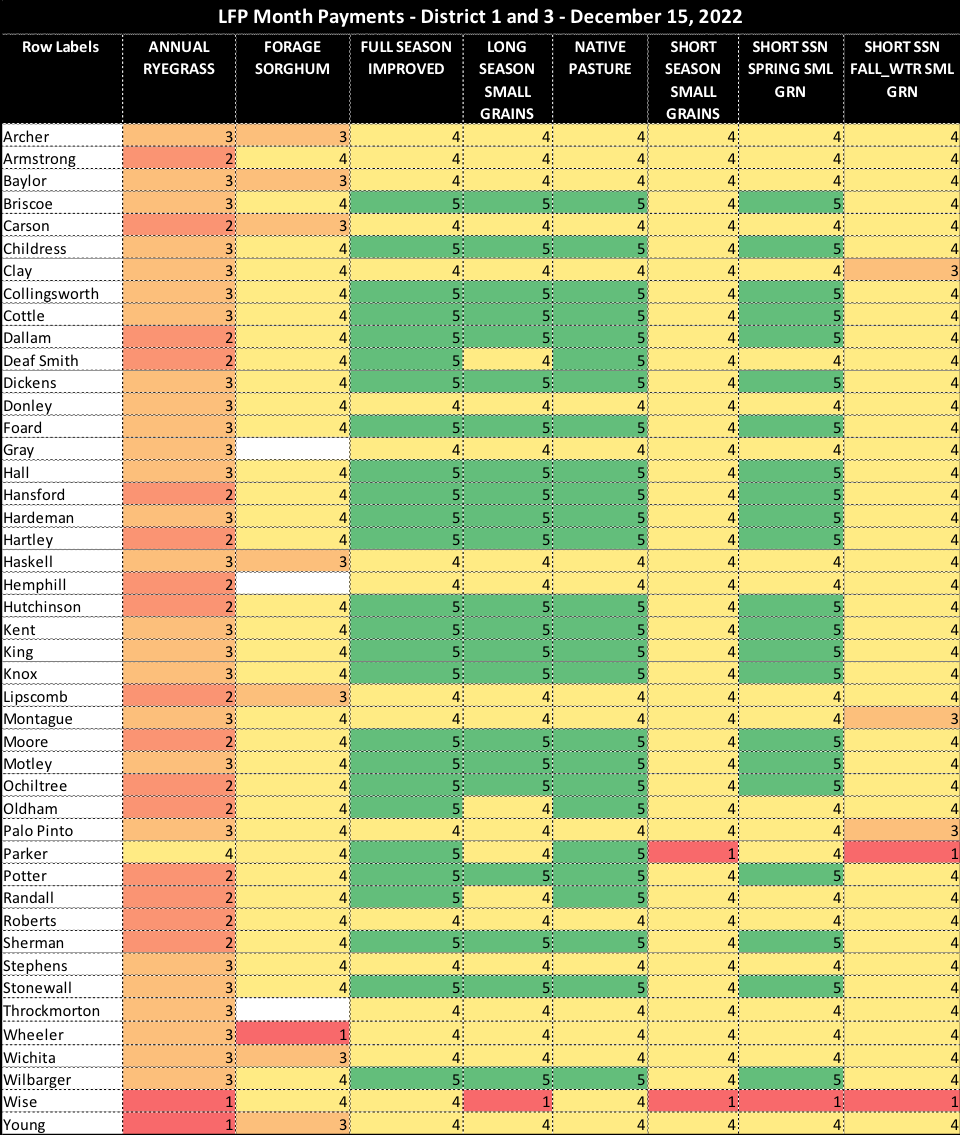

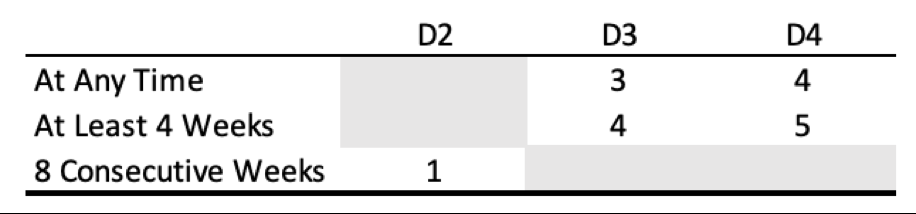

The drought duration in each county determines the number of monthly payments. The table below provides the monthly payments based on durations spent in each drought category (Table 1).

Table 1. Monthly Payments by Time Period County Designated in Given Drought Status

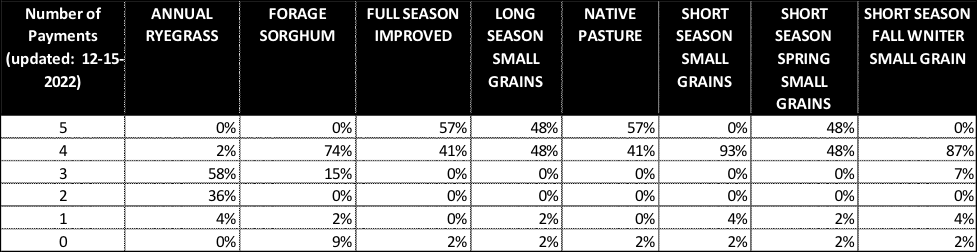

So far this year, most counties in Districts 1 and 3 qualify for payments under at least one crop, and in many counties, at least four payments (Table 2).

Table 2. Average Number of Payments for District 1 and 3 Counties.

Beef and dairy cattle, sheep, and goats are all eligible for payments and a long list of unique species. These include beefalo, buffalo, deer, equine, elk, reindeer, alpacas, emus, and llamas.

More important than the species is the grazing status of your livestock. Only the animals that were or would have been grazing during the normal grazing period will be eligible to receive a payment.

Eligible livestock must have been owned, leased, purchased, or contracted during the 60 days before the beginning date of the qualifying drought. Eligible livestock also includes those sold due to drought conditions. Ranchers must have owned any eligible livestock for commercial operations, not recreation or hunting.

Payments

The LFP monthly payment rate, applied based on the conditions outlined in the previous section, is equal to 60% of the lesser of either the monthly feed cost:

- For all covered livestock owned/leased or

- Calculated by using the normal carrying capacity of the eligible grazing land of the producer.

Total LFP payments to a producer will not exceed five monthly payments for the same kind, type, and weight range of livestock. Payment limits for LFP (without regard to any other program) are set at $125,000. AGI rules apply.

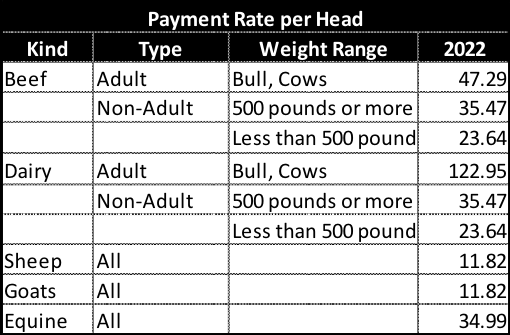

Table 3. 2022 Payment Rates for Common Livestock Species

LFP Payment Example

Using the 2022 Payment Rates table above and the number of eligible months from a select county below, you can estimate your total LFP payment for a given crop in each county. In this example, we will use Wilbarger County to calculate the potential expected payment for a producer.

Producers of native pasture in Wilbarger County would be eligible for five monthly payments per cow. If they were grazing ten cows, their payment would total $1,338 or $133.80/head. If that cow had a calf during that time, you should add $66.9 per head.

Cow Payment per Head = $47.29/head * 5 * 60% – Yearly Sequestration 5.7%) =

$47.29 * 5 = $234.45

$234.45 * 60% = $141.87

$141.87 – Yearly Sequestration Fees (5.7%) =

$141.87 – $8.08 = $133.8/head

Calf Payment per Head = $23.64/head * 5 * 60% – YSF = $66.9/head

Sheep /Goat Payment per Head = 11.82 * 5 * 60% – YSF = $33.44/head

As of December 15, 2022, many counties already have at least four monthly payments this year for native pasture and other forage options. The table below (Table 4) shows the monthly payments per county for LFP-eligible crops. Please check on the USDA website here (https://www.fsa.usda.gov/programs-and-services/disaster-assistance-program/livestock-forage/index) if you need any more information.

Table 4. LFP Monthly Payments (December 15, 2022). Source: USDA