The deadline for signing up for the Livestock Forage Disaster program is approaching at the end of January. Last year’s drought-hit many Texas ranchers hard, prompting significant payments across most counties. Contact your FSA office before the January 30 deadline to use this program.

Overview of Livestock Forage Program (LFP)

The Livestock Forage Disaster (LFP) program by the USDA is a valuable resource for ranchers facing financial losses due to drought conditions. This program does not involve premium payments or require prior enrollment. If you still need to, visiting your FSA office before the January 30 sign-up deadline for last year’s drought is crucial.

How LFP works

LFP provides payments to eligible livestock owners and contract growers who have livestock and are producers of grazed forage acreage or certain crops explicitly planted for grazing that have suffered a loss of grazed forage due to a qualifying drought. A livestock owner or contract grower producing owned or leased forage crops is eligible for payments from LFP.

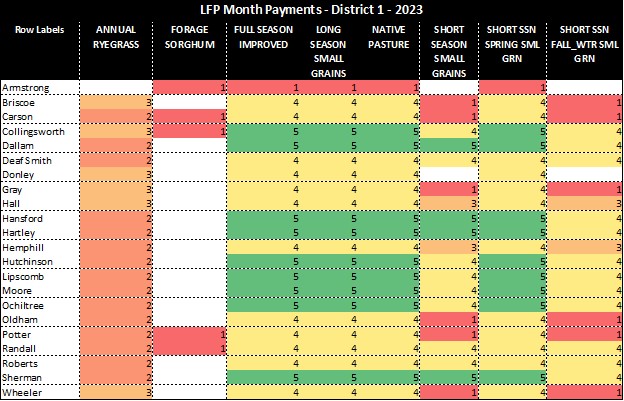

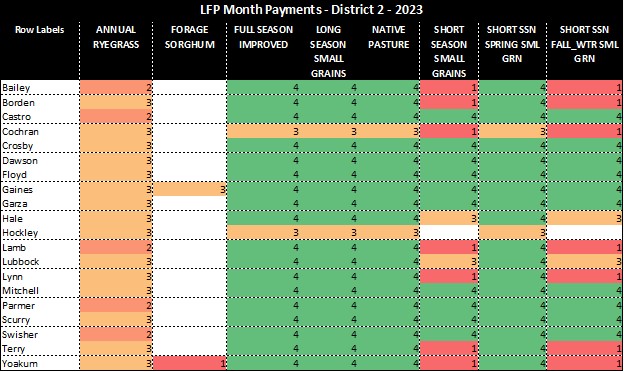

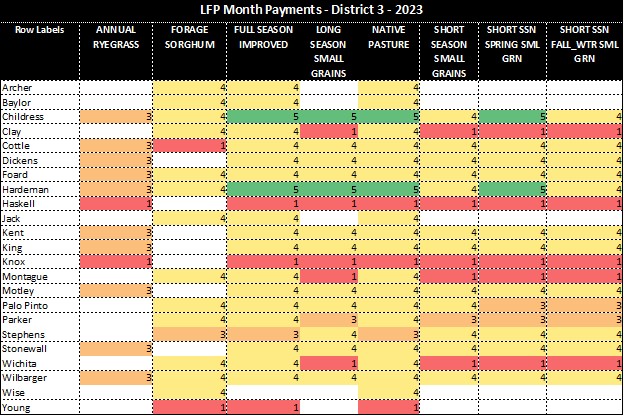

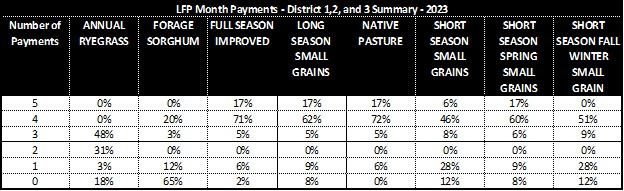

Drought duration in each county determines the number of monthly payments. Most counties in Districts 1, 2, and 3 are eligible for payments under at least one crop, with some counties qualifying for up to five payments, as shown in Table 1 and in more detail in annex tables (Tables 3, 4, and 5).

Table 1. Average Number of Payments for District 1, 2, and 3 Counties.

Beef and dairy cattle, sheep, goats, and other species such as beefalo, buffalo, deer, equine, elk, reindeer, alpacas, emus, and llamas are eligible for payments. The crucial factor is the grazing status of the livestock during the normal grazing period. Only the animals that were or would have been grazing during the normal grazing period will be eligible for payment.

Producers must have owned, leased, purchased, or contracted livestock during the 60 days before the start of the qualifying drought. Commercial livestock operations, not recreational or hunting purposes, qualify for the program.

Payment Structure

LFP monthly payments are calculated as 60% of the lesser of the monthly feed cost for all covered livestock owned or leased or calculated based on the normal carrying capacity of the eligible grazing land.

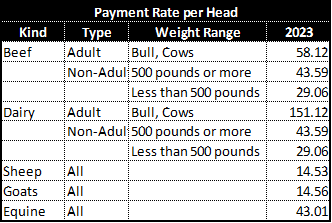

Total LFP payments to a producer will be, at most, five monthly payments for the same kind, type, and weight range of livestock. Table 2 provides the payment rates for common livestock species in 2023.

Table 2. 2023 Payment Rates for Common Livestock Species

LFP Payment Example

Using the 2023 Payment Rates and the number of eligible months in a specific county, producers can estimate their total LFP payment. For instance, in Hardeman County, producers of native pasture would be eligible for five monthly payments per cow. If grazing ten cows, the payment would total $1,644.2 or $164.42 per head. Additional payments apply for calves and other livestock, as detailed in the payment example. If that cow had a calf during that time, you should add $82.21 per head.

Cow Payment per Head = $58.12/head * 5 * 60% – Yearly Sequestration 5.7%) =

$58.12 * 5 = $290.60

$290.60 * 60% = $174.36

$174.36 – Yearly Sequestration Fees (5.7%) =

$174.36 – $9.94 = $164.42/head

Calf Payment per Head = $23.64/head * 5 * 60% – YSF = $82.21.9/head

Sheep /Goat Payment per Head = 11.82 * 5 * 60% – YSF = $42.10/head

For more information, refer to Table 3, Table 4, and Table 5 for the 2023 LFP monthly payments in Districts 1, 2, and 3, respectively, available on the USDA website (https://www.fsa.usda.gov/programs-and-services/disaster-assistance-program/livestock-forage/index).