Corn on Tuesday, Sep 17, 2024, in El Campo, Texas. (Michael Miller/Texas A&M AgriLife)

The 2025 crop and livestock budgets are available on the Texas A&M AgriLife Extension Economics website. In today’s post, we break down the District 1, District 2, and District 3 corn and sorghum budgets and discuss what they imply about feed grain production in 2025.

Master Marketer is Coming to Lubbock

Before I dive into this year’s corn and sorghum budgets, I want readers to know that the Master Marketer Program is coming to Lubbock, TX on February 27 and 28. Master Marketer provides intensive training in many marketing-related skills. An important step in maintaining a profitable farm business is writing and implementing a marketing plan. If you’re a producer and struggle with this part of managing your operation, I encourage you to attend Master Marketer and add some new skills to your “toolbox”. You can register online at https://tx.ag/MMLubbock2025. The fee to register is $50. For more information about the workshop, contact the following extension specialists:

- Mark Welch: jmwelch@tamu.edu, (979) 393-0891

- Andrew Wright: wright@ag.tamu.edu, (806) 746-6101

- Emmy Kiphen: emmykiphen@tamu.edu, (979) 393-0890

Projected Costs and Returns

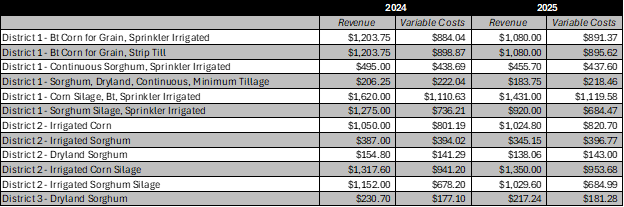

This year’s projected revenues and variable costs for corn and sorghum enterprises in the Texas High Plains and Rolling Plains are listed in Table 1. Variable costs in 2025 should be close to last year. How variable costs change varies from budget to budget, with some enterprises showing a small decrease in costs and others showing a small increase. However, most budgets estimate variable costs within one percent of 2024 values. The same can’t be said for revenues this year. On average, revenues in 2025 are projected to be about ten percent less in 2024 because of lower commodity prices. As a result, we expect net returns from feed grain enterprises to fall in 2025.

Table 1. Feed Grain Revenues and Variable Costs in 2024 and 2025

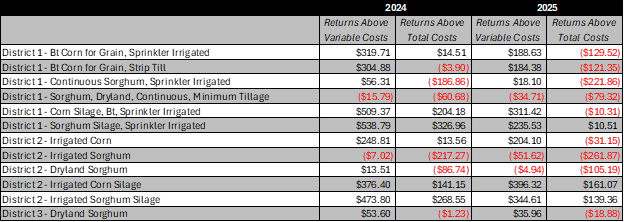

Table 2 compares net returns from feed grain enterprises in 2024 and 2025. While most enterprises continue to show a positive return over variable costs, those returns are significantly less this year. Only three budgets project a positive return over total costs. As you consider this information, remember the rule of thumb for economic decision-making. Focus on returns above variable costs if you have already incurred fixed costs. If an enterprise can cover its variable costs of production, you are better off producing something and using the revenue you earn to pay at least part of your fixed costs.

Table 2. Feed Grain Net Returns, 2024 and 2025

Breakeven Prices in 2025

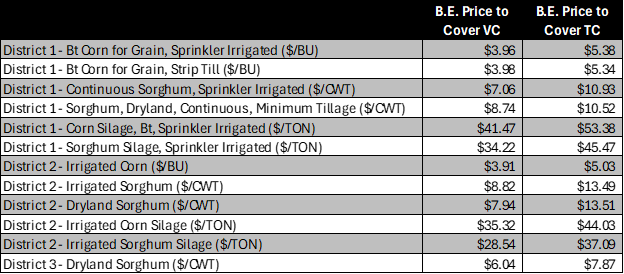

One important value to be aware of in an enterprise budget is the commodity’s breakeven price. This is the price at which you can expect revenue to exactly equal costs, given the expected level of production in the budget. Table 3 lists the prices necessary to break even on both variable costs and total costs for corn and sorghum enterprises in Districts 1, 2, and 3 in 2025.

Table 3. Breakeven Prices for Feed Grain Enterprises, 2025

Normally, the risk of loss is greater when a commodity’s breakeven price is close to its expected price. Using sorghum silage in District 1 as an example, the expected yield in the budget is 20 tons and variable costs are $684.47/acre. Given this yield and variable cost, this enterprise breaks even on variable costs at $34.22/ton. At this yield and the budgeted total cost, this enterprise breaks even on total cost at $45.47. The expected price in the budget is $46/ton, so this enterprise should easily break even on its variable cost. On the other hand, $46 is very close to the break-even price for total costs. If either price or yield is even a little less than expected, sorghum silage may not break even on its total costs.

Final Comments on the Budgets

The numbers in these budgets are general guidelines for corn and sorghum enterprises and will not represent every operation perfectly. To build a budget that represents your operation, you can use the following options:

- Producers in District 1 can access a Crop Profitability Analyzer, sponsored by Texas Corn Producers, by clicking here.

- District 2 producers access a similar decision tool, sponsored by Cotton Inc., at https://southplainsprofit.tamu.edu/.

- AgriLife Extension Agricultural Economics offers tools to help you build your own budgets on our website.

Keep in mind also that the outlook for commodity prices and some input costs is still not yet fully formed. The actual prices and costs seen this year may be very different from what the budgets predict. Make sure you have a plan established to manage risks related to production and prices this year. To keep up to date on the latest cotton marketing information, make sure to check out Dr. Mark Welch’s grain marketing website.