Aug. 9, 2022 in College Station, Texas. (Sam Craft/Texas A&M AgriLife Marketing and Communications)

Last month, USDA released two important reports: the monthly Crop Production report, and the latest World Agriculture Supply and Demand Estimate (WASDE) report. In this post, we discuss what these reports say about cotton production in 2024.

Cotton Production Update

The August Crop Production Report is an important one for cotton. In it, USDA provides their first production estimates based on current crop conditions, rather than historical trends. For this reason, we might consider the August report the first “real” look at cotton production for the year.

What’s in this year’s report for cotton? First, the report revised the total number of cotton acres planted in the United States downward. The June acreage report estimated total cotton area planted at 11.67 million acres. In contrast, the August Crop Production report estimates 11.17 million acres planted. For upland cotton, the June report estimated 11.49 million acres planted, whereas the August report estimated 10.97 million acres planted. This revision represents a 4% decrease in USDA’s estimate for cotton acres planted in 2024.

How much can we expect these acres to produce? The August report estimates harvested acres for all cotton at 8.6 million acres and harvested acres for upland cotton at 8.4 million acres. Based on these estimates, it seems that USDA expects about 77% of all cotton acres planted this year to be harvested. For context, the May, June, and July WASDE reports assumed that about 82-85% of what was planted would be harvested based on historical trends.

The expected average yield given in the August report is 840 pounds/acre for all cotton and 828 pounds/acre for upland cotton. If the values for harvested acres and yield are accurate, we can expect the United States to produce 15.1 million total bales of cotton, including 14.6 million bales of upland cotton, in 2024.

For the state of Texas, the report estimates the number of upland cotton acres planted at 5.95 million with acres harvested at 3.65 million. This is 450,000 acres fewer acres planted than was reported in June, a 7% decrease, and a projected 39% abandonment rate. The report estimates Texas’ average yield at 592 pounds/acre and estimates total production at 4.5 million bales, a 66% increase from last year.

Current WASDE Estimates

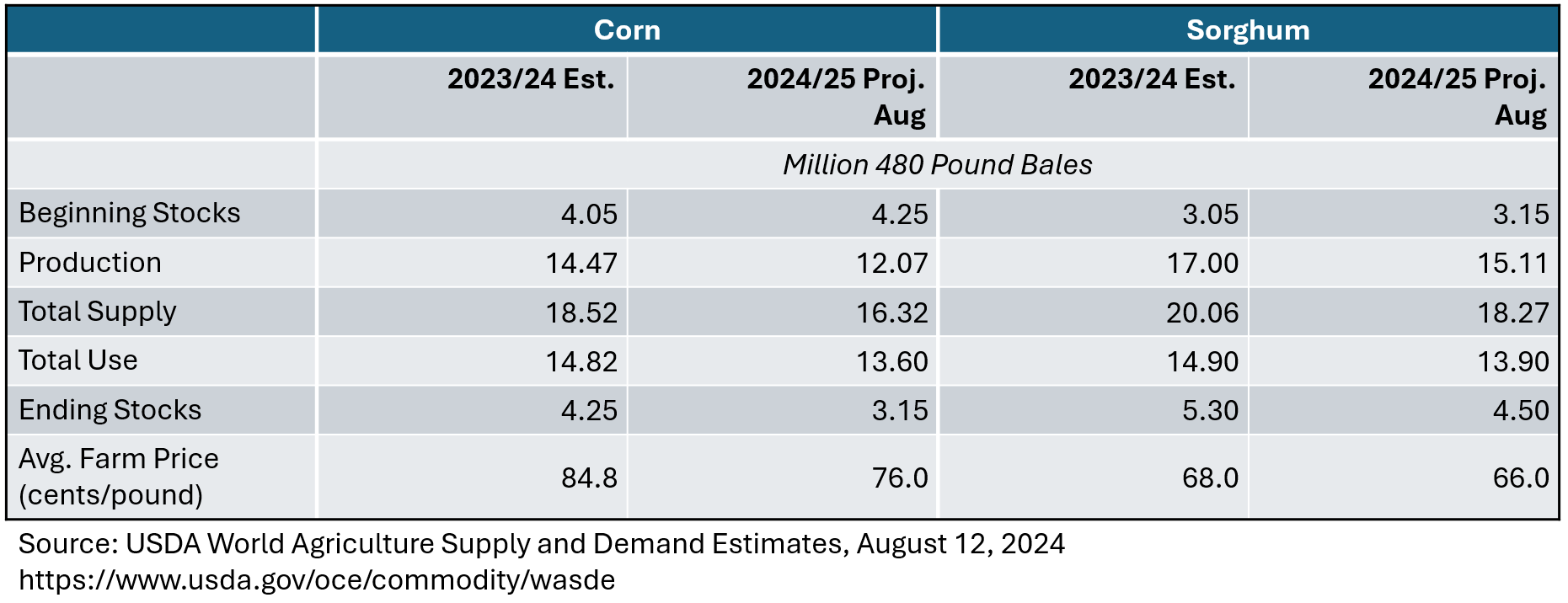

We can see the impact of the above estimates on U.S. cotton ending stocks in the August WASDE report (Table 1). The downward revisions to planted and harvested acres bring production down almost 2 million bales relative to the July projection. This is offset slightly be greater than expected beginning stocks, so total cotton supplies show a 1.79 million bale decrease. Meanwhile, total use is revised down by 1 million bales based on fewer exports. As a result, ending stocks decreased by 800,000 bales relative to the estimate reported in July.

Table 1. August 2024 WASDE Summary for United States Cotton

Cotton Market Outlook

How did the markets respond to this news? Figure 1 shows how the ICE December 2024 cotton contract traded during the weeks of August 12-16, August 19-23, and August 26-30. The Crop Production and WASDE reports were both released on August 12 at 11:00 am CST. At that time, the contract price jumped up quickly but fell back to where it had been trading that morning just as quickly.

Figure 1. ICE December 2024 Cotton Contract Prices, August 12-30, 2024

However, since August 16, the December contract price had been moving upward. At this point, the downward trend the December contract price followed since March appears to have shifted into more of a sideways pattern. Whether this represents a real change in the contract’s price trend remains to be seen. As they make harvesting decisions this year, producers should continue to monitor the price in their area and consider how the price movements that have occurred since February have changed their breakeven yield on harvest costs for this year’s crop.