An important part of managing a farm business is managing debt. Producers who utilize debt effectively can increase the profitability of their operation. However, borrowing comes at a cost. Today, we’ll discuss the different types of loans available to producers and their structures. We’ll also look at how different loan structures impact the cost of borrowing.

An important part of managing a farm business is managing debt. Producers who utilize debt effectively can increase the profitability of their operation. However, borrowing comes at a cost. Today, we’ll discuss the different types of loans available to producers and their structures. We’ll also look at how different loan structures impact the cost of borrowing.

Types of Agricultural Loans

In general, there are three types of farm loans:

Producers use operating loans to finance input purchases, pay for other expenses, or cover short-term cash shortages. Operating loans might take the form of a short-term note with a bank or a line of credit either with a bank or an input supplier. Normally, borrowers must pay back operating loans within a short period of time, likely a year or less.

Equipment loans provide funds for purchasing equipment such as tractors, harvesters, and related equipment. Producers pay off equipment loans over a longer period, generally 3-10 years, depending on the size of the loan.

Finally, producers use real estate loans to purchase or make improvements to land. Borrowers pay these loans back over long periods, generally anywhere from 10-30 years.

Loan Structure

How a lender structures a loan will have a significant impact on both the total cost of the loan and the producer’s ability to make payments from one period to the next. In general, a loan’s structure takes four things into account:

Loan term refers to the length of time between when a loan starts and when it must be repaid. It describes how long a borrower has from the time the loan begins to pay back the loan principle and any interest that accrues while the loan is in effect.

A loan’s interest rate is the cost of the loan. It is the amount charged by the lender to make the loan, usually calculated as a percentage of the loan’s value. Lenders sometimes offer the option of choosing either a fixed or variable interest rate on a loan. With a fixed rate loan, the interest rate charged on the loan principle stays the same throughout the loan term. The interest rate in a variable rate loan will change as interest rates in the broader economy change. As interest rates increase, the loan charges more interest. As interest rates decrease, the loan charges less interest.

Some loans require the borrower to offer collateral to secure the loan. Generally, this will be something tangible that the lender can take possession of to limit their losses if the lender defaults on the loan. For agricultural loans, this might be land, equipment, or commodities produced by the farm.

Finally, repayment refers to how borrowers make payments on principal and interest. Short-term loans may require that borrowers pay all of the loan principal and accrued interest at once at the end of the loan. Equipment and real estate loans are often amortized. That is, payments on principal and interest are made periodically during the loan term.

Most lenders can be flexible when it comes to setting a loan’s terms to meet the borrower’s needs and their ability to make payments. For example, a lender may offer a longer loan term at a slightly lower interest rate to make regular payments more feasible for the borrower. That said, a longer loan term, even at a lower interest rate, might cost more in interest over the life of the loan. For this reason, it’s important to consider how different loan structures impact a loan’s total cost.

Impact of Structure on Loan Costs

To illustrate how loan structure affects loan costs, we will consider two possible loans. In both cases, the borrower wishes to secure a $50,000 equipment loan. The first loan requires monthly payments for 5 years at 8.5% interest. The second loan requires monthly payments over 6 years at 7.25% interest. In this example, we will focus on the difference in interest costs and assume that all other costs related to procuring these loans are the same.

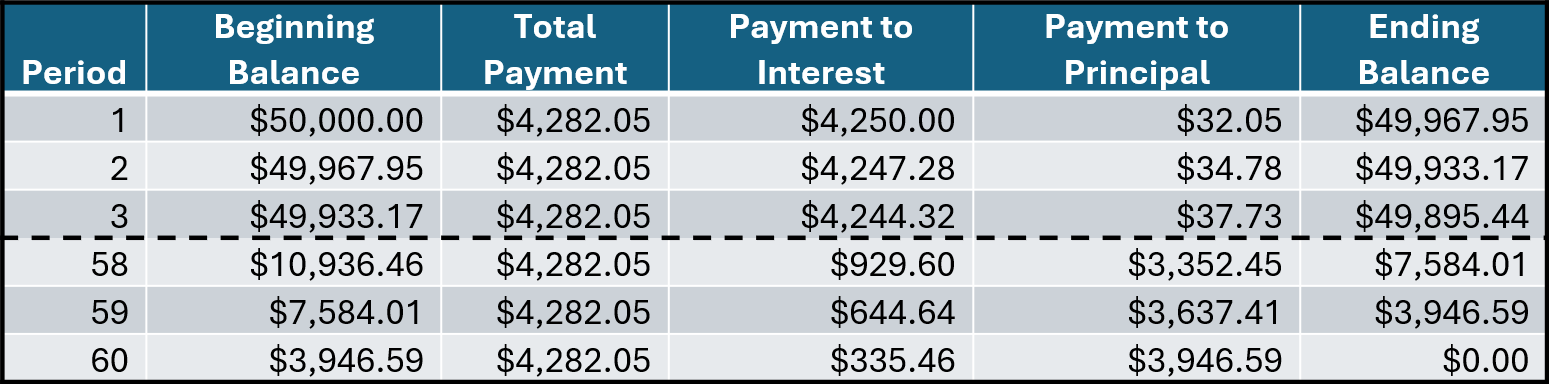

Table 1 illustrates the payments to principal and interest in the first 3 periods and the last 3 periods for the first loan:

Table 1. First and Last Three Months of Payments for Loan 1

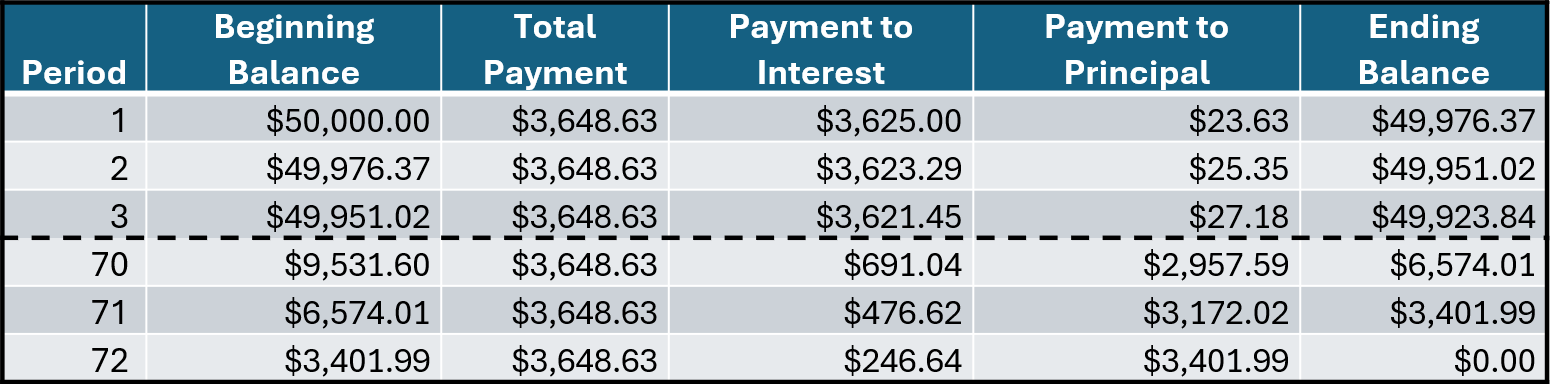

Table 2 illustrates the same information for the second loan:

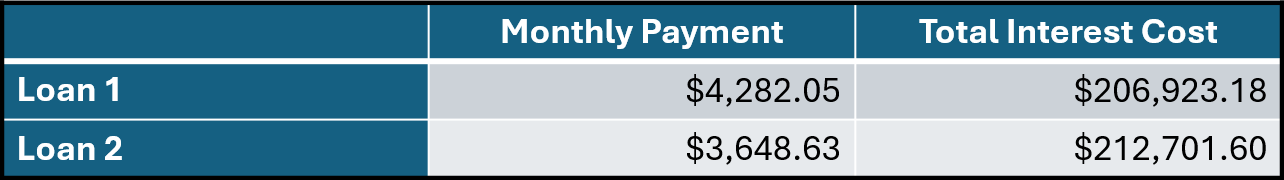

Finally, Table 3 compares the monthly payment and the total interest cost for the two loans:

Table 3. Comparison of Loans 1 and 2

Notice that while the second loan comes with a lower interest rate and lower monthly payments, it charges almost $6,000 more in interest.

Hopefully, readers take two things away from this example. First, how a loan is structured will impact both the feasibility of payments and the total cost of the loan over time. Second, there may be a trade-off between feasibility and costs. Borrowers should be aware of this trade-off as they begin the loan application process.