To fight rising inflation, the Federal Open Market Committee started raising interest rates at an aggressive pace in 2022. In this post, we will look at the Federal Reserve’s progress in the fight against inflation. We’ll also discuss what to expect from the Federal Reserve in terms of interest rate policy in 2024.

To fight rising inflation, the Federal Open Market Committee started raising interest rates at an aggressive pace in 2022. In this post, we will look at the Federal Reserve’s progress in the fight against inflation. We’ll also discuss what to expect from the Federal Reserve in terms of interest rate policy in 2024.

What We’re Reading

Wheat crop shaping up better than past two years, but prices are low – AgriLife Today

COTTON SPIN: Is cotton’s old crop rally over? – Southwest Farm Press

Farm bill: Increased payment limits critical – Southwest Farm Press

Jaroy Moore leaves ag research legacy – Southwest Farm Press

The Now and Later of Feedlot Inventories – Southern Ag Today

Planting Date: The Need for Speed – Southern Ag Today

Inflation and Interest Rates in 2023

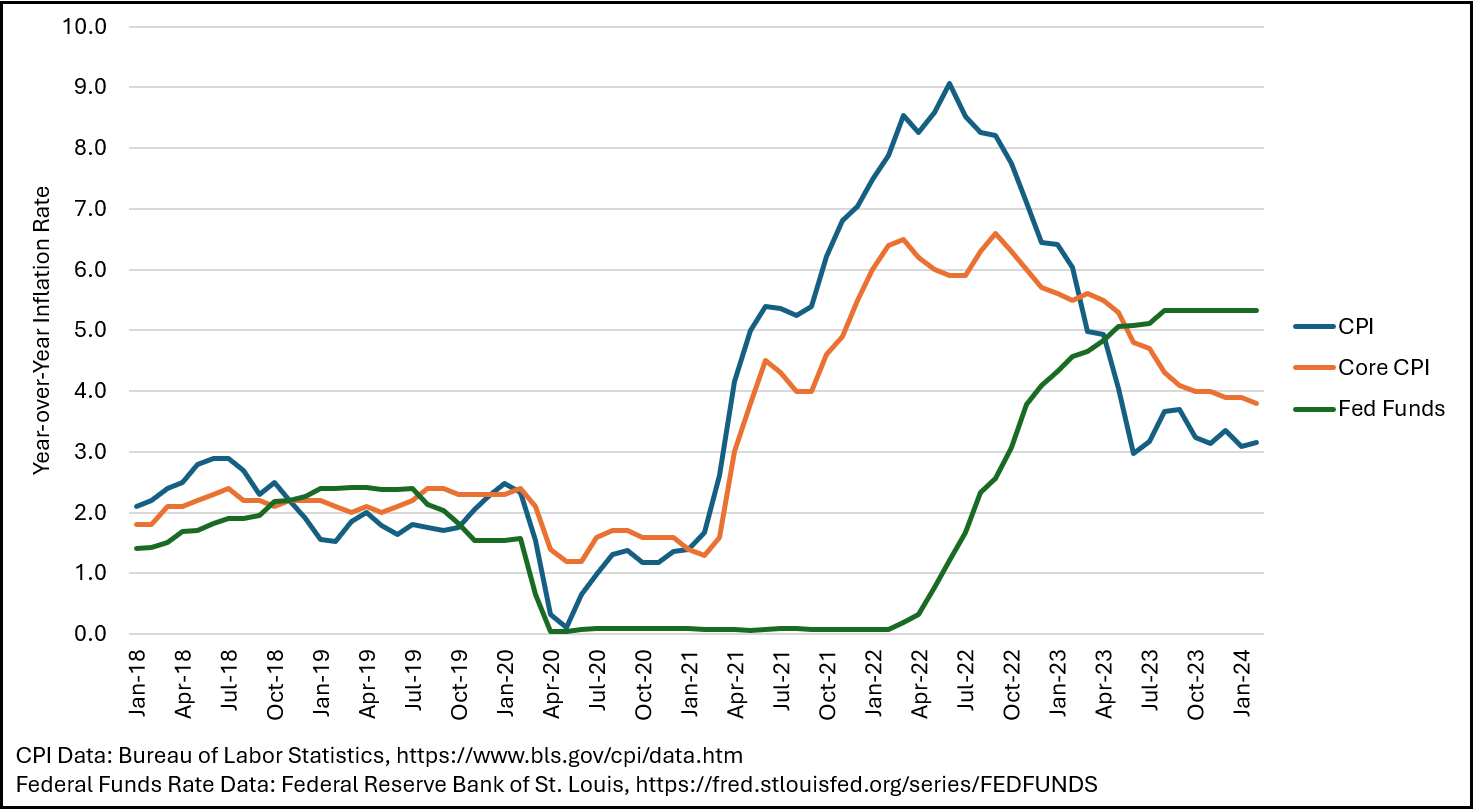

Figure 1 charts the year-over-year inflation rate, based on the Consumer Price Index (CPI), over the last five years. In the first half of 2023, the rate of inflation fell from 6.4% to 3.2%. Since then, the inflation rate has fluctuated between 3% and 4%. Core inflation, which excludes changes in food and energy prices, fell throughout 2023 from 5.6% in January to 3.9% in December.

Figure 1. 12-Month CPI Inflation Rate, January 2018-February 2024

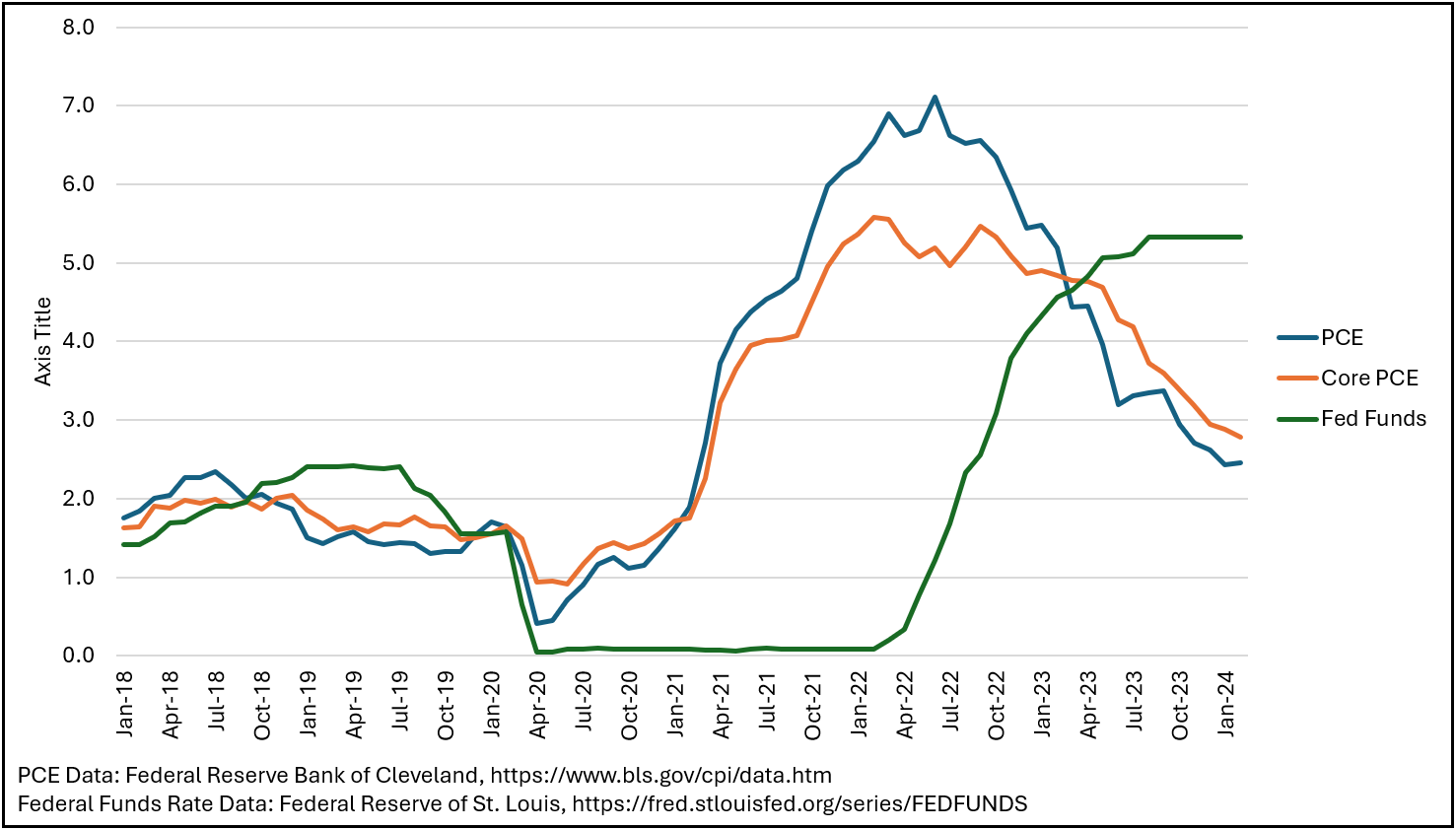

Figure 2 charts the year-over-year inflation rate, based on the Personal Consumption Expenditures Index (PCE), for the same period. While the CPI gets a lot of attention in the media, the PCE index is the Federal Reserve’s preferred measure of inflation. Although the rate of inflation, as measured by the PCE index relative to the CPI, is lower, the story told by both Figures 1 and 2 is essentially the same. Overall inflation decreased in 2023 by about 3 percentage points, while core inflation has come down by about 2 percentage points. The main difference in the inflation story told in Figure 2 is that overall inflation as measured by the PCE index did not level off in the second half of the year but decreased from January to December 2023.

Figure 2. 12-Month PCE Inflation Rate, January 2018-February 2024

Both Figures 1 and 2 also show how the Federal Funds Rate has changed over the last five years. The Federal Funds Rate is the interest rate set by the Federal Open Market Committee (FOMC). It is the rate at which banks in the Federal Reserve System borrow from each other and influences several other interest rates in the economy. As shown in Figure 1, the FOMC raised this rate quickly over the course of a year from March 2022 through March 2023 to combat inflation. After that, interest rate increases continued at a slower pace until June 2023. Since then, the FOMC has held the interest rate steady at a target of 5.25%-5.50%.

Looking Forward: Inflation and the Federal Funds Rate in 2024

Figures 1 and 2 tell us three things about the Federal Reserve’s progress in the effort to tame inflation. First, optimistically, the rate of inflation has decreased significantly over the last year and nine months. Based on the Bureau of Labor Statistics’ most recent estimates, since June 2022 the year-over-year CPI inflation rate has decreased from 9.1% to 3.2%. According to the Bureau of Economic Analysis’ inflation data, the inflation rate has gone from 7.1% to 2.5%. In short, the Federal Reserve is making progress. Second, there is still progress that needs to be made. The Federal Reserve’s target inflation rate is 2%. The year-over-year inflation rate for both the CPI and the PCE index is still above this target. Finally, getting the inflation rate down to 2% will not be easy and will take time. In both figures, the decrease in the inflation rate has begun to level off. If this trend continues, then the last 1-2 percentage point decrease necessary to reach a 2% inflation rate will take time to achieve. This is especially true if the FOMC chooses to keep the Federal Funds Rate at its current level.

What will the FOMC do in 2024? This is difficult to predict; however, the news organization Reuters has tracked the attitudes of FOMC members regarding interest rate policy since February 2022. Currently, most FOMC members appear to have adopted a “wait and see” stance when it comes to changing the interest rate. These members favor reducing interest rates this year but remain willing to increase rates if inflation remains where it is or begins to tick upward again. It seems reasonable to expect interest rates to remain where they are in the first half of 2024. If inflation continues to decrease, then we may see 2 or 3 small rate decreases later in the year. The FOMC will meet next on April 30 and May 1 to revisit its interest rate policy.

Implications for Production Costs in 2024

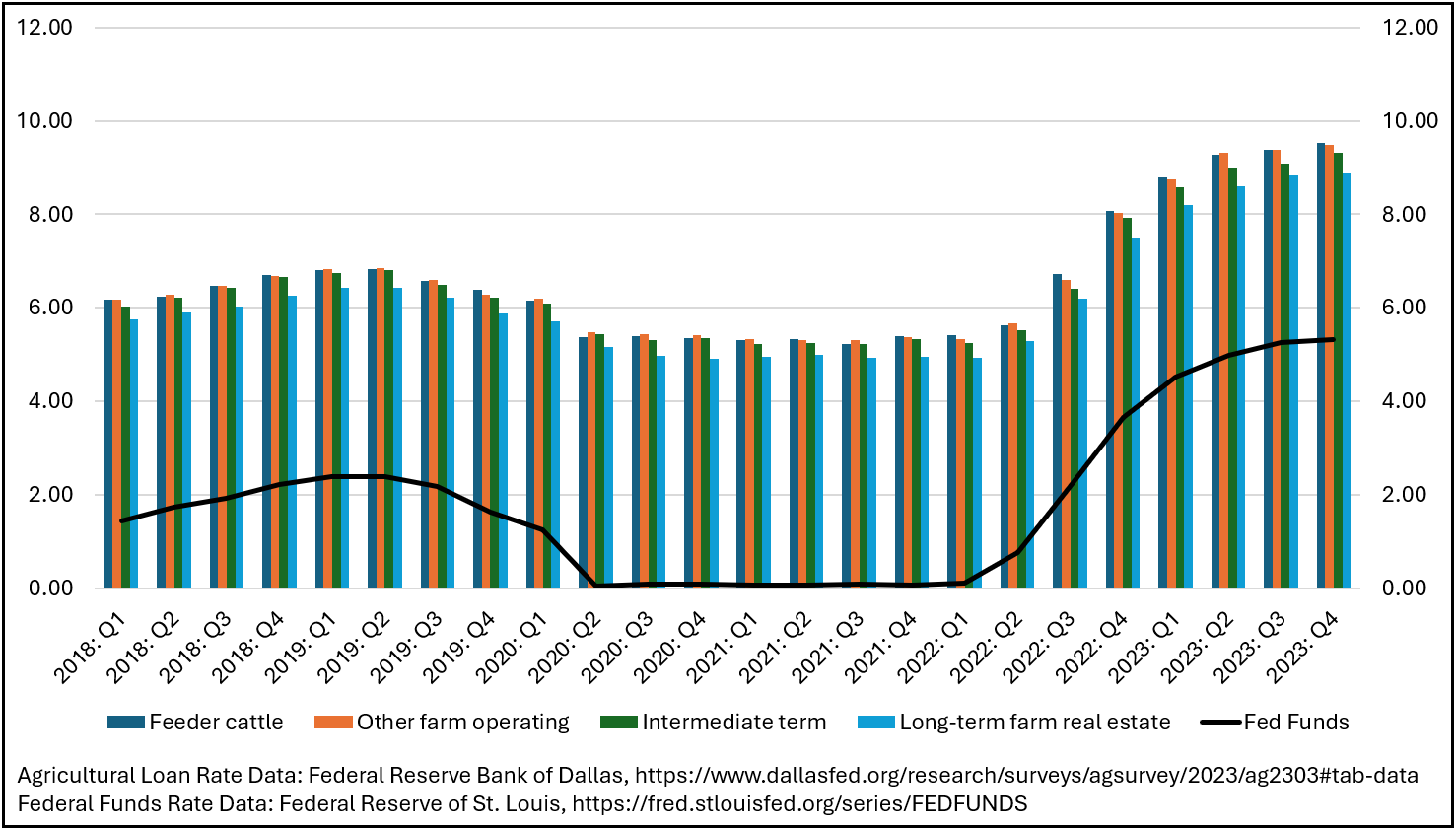

Figure 3 illustrates how interest rates for different agricultural loans changed from 2018 through 2023 on a quarterly basis. The black line in the figure shows how the Federal Funds Rate changed over the same period.

Figure 3. Select Agricultural Loan Rates, Q1 2018-Q1 2024

Producers should expect agricultural loan rates to remain at or near their current levels until the FOMC lowers the Federal Funds rate. Until then, high interest rates will continue to be a challenge.