Aug. 9, 2022 in College Station, Texas. (Sam Craft/Texas A&M AgriLife Marketing and Communications)

The 2024 crop and livestock budgets will soon be available for all districts on the Texas A&M AgriLife Extension Agricultural Economics website. In this post, we look at the numbers in the budgets for cotton production in Districts 1 and 2.

What We’re Reading

2024 wheat prices speculated to be lower than ’23 – Southwest Farm Press

More cotton, lower prices in 2024? – Southwest Farm Press

Ken Legé: new Lubbock Extension cotton specialist – Southwest Farm Press

What to consider when making ARC/PLC election – Southwest Farm Press

Cotton Crop Insurance: Unveiling Regional Differences in Projected and Harvest Prices – Southern Ag Today

2024 Winter Wheat Production Prospects – Southern Ag Today

Projected Costs and Returns in 2024

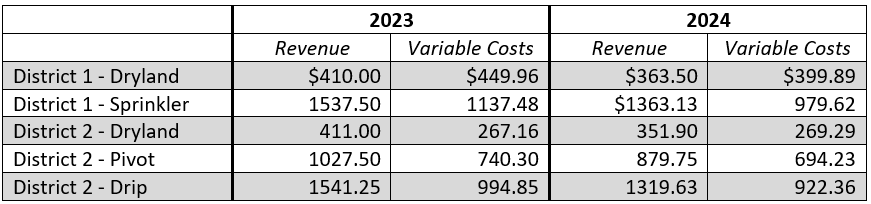

Table 1 compares per-acre revenue and variable costs in the 2023 and 2024 Texas A&M AgriLife Extension cotton budgets for Districts 1 and 2. Based on these numbers, producers can expect both lower revenues and lower variable costs this year relative to 2023. Revenues decrease because of lower expected prices for both cotton lint and cottonseed. Variable costs decrease largely due to lower expected fertilizer and energy costs. For more on how fertilizer and energy costs might change in 2024, check out this post.

Table 1. Cotton Revenue and Variable Costs in the 2023 and 2024 Extension Budgets

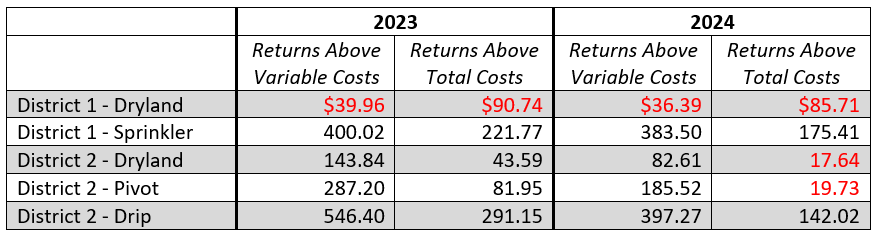

What do lower revenues and variable costs imply for cotton production this year? Table 2 compares the expected per-acre returns above variable costs and returns above total costs for cotton enterprises in Districts 1 and 2. In most cases, expected returns are less in 2024 relative to 2023 but still positive.

Table 2. Expected Returns to Cotton Production

There are four negative values to highlight in Table 2. The 2024 returns above total costs for dryland production in both districts are negative, as are the returns above total costs for pivot irrigated cotton in District 2 and the returns above variable costs for dryland cotton in District 1. Does this mean that producers should avoid putting resources into these enterprises this year?

Keep in mind that total costs for any enterprise include fixed costs that must be paid even when nothing is planted and/or harvested. The rule of thumb for economic decision making is to focus on returns above variable costs if you have already incurred fixed costs. If an enterprise can cover its variable costs of production, you are better off producing something and using the revenue you earn to pay at least part of your fixed costs. For dryland and pivot irrigated cotton in District 2, returns above variable costs are positive so it would make economic sense to plant cotton if a producer is already invested in these enterprises. On the other hand, it might not make economic sense to plant dryland cotton in District 1 this year unless expectations regarding commodity prices or production costs change significantly.

Breakeven Prices for 2024

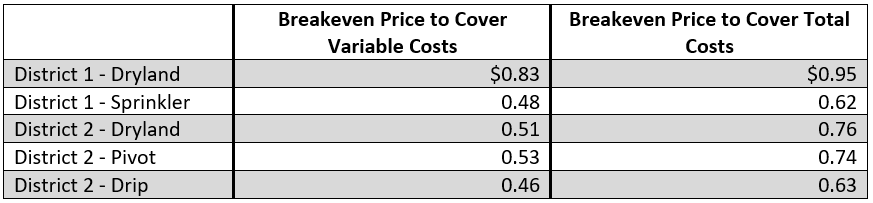

One important value to be aware of in an enterprise budget is the commodity’s breakeven price. This is the price at which you can expect revenue to exactly equal costs, given the expected level of production in the budget. Table 3 lists the breakeven prices to cover both the variable costs and the total costs reported in the 2024 budgets. Using pivot irrigated cotton in District 2 as an example, the expected yield per acre in the budget is 1000 lbs. of cotton lint. If this yield is achieved, then an acre of pivot irrigated cotton will break even on its variable costs at a price of $0.53/lb. and will break even on its total costs at a price of $0.74/lb.

Table 3. Expected Breakeven Prices for Cotton Enterprises

Except for dryland cotton in District 1, cotton enterprises in Districts 1 and 2 should have no trouble breaking even on their variable costs in 2024. Breaking even on total costs will be more difficult this year; however, sprinkler irrigated cotton and District 1 and drip irrigated cotton in District 2 should be able to do so. The prices necessary to break even on total costs for dryland and pivot irrigated cotton in District 2 are just barely above the expected cotton price listed in the budgets. If cotton prices are higher than expected this year, or if producers can take advantage of marketing opportunities to secure a higher-than-expected price, these enterprises could end up producing a positive return over total costs this year.

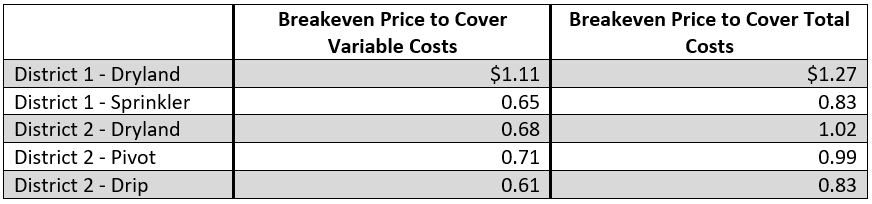

What if cotton yields are less than expected this year? Table 4 reports breakeven prices for cotton production in Districts 1 and 2, using a yield that is 25% less than the values in the budgets. Using pivot irrigated cotton in District 2 as an example, if the expected yield is decreased to 750/lbs. then the breakeven price necessary to cover variable costs increases to $0.71.

Table 4. Breakeven Prices for Cotton Enterprises, Assuming a 25% Reduction in Yield

The values in Table 4 highlight the risk associated with cotton production this year. If yields are much lower than expected, then cotton enterprises in Districts 1 and 2 are unlikely to break even on their total costs and may barely break even on their variable costs. In the coming weeks, we will discuss programs that producers can use to mitigate their production and marketing risk in this blog.

Some Final Comments on the Budgets

Keep in mind that the numbers in these budgets are general guidelines and will not represent every operation perfectly. To build a budget that better represents your operation, you can use the following options:

- Producers in District 1 can access a Crop Profitability Analyzer, sponsored by Texas Corn Producers, by clicking here.

- District 2 producers access a similar decision tool on website https://southplainsprofit.tamu.edu/.

- AgriLife Extension Agricultural Economics offers tools to help you build your own budgets on our website.

One other thing to keep in mind is that the outlook for the 2024 cotton market is not yet fully formed. According to Dr. John Robinson, a cotton marketing specialist with Texas A&M AgriLife Extension, cotton demand will likely be weak this year; however, we do not yet know yet what cotton supplies will be in 2024. If production meets early expectations, then prices should be close to those reported in the Extension budgets. On the other hand, if production is less than expected then prices may be slightly higher (or lower if cotton production is larger than expected). Until we know how much cotton is planted in 2024, and what the weather is like during the growing season, there is still plenty of room for market expectations to change. To stay up to date on the latest cotton marketing information, make sure to check out Dr. Robinson’s cotton marketing website. While there, make sure to sign up for his weekly email newsletter as well.

Taking a Short Break

High Plains Ag Week will take a break next week as we head to Atlanta, GA for the annual Southern Agricultural Economics Association meetings. We’ll return to our regular posting schedule on February 14.