Macroeconomic Trends and Their Impacts on Farmers

Changes in both the U.S. and global macroeconomic environments can have a significant impact on the bottom line of farms and ranches. For this reason, it is important to be aware of changes in the macroeconomy and to consider how these changes might affect your operation.

Board Update 3/20/2023

Tulia, Amarillo, Dalhart Average – Cattle Prices by Category 3/16/2023

Dates & Deadlines

3/27-31/2023 – Ranch Management University

4/6/2023 – RWFM Stewardship Webinar Series: Water Law Overview & Update

4/14/2023 – Owning Your Piece of Texas

4/19-21/2023 – Prescribed Burn School

4/25-26/2023 – Hemphill County Beef Conference, Canadian

5/4/ 2023 – RWFM Stewardship Webinar Series: Wild Pigs in Texas

Macroeconomic Trends and Their Impacts on Farmers

Changes in both the U.S. and global macroeconomic environments can have a significant impact on the bottom line of farms and ranches. For this reason, it is important to be aware of changes in the macroeconomy and to consider how these changes might affect your operation.

There are several indicators you can use to understand the macroeconomic environment. In this post, we will look at trends in three of these indicators and discuss the potential implications of those trends for Texas farms and ranches.

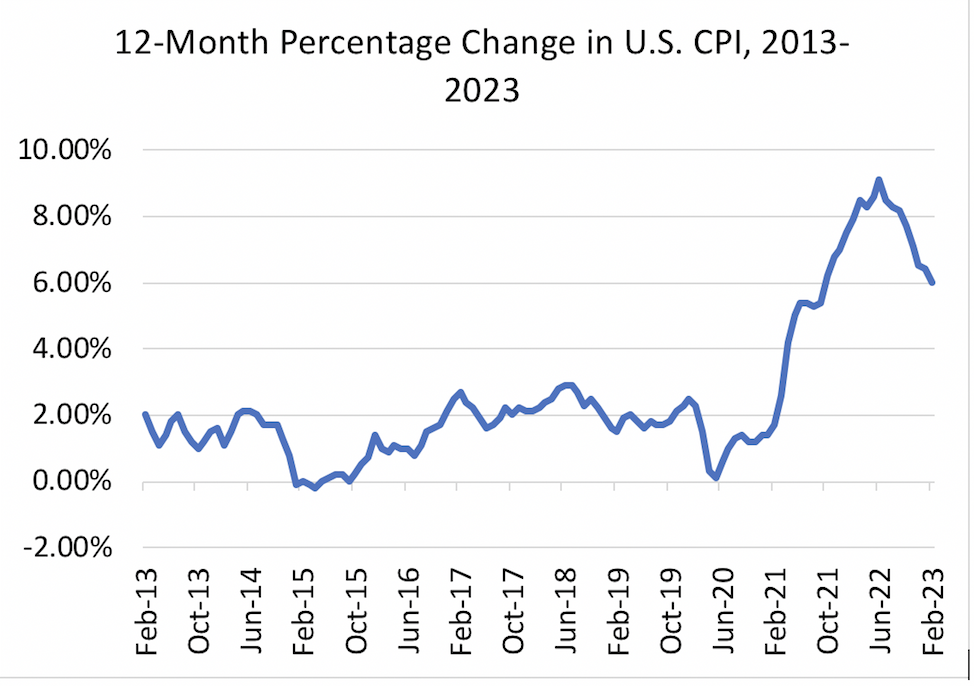

Inflation

Inflation refers to a general rise in prices in the economy. As prices rise, consumers find that their income does not purchase as many goods and services this year as it did last year. As a result, consumers must adjust their spending by forgoing certain purchases or by changing what they purchase at the store. For example, they might substitute a more expensive product for one that is similar but does not cost as much.

Inflation in the U.S. is measured using the Consumer Price Index (CPI), which measures the change in prices paid by U.S. consumers for a common set of goods and services. Figure 1 illustrates the 12-month percent change in the CPI from February 2013 through February 2023 (source: Bureau of Labor Statistics). Inflation increased sharply from May 2020 until July 2022. In July 2022, the year-over-year percent change in inflation was 9.1%. In other words, prices were 9.1% higher on average in July 2022 relative to the price level in July 2021. Since then, year-over-year inflation has decreased to 6.0% in February 2023.

Source: Bureau of Labor Statistics, https://www.bls.gov/opub/ted/2023/consumer-price-index-up-0-4-percent-over-the-month-6-0-percent-over-the-year-in-february-2023.htm

Inflation impacts both the cost of producing agricultural commodities and the demand for those commodities. On the cost side, inflation increases the prices paid by farms and ranches for the inputs they use to produce commodities. On the demand side, inflation increases the prices paid by consumers for agricultural commodities and for goods produced using those commodities. However, the full increase in consumer prices caused by inflation rarely makes it way back to the farm or ranch. According to the USDA, the farm share of each dollar spent on food in the United States is $0.145. Thus, most of the increase in consumer expenditure on food does not accumulate to farms and ranches.

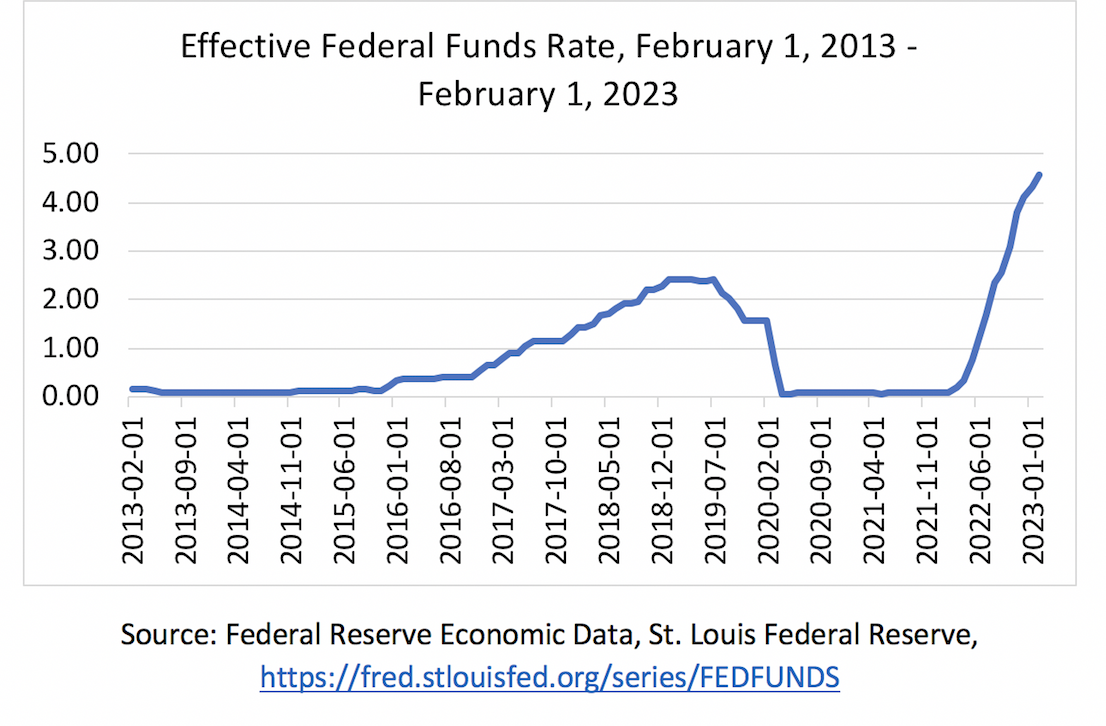

Interest Rates

In response to historically high inflation rates, the Federal Reserve has been steadily increasing interest rates over the past year. Figure 2 illustrates how the federal funds rate, which is controlled by the Fed, has changed over the last 10 years (source: Federal Reserve Economic Data, St. Louis Federal Reserve). After slowly increasing the federal funds rate over a period of 4 years, the Fed quickly decreased this interest rate to effectively zero as a part of its response to the COVID-19 pandemic. Then, in February 2022 the federal funds rate began to increase again and is 4.57% as of February 2023.

Higher interest rates will translate into higher costs to farms and ranches. As the federal funds rate increases, other interest rates in the economy, such as mortgage rates and rates on operating loans for businesses, will increase as well. Some of these increases have already been accounted for in the enterprise budgets published by AgriLife; however, the Federal Reserve has indicated that it intends to continue increasing interest rates this year. The Federal Open Market Committee (FOMC), which is the group within the Fed that makes decisions about the federal funds rate, will announce today (March 22) whether it intends to increase the federal funds rate, and will meet again on the following dates this year:

- May 2-3

- June 13-14

- September 19-20

- October 31- November 1

- December 12-13

Exchange Rates

The exchange rate between the U.S. dollar and other world currencies is another macroeconomic indicator that is useful to track. Put simply, the exchange rate describes the value of one currency relative to another. When the dollar increases in value relative to other currencies the exchange rate increases. U.S. goods become more expensive in international markets and foreign goods become less expensive in the U.S. market. The opposite is also true.

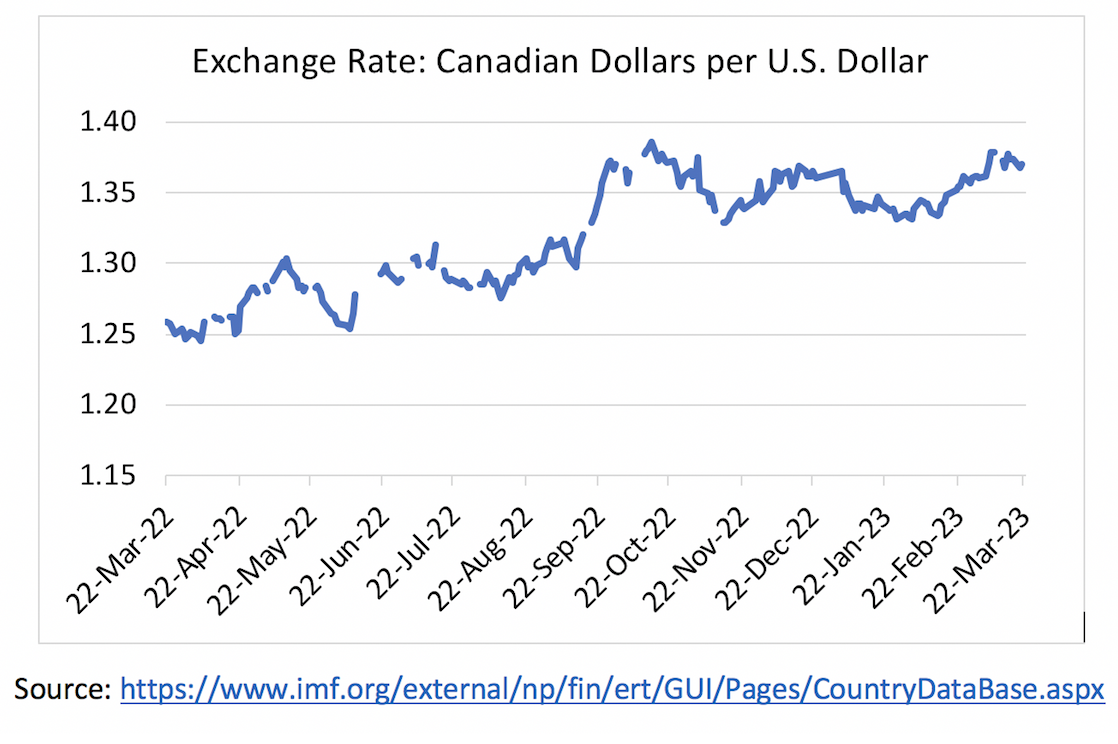

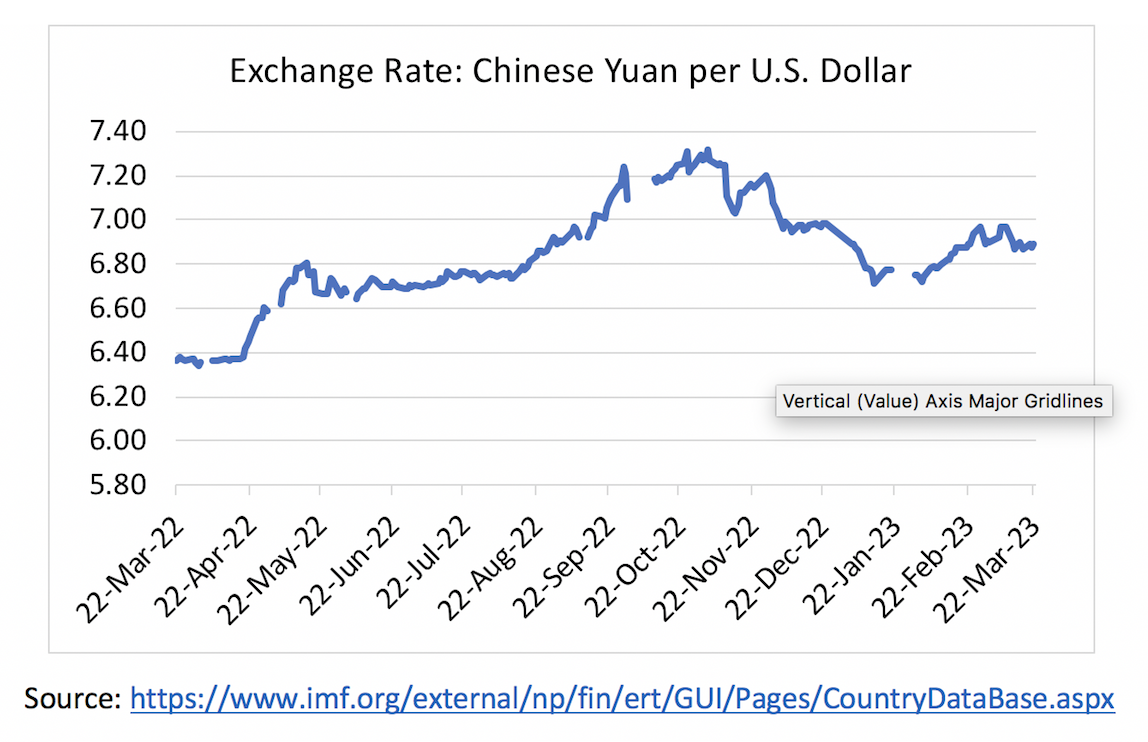

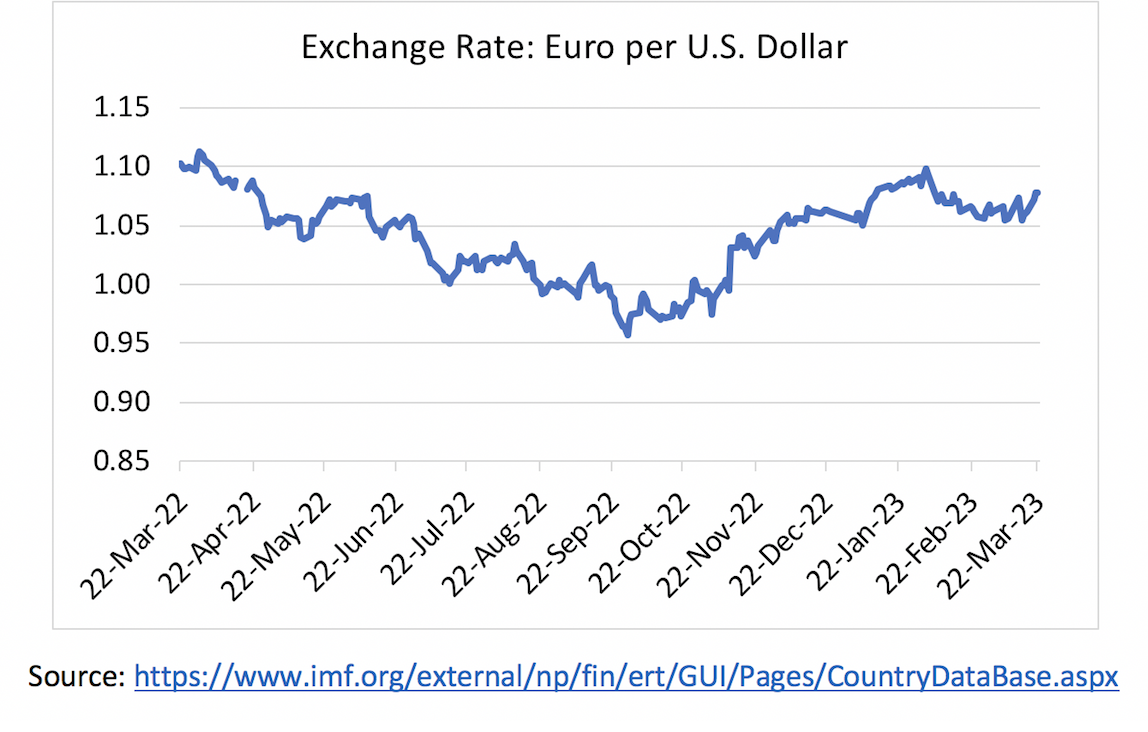

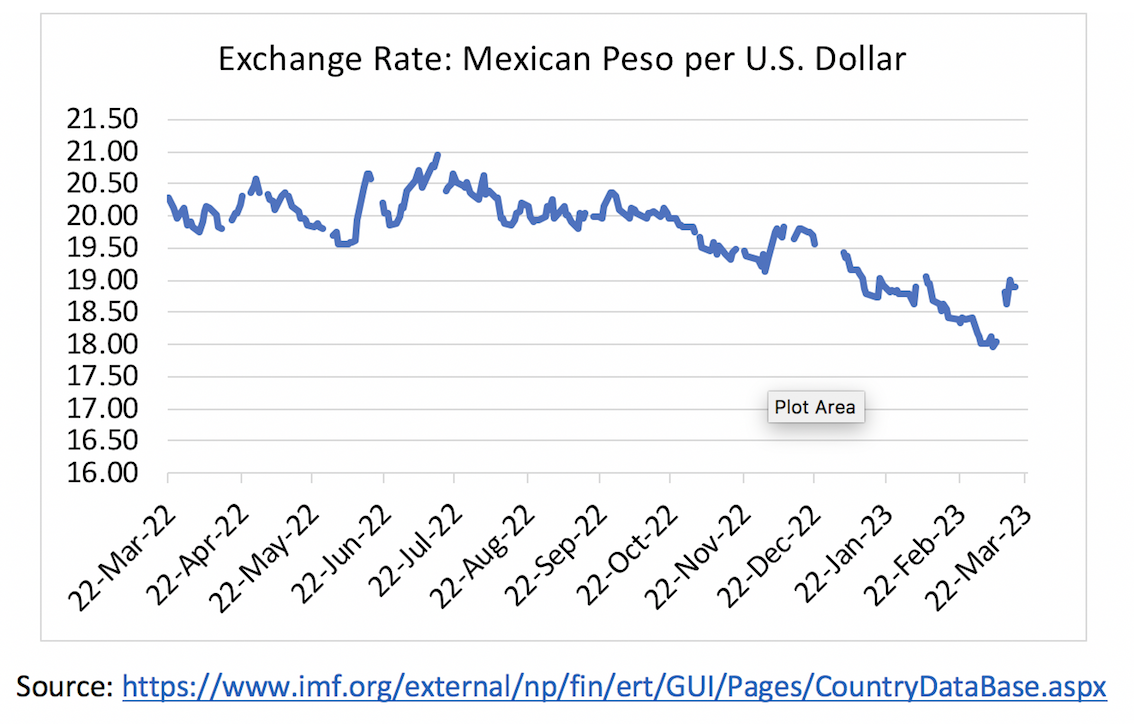

Figures 3, 4, 5, and 6 illustrate how the value of the U.S. dollar has changed over the past year with respect to the Canadian dollar, the Chinese Yuan, the Euro, and the Mexican peso (source: International Monetary Fund). In each figure, the exchange rate is listed in terms of foreign currency per U.S. dollar, so an increase in the trend indicates that the U.S. dollar has increased in value relative to the foreign currency and vice-versa.

Over the last 6-12 months, the U.S. dollar had increased in value relative to 3 of these 4 currencies, the Mexican peso being the exception. This may indicate that U.S. agricultural exports might be lower this year, and in fact in the USDA Economic Research Service’s latest update of the Outlook for U.S. Agricultural Trade, ERS has revised the forecast for 2023 U.S. agricultural exports down relative to its November 2022 prediction.

Thinking About Macroeconomic Trends

As you consider these and other macroeconomic indicators and what they mean for your operation, remember that the macroeconomic environment is complex, and it is difficult to reduce macroeconomic events down to simple cause-and-effect relationships. Yes, as the dollar strengthens U.S. goods become more expensive in foreign markets, but the exchange rate is not the only determinant of foreign demand for U.S. commodities. Rather than using these trends as predictors of what will happen in the future, use them to identify areas of the macroeconomy that might inject risk or uncertainty into your operation. Understanding these sources of risk and uncertainty and finding ways to address them in your business plan will make your operation more resilient to events in the macroeconomic environment that are often beyond your control.