(Courtney Sacco/Texas A&M AgriLife Marketing and Communications)

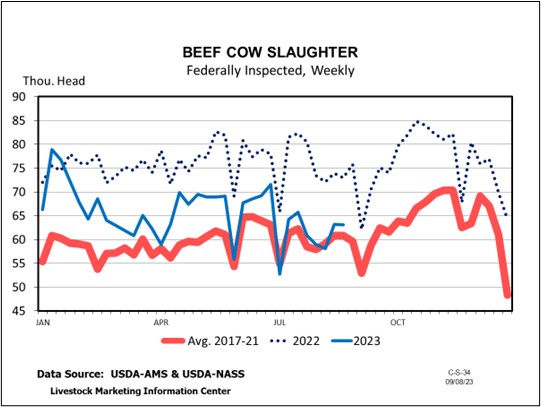

We continue our review of fall markets by looking at the beef cattle market. Beef cattle prices have been high this year because of tight supplies and strong demand for beef. Four factors to keep an eye on in the last part of the year are retail demand, beef production, feed costs, and weather.

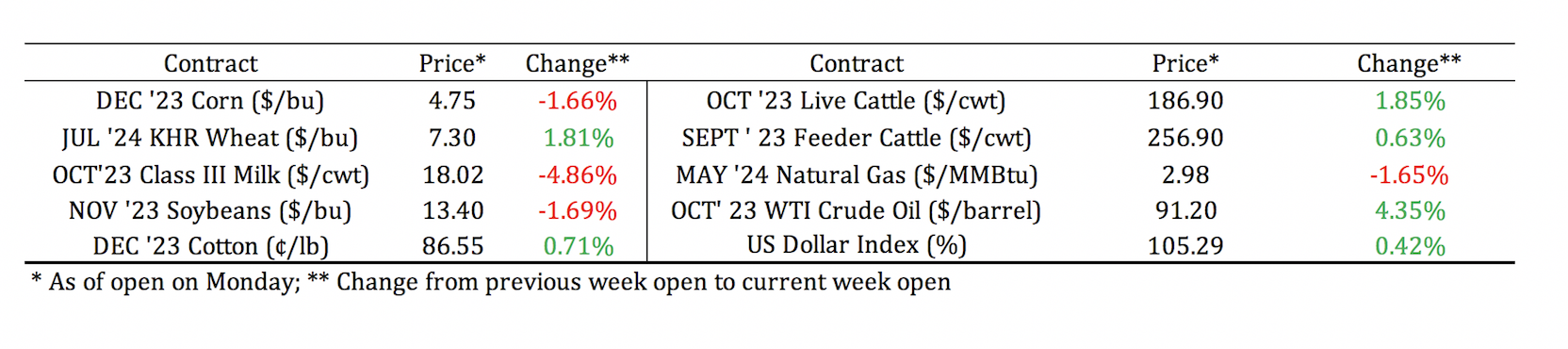

Beef Cattle Market Outlook

Cattle prices in the southern plains have increased steadily this year (Figure 1). Prices increased based on strong consumer demand for beef, coupled with tight supplies in the cattle markets and reductions in beef production relative to 2022. In the long term, we expect supplies to remain tight; however, how consumers will respond to high beef prices moving forward remains to be seen.

Figure 1

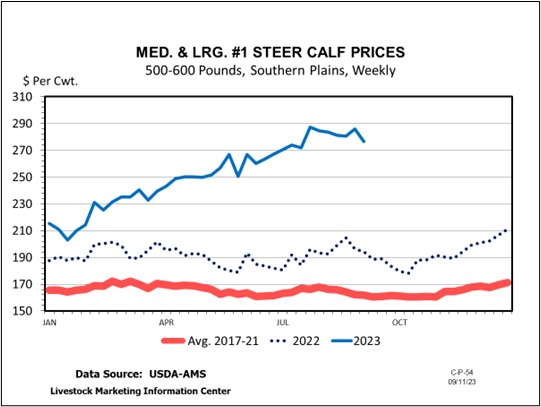

Retail Demand

At the retail level, demand for beef products has been strong all year. Expenditure on beef graded choice (across all cuts; Figure 2) set record highs in May, June, and July this year. Expenditures in August were slightly lower than in July. However, that is not necessarily unexpected. It remains to be seen how high these prices can go or how long the market can sustain them. For now, consumers seem willing to pay higher prices to continue to purchase beef products; however, at some point, consumers should become sensitive to high beef prices relative to the price of substitutes like pork or poultry. At that point, expect beef demand to weaken and beef expenditures to decrease.

Figure 2

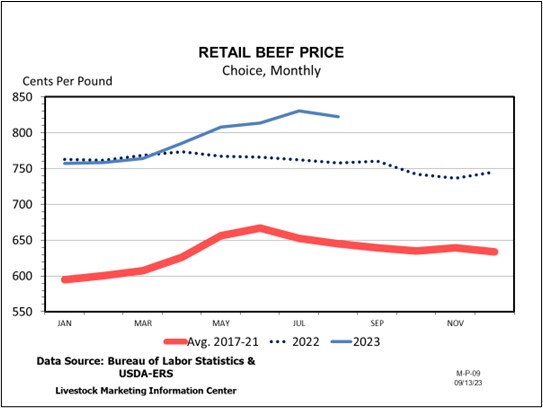

Supply

Herd culling because of drought conditions and high production costs has led to tighter supplies in cattle markets. Right now, all signs point to these conditions continuing into 2024. Although beef cow slaughter numbers have been less in 2023 (Figure 3), these numbers are still probably still high relative to current herd sizes and do not necessarily point to an effort on the part of producers to rebuild herds.

Figure 3

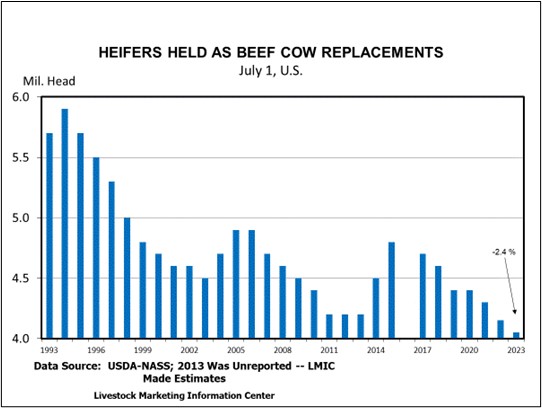

This year, the number of heifers held back as beef cow replacements is also low (Figure 4). Expect cattle supplies to remain tight, at least in the near term.

Figure 4

Feed Costs

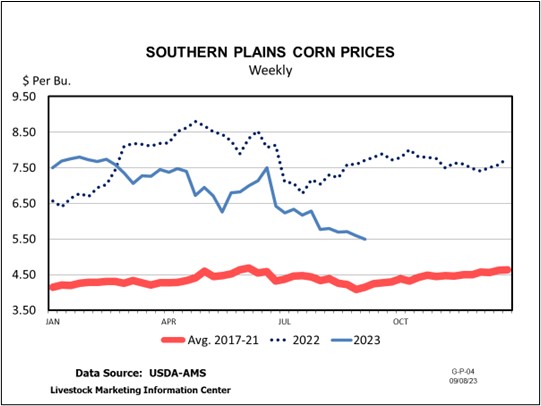

Corn prices have decreased this year but are still high compared to historical averages (Figure 5). Corn prices generally indicate feeding costs and usually vary inversely with cattle prices.

Figure 5

Looking Forward

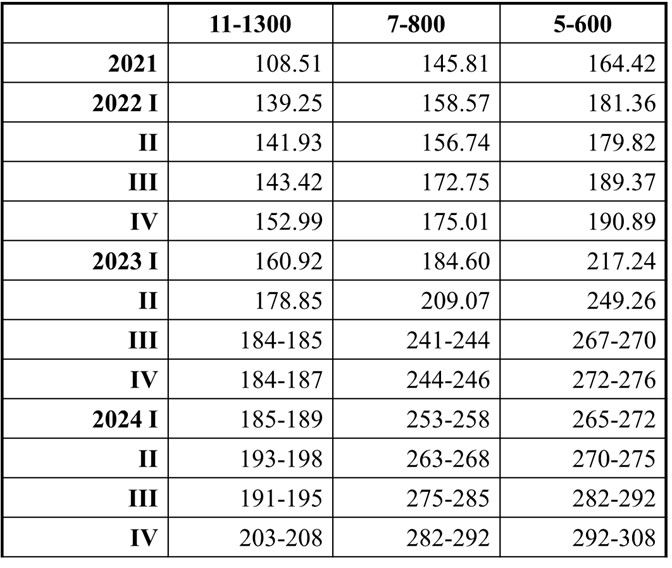

Tight supplies, lower corn prices, and strong retail demand should support prices in the cattle markets in the coming months. Price forecasts for the rest of this year and 2024 are from Dr. David Anderson for Texas combined auctions (Table 1).

Table 1

It remains to be seen whether prices are high relative to production costs to encourage producers to rebuild their herds. It may be that prices are where they need to be, but more rainfall and time are needed for pastures to recover from the last two years of hot, dry conditions before rebuilding can begin in earnest.