(Laura McKenzie/Texas A&M AgriLife Marketing and Communications)

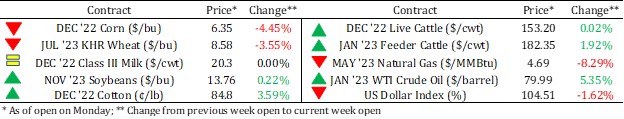

We continue our fall market reports reviewing the beef cattle market. Beef cattle prices have improved this year, which has undoubtedly helped during this drought. Four crucial market drivers have played and will play a significant role in future prices: Weather, Feed Costs, Beef Production, and Demand.

Dates & Deadlines

12/13/2022 – Armstrong County Fall Producers Meeting, Claude

01/18/2023 – 01/19/2023 – Red River Crop Conference, Childress.

01/24/2023 – 03/09/2023 – Master Marketer, Vernon.

What We’re Reading

November WASDE: USDA raises corn, soybean yields – FarmFutures

Rise in partisanship complicates Farm Bill – Southwest Farm Press

USDA releases nationwide farmer, rancher and forest manager survey – Morning Ag Clips

Traditional holiday baking costs up – AgriLife Today

Beef Cattle Market Outlook

Overall, beef cattle prices have been the best from last year, which undoubtedly helps ranchers during this drought. Strong demand helped support higher prices this year, even though total beef production has increased from the previous year. The reduction of the cow herd in the U.S. has lowered the number of calves offered during 2022. In the long term, we expect lower calves for the following years and better feeder, weaned steer, and heifer prices. Four crucial market drivers have played and will play a significant role in future prices: Weather, Feed Costs, Beef Production, and Demand.

Weather and Pasture Conditions

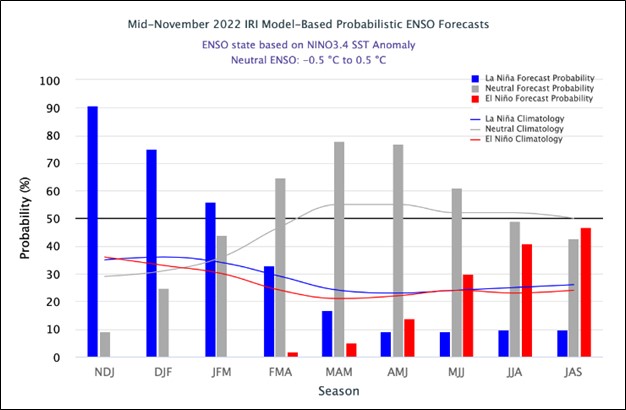

Like last year, the La Niña weather event played an essential role in Texas and most southern states. The drought produced by La Niña affected summer grass production, hay production, and grain production not only in Texas but also in the U.S. and around the World.

Consequently, we have seen higher culling rates, higher hay and feed prices, and less available grazing forage for our cow-calf operations and feeders. The probability of continuing in a Niña pattern through this winter is still high. However, the Columbia Climate School and the International Research Institute for Climate and Society (CPC-IRI) forecast a weaker Niña starting at the beginning of this new year and a Neutral, normal rainfall for the rest of the year (Graph 1).

Graph 1. Mid-November 2022 CPC/IRI Official Probabilistic ENSO Forecast

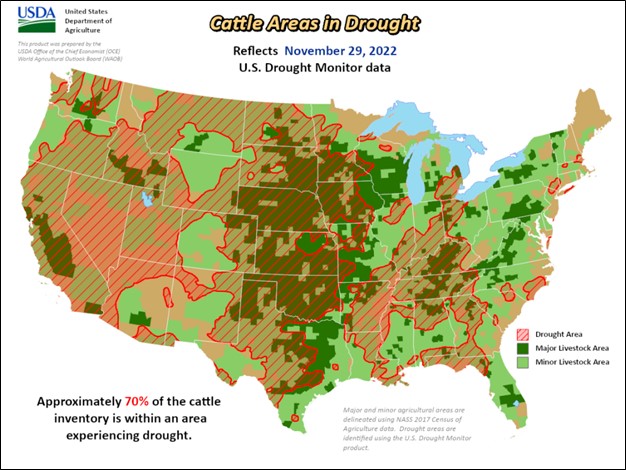

Most of the beef cattle area was affected by the drought. We have also seen less local winter forage supply for stockers and cow-calf operations, pressuring prices and increasing production costs. Last week’s USDA report showed that 70% of the beef cattle inventory is still affected by some drought (Graph 2).

Graph 2: Cattle areas in Drought (USDA)

Pastures and wheat fields for grazing conditions had severely deteriorated this year across Texas and the Southern Plains resulting in an increase in the volume of feeder beef cattle in auction markets and feedlot costs.

Feed Costs

This Niña increased grain and feed cost prices globally. Concerns about corn production in Argentina and Brazil due to La Niña dry weather tied with lower corn stocks and yields in the U.S. have increased corn prices. Corn prices are among the best indicators of feeding costs and are usually negatively correlated with feed cattle prices (Graph 3).

Graph 3. Southern Plains Corn Prices

Supply

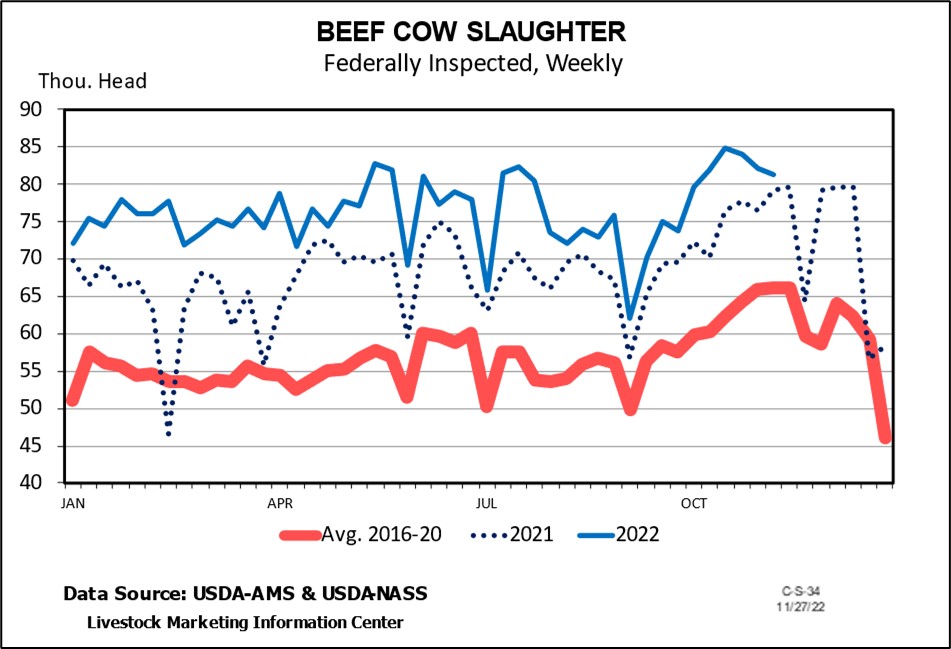

An increase in cow culling, especially in states already suffering drought but also due to higher production costs relative to low prices, led to higher beef production this year. So far this year, culling rates have increased by 12% compared to last year and more than 35% from the previous five years’ average (Graph 4). The number of heifers slaughtered this year has also increased compared to last year.

The increased cow slaughter will result in an even lower cow inventory next year, which was already 2.3% lower than in 2021. We expect a higher percentage reduction in beef cow inventory in 2023.

This inventory reduction has increased cow-beef production this last year. However, a decrease in calf supply for 2023 will lead to higher cattle prices in the long term.

Graph 4. Beef Cow Slaughter

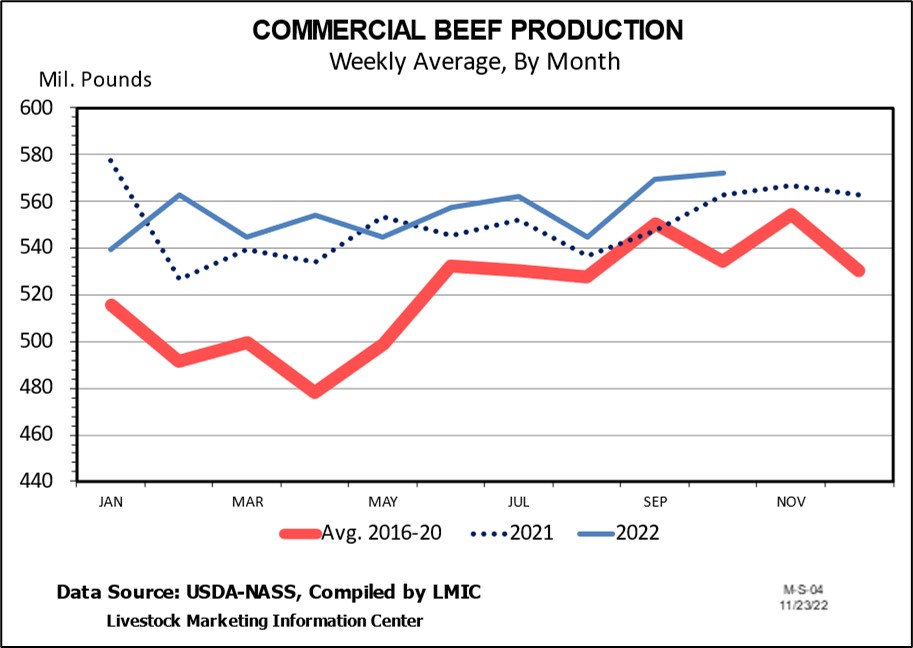

Beef production in 2022 will probably be record high (Graph 5). Steer slaughter has been 1.8 percent less than in 2022 this year. A lower number of steers slaughtered indicates that the higher beef production this year was caused by a larger number of culled cows and heifers sold. Reductions in cow inventory will support higher prices for weaned cattle in 2023 and 2024.

Graph 5. Beef Production

What to Expect?

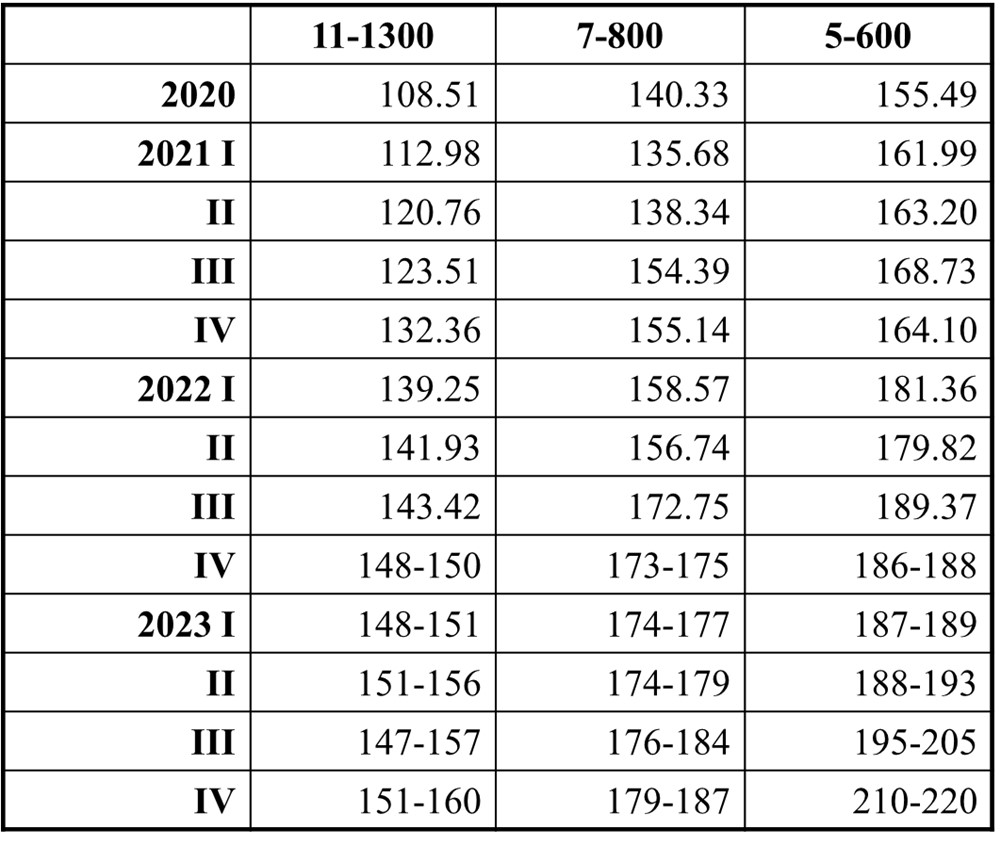

We expect the market to improve in 2023 due to lower beef production. However, demand might be weaker than these last years. A potential recession will decline consumers’ disposable income, leaving them with less money to purchase high-end price cuts. We have seen lower retail prices than last year, which reflects a decline in wholesale prices during the second half of 2022. Price forecasts for the rest of 2022 and 2023 are from Dr. David Anderson for Texas combined auctions (Table 1).

Table 1. Forecast Prices for 2001-2023. (Texas Combined Auction for 5-600 and 7-800 Lb.).

Even though there is an expectation of price improvement, prices still need to be higher relative to today’s production costs. During this period, a solid management information system in place, a permanent cost control system, and a risk management program are critical.