(Laura McKenzie/Texas A&M AgriLife Marketing and Communications)

Preliminary wheat budget results showed production costs decreased by around 10% compared to last year. However, net margins are expected to decrease too. Breakeven prices are close to or higher than July 2024 wheat market prices for this region.

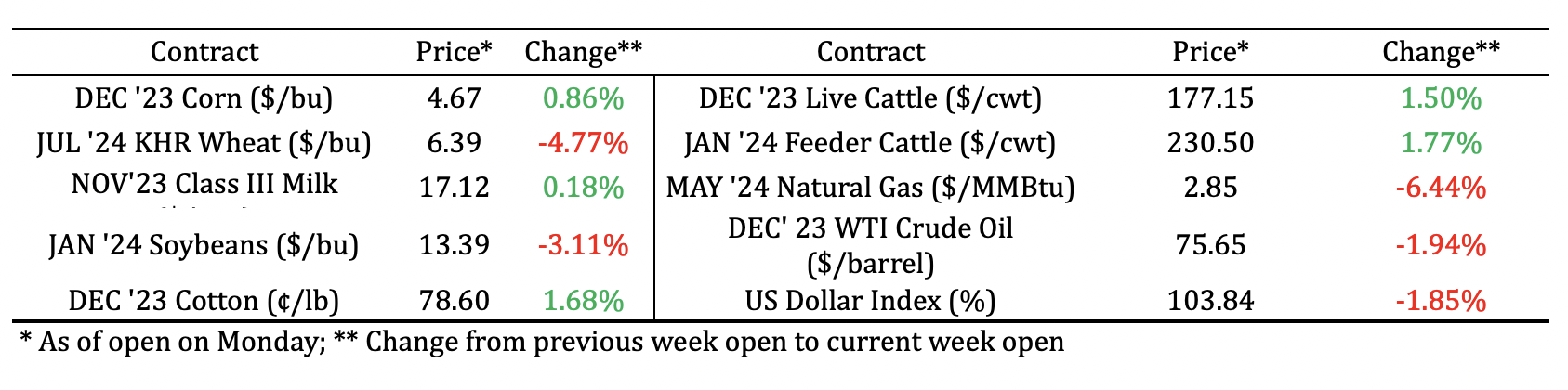

Board Update 11/22/2023

Wheat 2023 Breakeven Price Analysis

In our September blog, we revisited the ongoing trend of weakening wheat prices, a shift notably observed over the past few years influenced by the persistent La Niña effect. Prices have continued downward despite lower US stocks and diminished global reserves. The current pricing levels appear to hover around or fall below the economic breakeven levels calculated for various regions within our districts.

Examining the July 2024 KC HRW contract price, we observed promising marketing opportunities during July (Graph 1). While market volatility emerged in July and August 2023 due to uncertainties surrounding Black Sea exports, prices have steadily declined.

Graph 1. July 2024 KC HRW Contract Price. Source: CME Group.

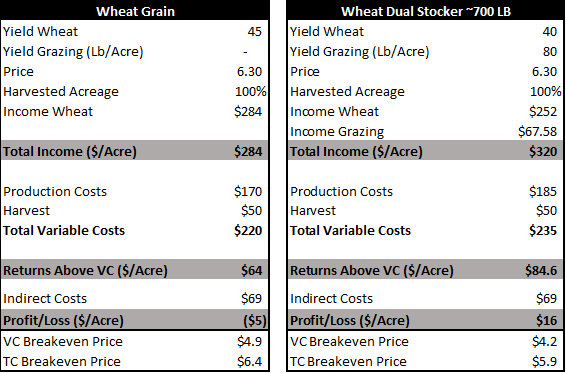

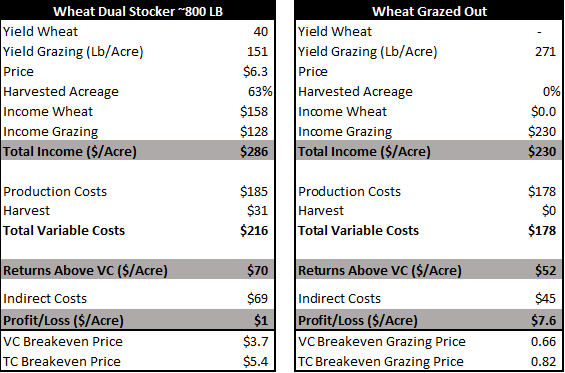

Estimated Wheat Budgets

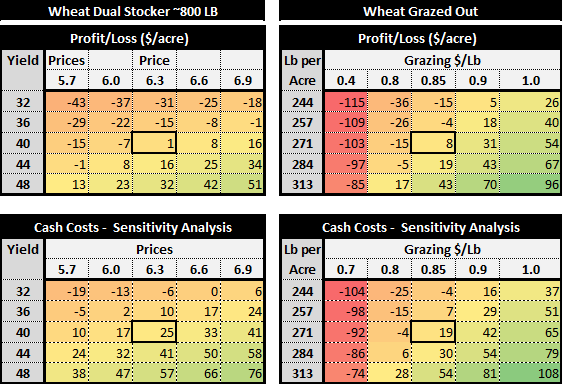

Farmers decide whether to graze their wheat, harvest only, or pursue mixed strategies in the Southern Rolling Plains, where wheat production includes grain and forage grazing. Today, we will analyze various budgets, including Wheat Dryland – No-Till, Wheat Dual Stockers 700 Lbs., Wheat Dual Stockers 800 Lbs., and Wheat Grazed Out (Table 1). While production costs are lower by around 10% compared to last year, mainly due to lower fertilizer prices, net margins have decreased too. Breakeven prices are close to or higher than July 2024 wheat market prices for this region.

Table 1. Wheat Budgets Summary

Estimated Results

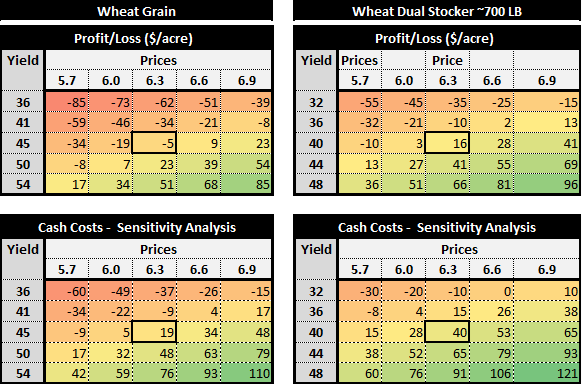

A preliminary assessment of these budgets indicates a slightly negative outcome for Non-till Wheat grain-only production. Based on a yield of 45 bu/acre and a wheat price of $6.3/bu, the breakeven price for covering total costs is $6.4/acre. The breakeven yield at these anticipated wheat prices is 46 bu/acre to cover all costs (Table 2). For those owning all machinery, considering only financial costs, this indifference yield drops to 37 bu/acre, though not accounting for future amortization costs.

In the dual-purpose wheat production scenario (Wheat Dual Stocker ~700 Lb), pulling cattle before March 1st and harvesting the entire planted area, a five bu/acre yield drag was considered due to grazing effects. With an estimated grazing production of 80 pounds per acre, the breakeven price is $5.9/bu. This reflects a slightly improved outcome due to grazing income at $0.85 per pound of gain.

Table 2: Price and Yield Sensitivity Analysis (Part I)

The Wheat Dual Stocker ~800 LbT scenario, representing a system keeping stockers from early grazing through May 1st, requires approximately 33% of the planted area for late grazing, which will not be harvested. Despite a decrease in breakeven price to $5.4/bu, net results closely mirror the grain-only wheat scenario due to the additional grazing income hardly offsetting the lower harvested area.

In the Wheat Grazed Scenario, additional cattle were assumed during the second grazing phase to optimize forage use and increase the total pounds gained per acre. With an estimated total production of 271 pounds per acre, the net income for the enterprise amounted to $7/acre. The grazing breakeven price to cover full costs was $0.82/lb.

Table 2: Price and Yield Sensitivity Analysis (Part II)

Conclusions

Total breakeven prices align closely with wheat grain prices. As always, we encourage farmers to create customized budgets considering their technology, equipment, hired services, soil type, and expected yields. Variations in these factors across our diverse region can significantly impact outcomes. At this early season stage, we assumed average yields and production.

Don’t hesitate to contact us if you have any questions or need guidance using our “Wheat and Small Grain Decision Aids” Excel spreadsheet, available here.