Cotton field on Sept. 2, 2021. (Laura McKenzie/Texas A&M AgriLife Marketing and Communications)

On Monday, June 30, the USDA released its June Acreage Report. In today’s post, we examine the report’s implications for crop production nationwide and in Texas.

Planted Acres for Cotton, Corn, Sorghum, and Wheat

The June Acreage Report is essential for two reasons. First, it is the USDA’s first estimate of what producers have planted each year. Second, the June report provides the basis for production estimates in the USDA’s monthly WASDE report. For this reason, it can have a significant impact on agricultural commodity markets, particularly if the numbers in the report differ from market expectations.

Table 1 summarizes the planted acres for cotton, corn, sorghum, and wheat in the June report for the United States and Texas, comparing them to 2024 planted acres and the values reported in the Prospective Plantings Survey. Compared to 2024, cotton planted acres are down approximately 10% nationally and about 4% in Texas. Producers likely shifted some of these acres to corn production. According to the report, corn acreage increased by 5% nationwide and 7% in Texas compared to 2024. Neither sorghum nor wheat acres changed significantly relative to last year.

Comparing the June report to the Prospective Plantings Survey shows how producers’ intentions changed during the planting season. Compared to the March report, cotton planted acres increased 2.6% nationally and 3.6% in Texas. The number of acres planted with corn remained unchanged nationally but decreased by 6.1% in Texas. Sorghum planted acres decreased 5.6% nationally and 7.9% in Texas. Finally, the acres planted to wheat remained unchanged both nationally and statewide.

To summarize:

- Less cotton was planted in 2025 relative to 2024, but producers planted more than expected based on the March survey.

- More corn was planted in 2025, but no more than was expected.

- Less sorghum was planted in 2025, and the amount planted was significantly less than expected.

- About the same amount of wheat was planted in 2025 when compared to 2024, which was as expected.

Table 1. Planted acres for select crops

Using the Acreage Report to Predict Crop Production and Supply

Until now, the USDA has used the numbers from the March Prospective Plantings Survey to inform its production and supply estimates in the monthly WASDE report. Starting with the next WASDE, to be released on July 11, the USDA will use the numbers from the June report to estimate planted and harvested acres. Table 2 illustrates how the use of planted acres in the June report affects the balance sheets for cotton, corn, sorghum, and wheat.

As might be expected, cotton production and supply increase because of more planted acres than expected. Assuming nothing else changes in the balance sheet, the result is a 260,000-bale increase in ending stocks compared to 2024. Also, as expected, neither corn nor wheat ending stocks show much change when the June planted acres estimate is used. Sorghum production, supply, and ending stocks all undergo significant changes when the June acreage number is used. It will be interesting to see if the USDA adjusts the export value in the sorghum balance sheet to account for lower-than-expected production in 2025. In the May and June WASDE, the USDA predicted that 60% of the U.S. sorghum stocks would be exported to other countries in 2025. It makes sense to assume that this number will likely need to be adjusted to account for less-than-expected production.

Table 2. Potential changes to the July WASDE balance sheets

The Market Response

So far, the corn and cotton market response to the June Acreage Report has been muted. The price of the CBOT December ’25 corn contract took a slight dip on Monday and Tuesday, but it had been falling since June 20 (Figure 1). As of 11:45 this morning, the December contract price has increased about 6 cents since the market opened.

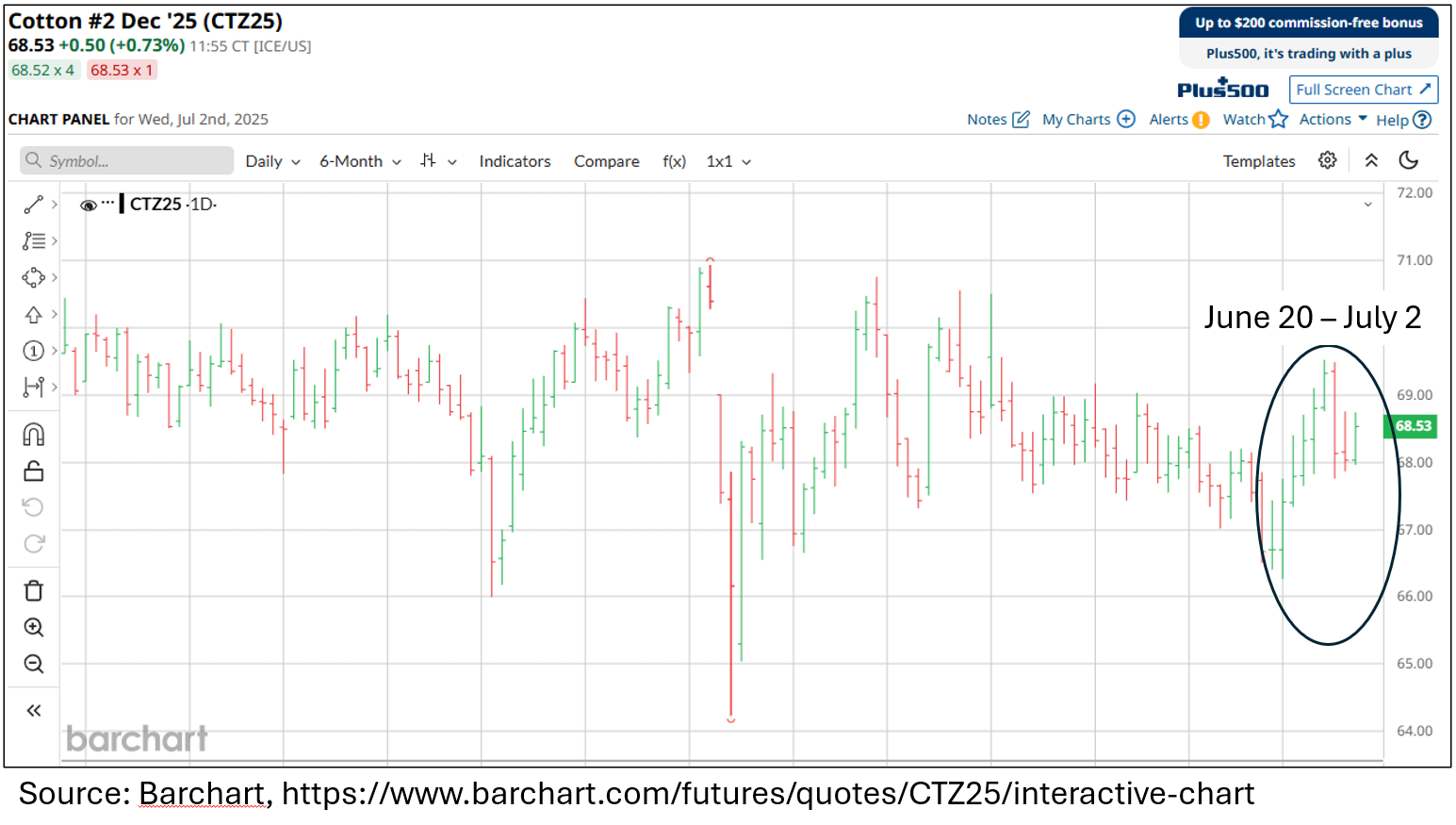

The ICE December ’25 cotton contract price fell significantly on Monday following the release of the June report (Figure 2). However, the December contract is still trading in the same range that it has since the end of March. Traders may be waiting to see how the USDA adjusts the numbers in the July WASDE before making any significant changes to their market positions.

Figure 1. Chart of the CBOT December ‘25 corn contract price, January 4, 2025, through July 2, 2025

Figure 2. Chart of the ICE December ‘25 cotton contract price, January 4, 2025, through July 2, 2025