(Laura McKenzie/Texas A&M AgriLife Marketing and Communications)

Welcome to our final post of the year. Today, we will review the economic topics that garnered the most attention in 2024 and discuss some of the challenges we anticipate in the upcoming year. Andrew and I are wrapping up the blog for 2024. Enjoy this Holiday Season, and see you all next year!

Top Posts of 2024:

1- Using Financial Ratios to Manage Debt:

This post examined financial measures to help you assess your repayment capacity. We began by discussing repayment capacity, which measures your ability to make scheduled debt payments on time using income from your business. Suppose your business doesn’t generate enough revenue to cover these payments. In that case, you must supplement the shortfall with funds from other sources. The second measure we explored is the Capital Debt Repayment Margin, which shows how much money remains after all scheduled debt payments. Finally, we covered the Term Debt Coverage Ratio, which measures your repayment capacity relative to the size of your scheduled debt payments.

2- Cotton Production and Market Update (September 4, 2024):

Cotton production and market updates are always crucial topics in our area. This post discussed the USDA Crop Production reports and the latest World Agriculture Supply and Demand Estimate (WASDE) reports. Low prices, high input costs, and drought conditions have severely challenged profitability in our region.

3- What Yield Do We Need to Be Profitable? (May 1, 2024)

Since 2022, wheat prices have been on a downward trend. During the 2023/24 season, wheat farmers in Texas faced challenges with low prices and high production costs. In this article, we analyzed the yields that farmers would need under these conditions to be profitable, highlighting that above-average yields were required.

4- Wheat 2024-25 Budget and Breakeven Prices (September 26, 2024).

Wheat farmers are once again facing numerous risks this season. The continuing downward trend in wheat prices impacts production in our area. Currently, prices are at or below the economic breakeven levels calculated for various regions within our district. Additionally, rising production costs and an expected dry season due to another La Niña year are increasing risks for ranchers this year.

2025 – Upcoming Issues and Market Outlooks

Weather

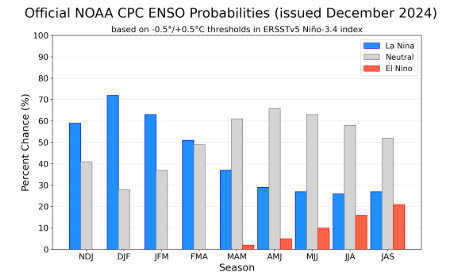

The Early-December 2024 CPC/IRI Official Probabilistic ENSO Forecast indicates an increased likelihood of a La Niña event this winter, lasting until approximately March (Figure 1). This La Niña occurrence is likely to worsen drought conditions across most winter wheat areas in the U.S.

Figure 1.CPC/IRI Official Probabilistic ENSO Forecast. (Source: Columbia Climate School International Research Institute for Climate and Society)

Cotton Market

The December USDA report indicates a high carryout of 4.4 million bales, explaining the current low prices. There is market uncertainty, particularly regarding demand-side factors, especially the pace of exports, which have been underwhelming. Seasonal lows are apparent, but the outlook remains bearish unless demand significantly improves. Projections for the 2025 cotton crop suggest planting between 11-11.5 million bales, potentially leading to a 16-million-bale crop if conditions are favorable. However, ending stocks could rise without stronger demand, further suppressing prices. A positive seasonal trend early in the year offers a glimmer of hope for slightly higher prices before harvest. Still, farmers will need proactive strategies to take advantage of this opportunity.

Grains

In 2024, the grain markets experienced an oversupply due to favorable weather conditions. However, the December USDA report provided a bullish surprise with increased export estimates, leading to lower ending stocks than anticipated. Notably, corn exports have gained momentum, which has helped support slightly higher prices as we move into 2025. In early 2025, we could see upward price movement driven by seasonal trends and strong export activity. However, uncertainties around trade policy pose significant risks, especially regarding key partners like Mexico and China. Changes in political dynamics could disrupt the markets, highlighting the importance of managing trade relations carefully.

Livestock

Cattle prices have risen sharply, driven by tight supplies and improved winter grazing conditions. Seasonal lows in calf prices rebounded dramatically, with recent weeks showing additional price boosts due to trade restrictions and tighter imports from Mexico. Prices for both feeder and fed cattle have also risen, reflecting strong demand and limited supply.

The restrictions on Mexican cattle imports, linked to concerns about screw worms, have tightened supplies and driven prices higher. This trend will likely continue into 2025, especially impacting markets in the southwestern United States. Meanwhile, lamb and goat markets exhibit typical seasonal patterns, with slightly improved prices at the end of 2024 compared to previous years.

Thank you for reading along this year. If you have any questions between now and the beginning of the year, or if you’d like for us to write about a topic you haven’t seen, please reach out to me at pancho.abello@ag.tamu.edu or Andrew at andrew.wright@agnet.tamu.edu. Enjoy this Holiday Season, and see you all next year!