Field crops in Burleson County on July 30, 2021. (Laura McKenzie/Texas A&M AgriLife Marketing and Communications)

The 2024 crop and livestock budgets for most districts have been published on the AgriLife Extension Economics website. In this post, we look at the expected costs and returns for corn and sorghum enterprises in the High Plains.

Projected Costs and Returns in 2024

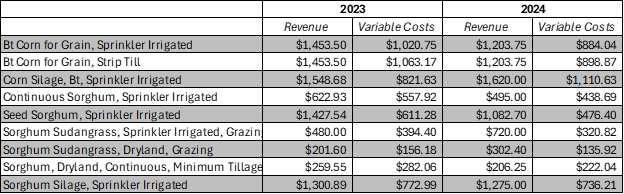

Budgets for corn and sorghum indicate that both variable costs and revenues will decrease this year relative to 2023. Table 1 illustrates this for corn and sorghum enterprises in Extension District 1. Budgets for similar commodities in Extension District 2 follow similar trends.

Table 1. Revenue and Variable Costs for Corn and Sorghum Enterprises in the 2023 and 2024 Extension Budgets

In most of the budgets, revenue decreases because of lower expected commodity prices this year. For example, the prices of corn and grain sorghum decrease by 17% and 20%, respectively, relative to 2023. Variable costs are slightly lower in 2024 based on lower expected fertilizer and chemical prices. The exceptions to this trend are the budgets for sorghum sudangrass in District 1 which show a fifty percent increase in revenue.

The price decreases seen in these budgets are the result of normal market forces at work. Grain prices increased in 2020, 2021, and 2022 because of drought and other temporary market shocks. In April and May 2022, grain prices reached their peak, just after Russia first invaded Ukraine. Since then, grain prices have decreased back to a level that is closer to their historical average.

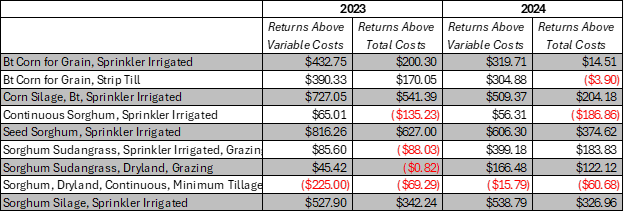

Overall, the expected decreases in revenue in the 2024 budgets outweigh the expected reductions in variable costs. As a result, expected net returns for these crops are less in 2024 than in 2023 (Table 2). Still, returns above variable costs remain positive for every enterprise listed in Table 2 except dryland sorghum. With one exception, enterprises with positive returns above total costs in 2023 are still profitable in 2024.

Table 2. Expected Returns to Corn and Sorghum Production

As you use these budgets to make decisions, keep in mind the rule of thumb for economic decision making. Focus on returns above variable costs if you have already incurred fixed costs. If an enterprise can cover its variable costs of production, you are better off producing something and using the revenue you earn to pay at least part of your fixed costs.

Breakeven Prices for 2024

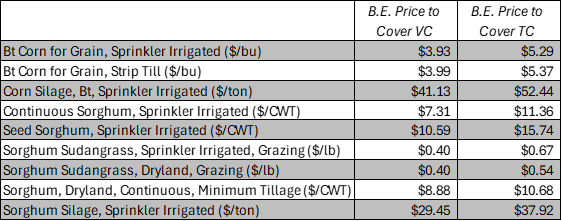

One important value to be aware of in an enterprise budget is the commodity’s breakeven price. This is the price at which you can expect revenue to exactly equal costs, given the expected level of production in the budget. Table 3 lists the prices necessary to break even on both variable costs and total costs for corn and sorghum enterprises in District 1 in 2024.

Table 3. Expected Breakeven Prices for Corn and Sorghum Enterprises

Normally, the risk of loss is greater when a commodity’s breakeven price is close to its expected price. Using sprinkler irrigated corn as an example, the expected yield in the budget is 225 bushels and variable costs are $884.04/acre. Given this yield and variable cost, this enterprise breaks even on variable cost at a price of $3.93. At this yield and the budget total cost, this enterprise breaks even on total cost at a price of $5.29. Considering the expected price in the budget is $5.35, this enterprise should easily break even on its variable cost. On the other hand, a price of $5.35 is very close to the break-even price for total costs. If either price or yield is less than expected, sprinkler irrigated corn may not break even on its total costs.

Final Comments on the Budgets

Keep in mind that the numbers in these budgets are general guidelines for corn and sorghum enterprises and will not represent every operation perfectly. To build a budget that better represents your operation, you can use the following options:

- Producers in District 1 can access a Crop Profitability Analyzer, sponsored by Texas Corn Producers, by clicking here.

- District 2 producers access a similar decision tool on website https://southplainsprofit.tamu.edu/.

- AgriLife Extension Agricultural Economics offers tools to help you build your own budgets on our website.

Keep in mind also that the outlook for commodity prices and for some input costs is still not yet fully formed. The actual prices and costs seen this year may be very different from what the budgets predict. Make sure you have a plan established to manage risks related to production and prices this year.