by Dr. Levi Russell, Assistant Professor & Extension Economist

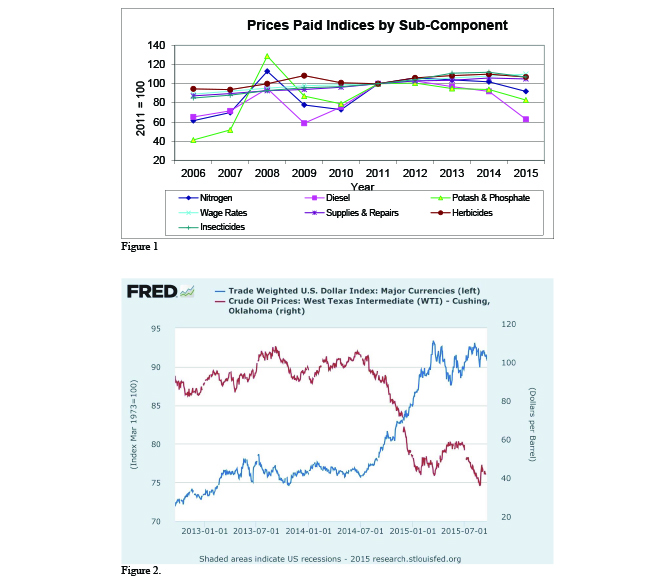

The prices paid by farmers indices by sub-component shown in Figure 1 represent the average prices of inputs purchased by farmers and ranchers to produce agricultural commodities. The 2015 data shown in the graph represents the prices sampled in mid-July 2015 (the most recently available data), with previous years shown as annual averages. Most input price indices changed very little from the previous month, with the exception of nitrogen (down -4.2%) and potash and phosphate (down -6.7%). Diesel and supplies and repairs fell -3.1% and -0.9%, respectively while herbicide prices were up 0.9%. Wage rates and insecticide prices were unchanged.

Changes from the previous year (July 2014) are more varied. Wage rates increased 2.8%, while supplies & repairs, herbicides, and insecticides fell -0.9%, -1.8%, and -3.6%, respectively. Nitrogen and potash & phosphate prices fell -10.7% and -9.8%, respectively. The biggest decline was in diesel prices with a decrease of -32.3% from the previous year. With major commodity prices not likely to rebound to previous highs and oil prices still low, it’s unlikely that these input prices will experience much upward pressure in the coming months and could continue to decline.

Much of this general decline can be attributed to the strong dollar (see Figure 2), which has also put downward pressure on exports. This is not a case of the dollar being “strong” on its own, but a case of the dollar being less weak than other major currencies. The U.S. central bank, the Federal Reserve, has held interbank interest rates at 0% for a record amount of time. Citing concerns over weak economic data, the Federal Reserve continues to keep rates at 0%. If the low-rate policy continues, the dollar could weaken sometime in the next year, putting upward pressure on oil prices and, by extension, fertilizer prices. This is, of course, contingent on a restoration of faith in other major currencies.

As we move into what looks to be a low-price year, producers should take advantage of lower input prices and make use of price risk management tools to ensure that they get the best price possible for their crops. Areas of the state not in moderate to severe drought have an opportunity to offset the effect of lower prices on revenue with higher yield.