Market Growing Pains

From fine dining to food trucks, dishes like crispy lamb ribs, pulled mutton shoulder pad-thai, and cabrito kabobs are popping up almost everywhere. Lamb and goat, long disregarded by backyard barbecue enthusiasts and weeknight chefs alike, has not only reemerged onto restaurant menus, but it has morphed into a force to be reckoned with amongst an evolving food scene. Eating lamb and goat meat is all the rage!

Most exciting to us producers is that long-term projections are forecasting continued increases in demand for sheep and goat products, both domestic and international. The Aussies and Kiwis are looking to exportable more and more product to geographically closer China. Current domestic production is slipping, but with the expected increase in demand, prices should stay strong. Money talks and I expect more of the ranching community to get on board with having a few sheep and goats around.

Long term is the key word unfortunately as the Texas lightweight slaughter lamb market trended downward rather sharply in early April, but a spring-time dip in prices is not totally unexpected. To most folks the longer days mean it’s time to run outside and take photos in the blue bonnets. To the sheepman? Well besides the denning coyotes being on the prowl, stomach worm boom, noxious weeds erupting in every corner of the pasture, and the shearers being late for the 8th day in a row…. I forget where I was going with this. Oh yeah, the market takes its annual nosedive. Does it have to be this way though?

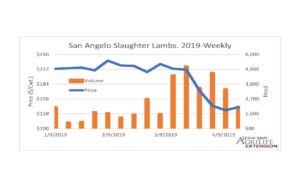

The predictable drop is likely result of an increased supply of lambs. Producers Livestock Auction in San Angelo sold roughly 50% more sheep and goats per week in early April than in March. With the largest percent of these animals being lambs from hair sheep breeds, which tend to go to the lightweight slaughter market. Supply hasn’t been as markedly increased for wooled lambs and goat kids and ultimately the market for these animals remained stable.

Bill Thompson, Texas A&M AgriLife Extension economist, has been reporting the effect of supply on the lamb and goat market for a few years. This data can be found at the following website. https://sanangelo.tamu.edu/extension/west-central-agricultural-economics/small-ruminant-mpa-project/ Supply volume has consistently been the best predictor of long-term price trends.

I feel strongly that sheep and goat producers should take a long look at this data and consider management practices that will allow them to market portions of their lamb crop during the late fall and winter, especially hair sheep producers who can capitalize on the aseasonal reproductive capabilities of these breeds. Market volatility limits industry expansion, so transitioning some of the lighter slaughter lambs that are hitting the traditional late spring and summer logjam to a the fall and winter could have reverberating benefits throughout the sheep industry. A consistent supply of fresh lamb product inspires confidence at each level of the production chain, and ultimately the consumer. Consumers always have and always will drive the market.

Almost daily I receive calls or emails from people in Texas who want to get into the sheep business and most all of them are looking towards hair sheep. This also begins to ask the question “Has the hair sheep industry oversupplied the market?” Time will tell, but at present, no. In the United States we have 300 million potential customers, of which most have never even tried lamb or goat. We have the potential to easily consume all we can produce domestically, but a flatter supply curve is still a must.

Folks who are interested in getting into small ruminants need to keep an open mind to raising goats. Meat goat prices have been consistently strong with less seasonal fluctuation. Plus, imported goat meat was down 30% in 2018, which had been steadily increasing the 5 previous years. The largest importer is Australia and I suspect that they aren’t able to supply the product due to drought and the feral management systems used to source goats.

In the past, most sheep and goat producers tend to be price takers. They have little control or ability to influence demand, unless they direct market to the consumer. Direct marketing isn’t for everyone but it doesn’t hurt to try to develop and grow our consumer base. My family eats lamb regularly at your home and we expose our friends and family to this great protein. It has had an impact. My extended family eats lamb regularly and my mother has added two lamb items to the menu at the family restaurant. They are selling at a pace that is far beyond our expectations. We must continue to promote our product. If we don’t eat it regularly, what kind of statement does that make to our consumers?

Also, I encourage the sheep community to stay up-to-date on what the American Lamb Board is doing to promote our product. They have fantastic programs that are responsible for some of the increased demand in lamb. A recent study by Texas A&M took a look at their impact. The report showed for every $1 invested into the American Lamb Checkoff Program it provided $14.20 to industry stakeholders!

In summary, the future is bright for the sheep and goat industry. But it is imperative for farmers and ranchers to stay up-to-date on the details of the industry. Producers should pay particular attention to supply a product that is in high demand at the time of market. Change is inevitable and we must see change as an opportunity, not a threat.

To provide feedback on this article or request topics for future articles, contact me at reid.redden@ag.tamu.edu or 325-653-4576. For general questions about sheep and goats, contact your local Texas A&M AgriLife Extension Service county office. If they can’t answer your question, they have access to someone who can.